As global markets navigate a landscape of mixed performances, with major U.S. indexes hitting record highs and European markets responding to political shifts, investors are keeping a close eye on economic indicators and central bank policies. Amidst this backdrop, dividend stocks present an attractive option for those seeking steady income streams; these stocks can offer stability and potential returns even as market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Cementos Molins (BDM:CMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cementos Molins, S.A. is a company involved in the manufacturing and sale of cement, lime, precast concrete, and other construction materials across multiple countries including Spain and Argentina, with a market cap of €1.58 billion.

Operations: Cementos Molins, S.A. generates revenue through its diverse portfolio of products, including cement and lime, precast concrete, and various construction materials across several international markets.

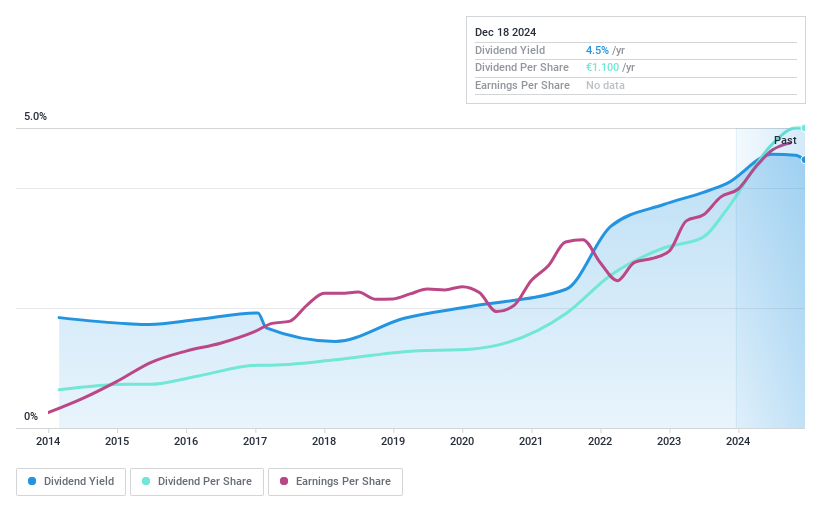

Dividend Yield: 4.2%

Cementos Molins offers a 4.16% dividend yield, which is lower than the top 25% of Spanish dividend payers. Despite its appealing low payout ratio of 18.3%, indicating dividends are well covered by earnings, the high cash payout ratio of 214.4% raises sustainability concerns as dividends exceed free cash flow coverage. However, Cementos Molins has maintained stable and growing dividends over the past decade with minimal volatility, supported by recent earnings growth of 23.3%.

- Delve into the full analysis dividend report here for a deeper understanding of Cementos Molins.

- Upon reviewing our latest valuation report, Cementos Molins' share price might be too optimistic.

Biofarm (BVB:BIO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Biofarm S.A. is a Romanian company involved in the manufacture and sale of medicines, with a market cap of RON731.14 million.

Operations: Biofarm S.A.'s revenue is primarily derived from its Pharmaceuticals segment, totaling RON282.13 million.

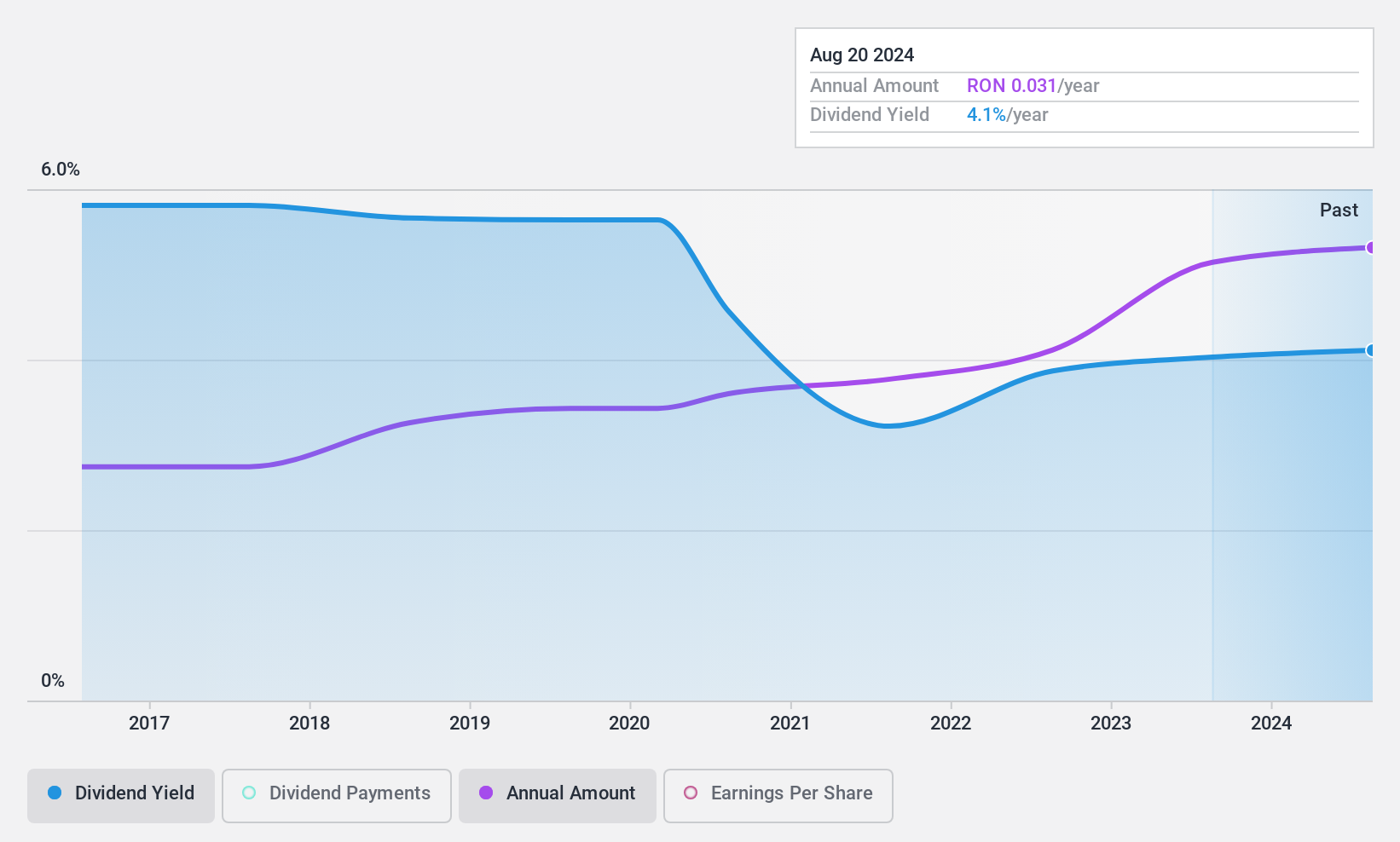

Dividend Yield: 4.2%

Biofarm's dividend yield of 4.19% is modest compared to the top 25% of Romanian dividend payers. While dividends are well covered by earnings due to a low payout ratio of 38%, the high cash payout ratio of 125.2% suggests sustainability issues, as dividends exceed free cash flow coverage. Nonetheless, Biofarm has delivered stable and growing dividends over the past decade with minimal volatility, supported by consistent earnings growth and recent net income improvements.

- Dive into the specifics of Biofarm here with our thorough dividend report.

- Our expertly prepared valuation report Biofarm implies its share price may be lower than expected.

SPK (TSE:7466)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SPK Corporation, with a market cap of ¥21.03 billion, operates through its subsidiaries in the trading of automotive spare parts and accessories as well as industrial vehicle parts both in Japan and internationally.

Operations: SPK Corporation's revenue is primarily derived from its Domestic Sales Headquarters at ¥30.38 billion, Overseas Sales Headquarters at ¥23.72 billion, Machinery Sales Headquarters at ¥8.19 billion, and CUSPA Sales Headquarters at ¥3.88 billion.

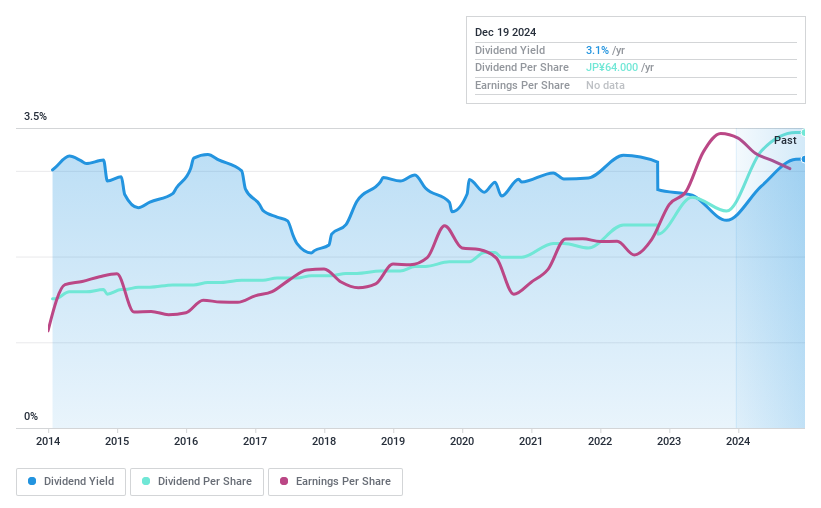

Dividend Yield: 3.1%

SPK Corporation's recent dividend increase to ¥28.00 per share highlights its commitment to returning value to shareholders, though sustainability concerns persist due to a high cash payout ratio of 112.1%, indicating dividends exceed free cash flow coverage. Despite this, SPK maintains a low payout ratio of 24.5%, ensuring dividends are well covered by earnings and have been stable and reliable over the past decade. The stock's price-to-earnings ratio of 9.3x suggests it is undervalued compared to the broader JP market.

- Unlock comprehensive insights into our analysis of SPK stock in this dividend report.

- Our valuation report unveils the possibility SPK's shares may be trading at a premium.

Make It Happen

- Reveal the 1928 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biofarm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:BIO

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives