Ryohin Keikaku (TSE:7453): Assessing Valuation After Board Sets Treasury Stock Disposal Plans

Reviewed by Kshitija Bhandaru

Ryohin Keikaku (TSE:7453) just announced a board meeting set for early October, where directors will discuss plans to dispose of the company’s treasury stock. This move often draws close investor attention, given its potential effects on share supply and capital structure.

See our latest analysis for Ryohin Keikaku.

Ryohin Keikaku’s announcement around disposing of treasury stock comes after a remarkable run, with the latest share price sitting at ¥2,702.5. Despite a recent pullback, including a 30-day share price return of -11.86%, the stock has delivered strong momentum over the longer term, boasting a 1-year total shareholder return of 97.93% and an impressive 382.39% over three years. This signals investor confidence through changing market cycles.

If you’re keeping an eye out for what’s moving beyond retail, consider broadening your search and discover fast growing stocks with high insider ownership.

With shares having soared over the past year and a fresh catalyst on the horizon, investors may wonder whether Ryohin Keikaku is still undervalued, or if the market has already factored in all of its growth potential.

Price-to-Earnings of 27.7x: Is it justified?

Ryohin Keikaku currently trades at a price-to-earnings (P/E) ratio of 27.7x, materially above both the industry average and peer group, signaling investors are paying a significant premium at the last close of ¥2,702.5.

The P/E ratio reflects how much investors are willing to pay for each yen of earnings. In the context of the Japanese Multiline Retail sector, a higher-than-average P/E suggests that the market is expecting higher future growth or believes the company has defensible advantages over competitors.

This premium may not be fully justified by fundamentals alone. Despite strong earnings momentum, the market could be overestimating Ryohin Keikaku's growth prospects or pricing in factors outside of underlying financials, such as brand strength or business model resilience.

- Compared to the JP Multiline Retail industry average of 18.2x, Ryohin Keikaku’s valuation is notably higher.

- The P/E ratio also exceeds the peer average of 19.2x, underscoring an even wider gap.

- When measured against the estimated Fair Price-to-Earnings Ratio of 23.6x, the current multiple remains on the expensive side, which points to the market’s high expectations or optimism for the company’s future.

Explore the SWS fair ratio for Ryohin Keikaku

Result: Price-to-Earnings of 27.7x (OVERVALUED)

However, slower revenue growth or a pullback from high market expectations could challenge the case for Ryohin Keikaku to sustain its current premium valuation.

Find out about the key risks to this Ryohin Keikaku narrative.

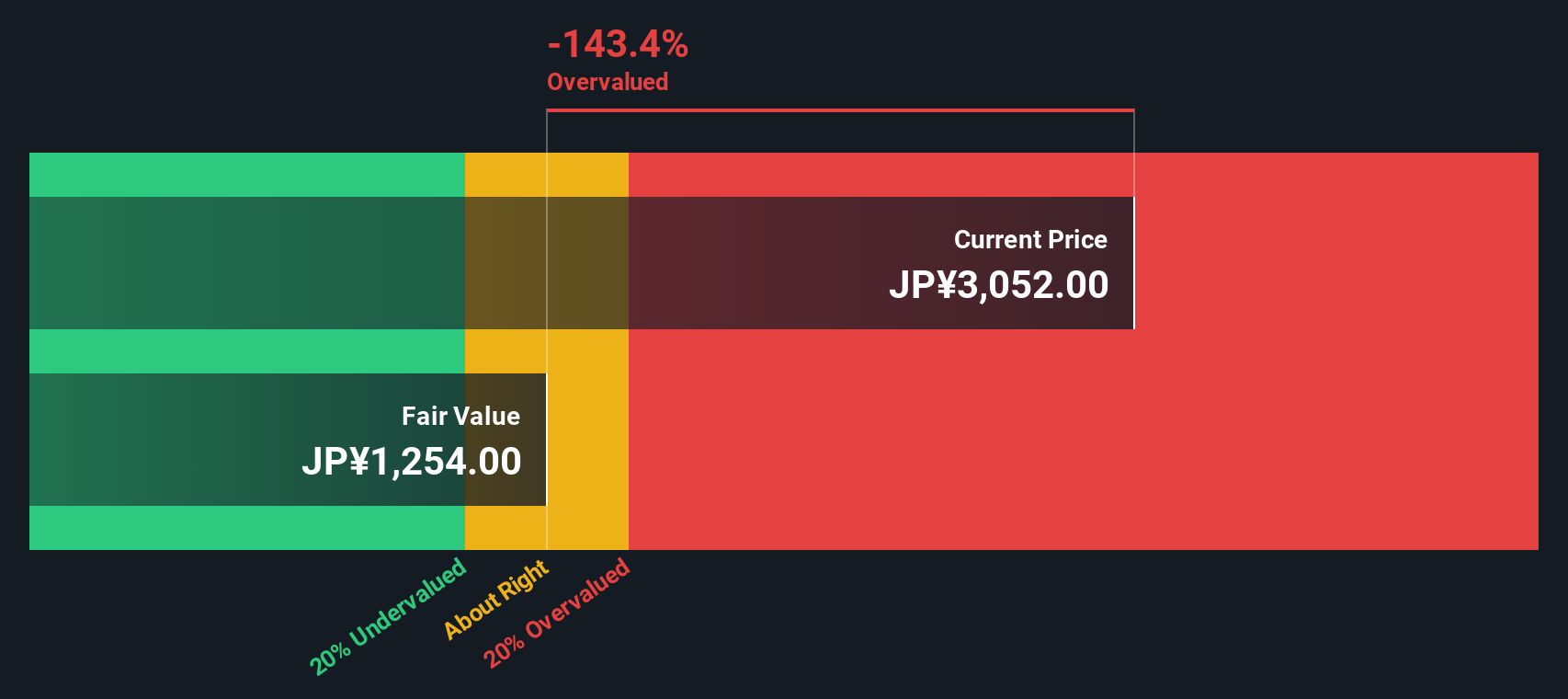

Another View: What Does the DCF Model Say?

While the market is valuing Ryohin Keikaku richly based on earnings multiples, the SWS DCF model offers a different angle. According to this cash flow-based approach, shares may be trading well above estimated fair value. This suggests potential downside if market optimism fades. Which approach tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ryohin Keikaku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ryohin Keikaku Narrative

If you want to explore the numbers from your own perspective or reach your own conclusions, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your Ryohin Keikaku research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You’re just a click away from uncovering stocks with breakout potential, reliable income, or transformational technology. Don’t let opportunities like these pass you by.

- Secure your portfolio’s future and target reliable yields with these 19 dividend stocks with yields > 3%, offering strong dividend prospects above 3%.

- Position yourself at the frontier of technology by checking out these 25 AI penny stocks, shaping artificial intelligence breakthroughs right now.

- Tap into opportunities the market may have missed by zeroing in on value with these 898 undervalued stocks based on cash flows, based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7453

Ryohin Keikaku

Develops, manufactures, distributes, and sells apparel, household goods, and food items in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives