- New Zealand

- /

- Software

- /

- NZSE:SKO

3 Growth Companies With High Insider Ownership Achieving 22% Revenue Growth

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape of U.S. trade policies and AI investments, major indices like the S&P 500 have reached new heights, reflecting investor optimism. In this environment, growth stocks have outperformed their value counterparts for the first time this year, highlighting the potential appeal of companies with robust insider ownership and strong revenue growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 22.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| CD Projekt (WSE:CDR) | 29.7% | 34.6% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Let's dive into some prime choices out of the screener.

Serko (NZSE:SKO)

Simply Wall St Growth Rating: ★★★★★☆

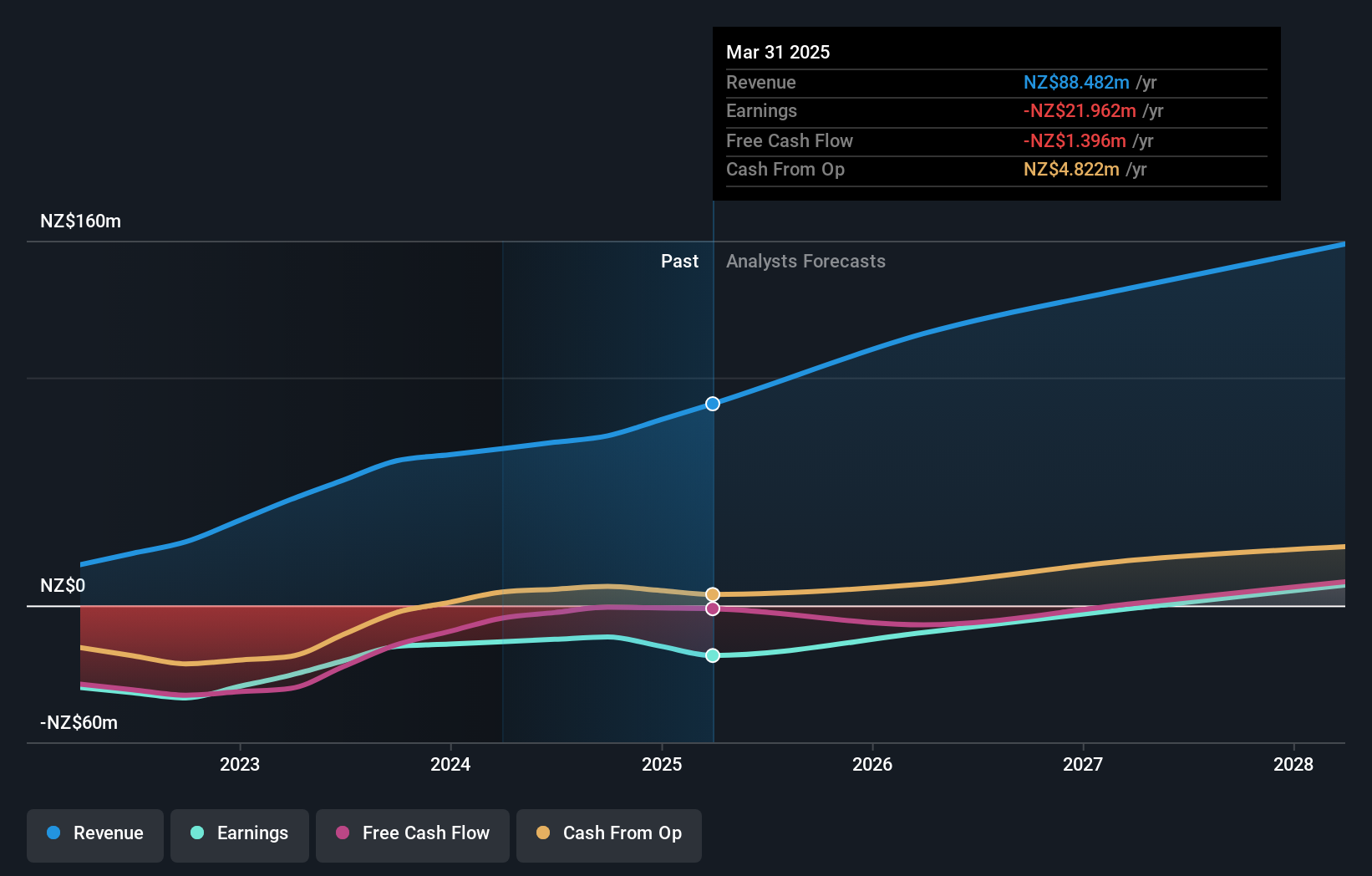

Overview: Serko Limited is a Software-as-a-Service technology company offering online travel booking software solutions and expense management services across New Zealand, Australia, North America, Europe, and other international markets with a market cap of NZ$463.08 million.

Operations: The company's revenue primarily comes from its provision of software solutions, amounting to NZ$74.45 million.

Insider Ownership: 31.5%

Revenue Growth Forecast: 22.2% p.a.

Serko's strong insider ownership aligns with its growth potential, as the company forecasts revenue growth of 22.2% annually, surpassing the NZ market average. Despite a recent net loss of NZ$5.11 million for H1 2025, improvements are evident compared to the previous year. The integration with Amadeus for NDC content enhances its corporate travel platform Zeno, potentially driving future revenue streams. Insider trading activity has been minimal recently but leans towards buying rather than selling.

- Navigate through the intricacies of Serko with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Serko is priced higher than what may be justified by its financials.

Komehyo HoldingsLtd (TSE:2780)

Simply Wall St Growth Rating: ★★★★★☆

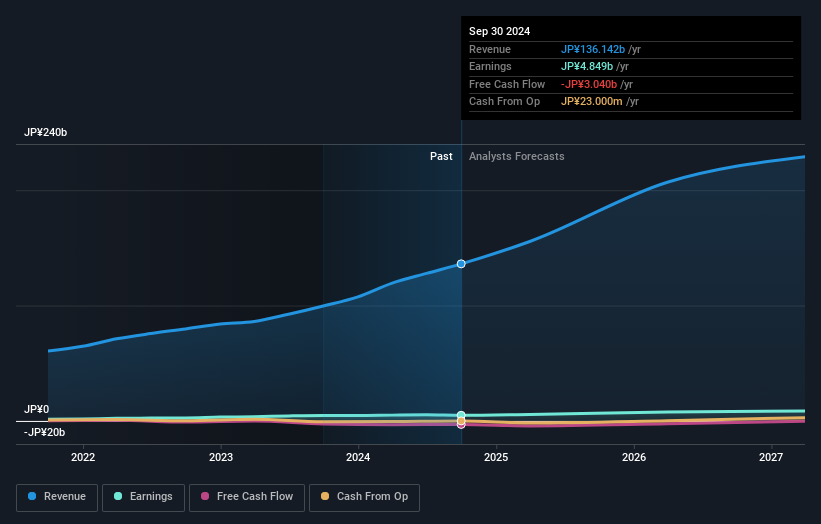

Overview: Komehyo Holdings Co., Ltd. operates in Japan, focusing on the purchase and sale of used and new products through its retail stores, with a market cap of ¥43.12 billion.

Operations: The company's revenue is primarily derived from its Brand Fashion Business, which generates ¥130.77 billion, supplemented by the Tire Wheel Business at ¥5.33 billion and the Real Estate Leasing Business contributing ¥319.38 million.

Insider Ownership: 34.6%

Revenue Growth Forecast: 21.2% p.a.

Komehyo Holdings Ltd. demonstrates strong growth potential, with earnings projected to increase 23.4% annually, outpacing the JP market average. Revenue is expected to grow significantly at 21.2% per year, suggesting robust business expansion. The company's price-to-earnings ratio of 8.9x indicates good value relative to the market and peers, though its dividend coverage by free cash flow is weak and share price volatility has been high recently.

- Click here to discover the nuances of Komehyo HoldingsLtd with our detailed analytical future growth report.

- Our valuation report here indicates Komehyo HoldingsLtd may be undervalued.

Japan Eyewear Holdings (TSE:5889)

Simply Wall St Growth Rating: ★★★★☆☆

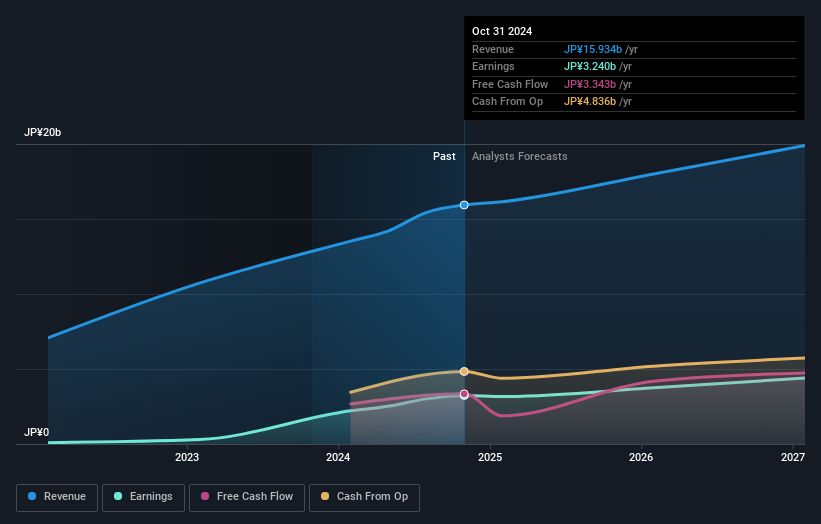

Overview: Japan Eyewear Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on the planning, designing, manufacturing, wholesaling, and retailing of eyewear products with a market cap of ¥54.26 billion.

Operations: The company's revenue segments include Four Nines, generating ¥5.60 billion, and Kaneko Glasses, contributing ¥10.34 billion.

Insider Ownership: 37.9%

Revenue Growth Forecast: 10.2% p.a.

Japan Eyewear Holdings is experiencing robust earnings growth, forecasted at 14.6% annually, surpassing the JP market average of 8.1%. Despite revenue growth being moderate at 10.2%, it exceeds the market rate and reflects positive business momentum. Recent revisions in financial guidance highlight improved performance with increased revenue and profit expectations for fiscal year-end January 2025, driven by strong store sales and tourism demand. The company's shares trade below estimated fair value despite high volatility recently.

- Click here and access our complete growth analysis report to understand the dynamics of Japan Eyewear Holdings.

- Our comprehensive valuation report raises the possibility that Japan Eyewear Holdings is priced lower than what may be justified by its financials.

Where To Now?

- Unlock our comprehensive list of 1468 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKO

Serko

A Software-as-a-Service technology business, provides online travel booking software solutions and expense management services in New Zealand, Australia, North America, Europe, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives