- Japan

- /

- Specialty Stores

- /

- TSE:4017

Creema Ltd.'s (TSE:4017) Shares Climb 36% But Its Business Is Yet to Catch Up

Creema Ltd. (TSE:4017) shareholders have had their patience rewarded with a 36% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

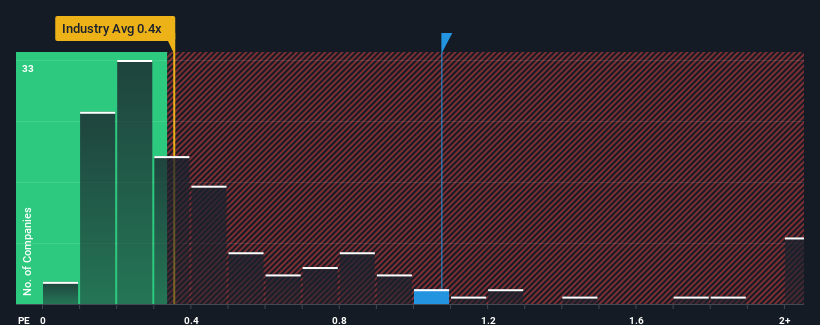

Since its price has surged higher, when almost half of the companies in Japan's Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Creema as a stock probably not worth researching with its 1.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Creema

How Creema Has Been Performing

For example, consider that Creema's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Creema's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Creema's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 22% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.7% shows it's about the same on an annualised basis.

In light of this, it's curious that Creema's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Creema's P/S

The large bounce in Creema's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't expect to see Creema trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Creema is showing 2 warning signs in our investment analysis, and 1 of those is significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4017

Creema

Operates as an online marketplace where individuals can directly buy and sell original handmade works online in Japan and Asia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.