- Japan

- /

- Specialty Stores

- /

- TSE:367A

Primo Global Holdings (TSE:367A) Margin Expansion Challenges Bearish Narratives

Reviewed by Simply Wall St

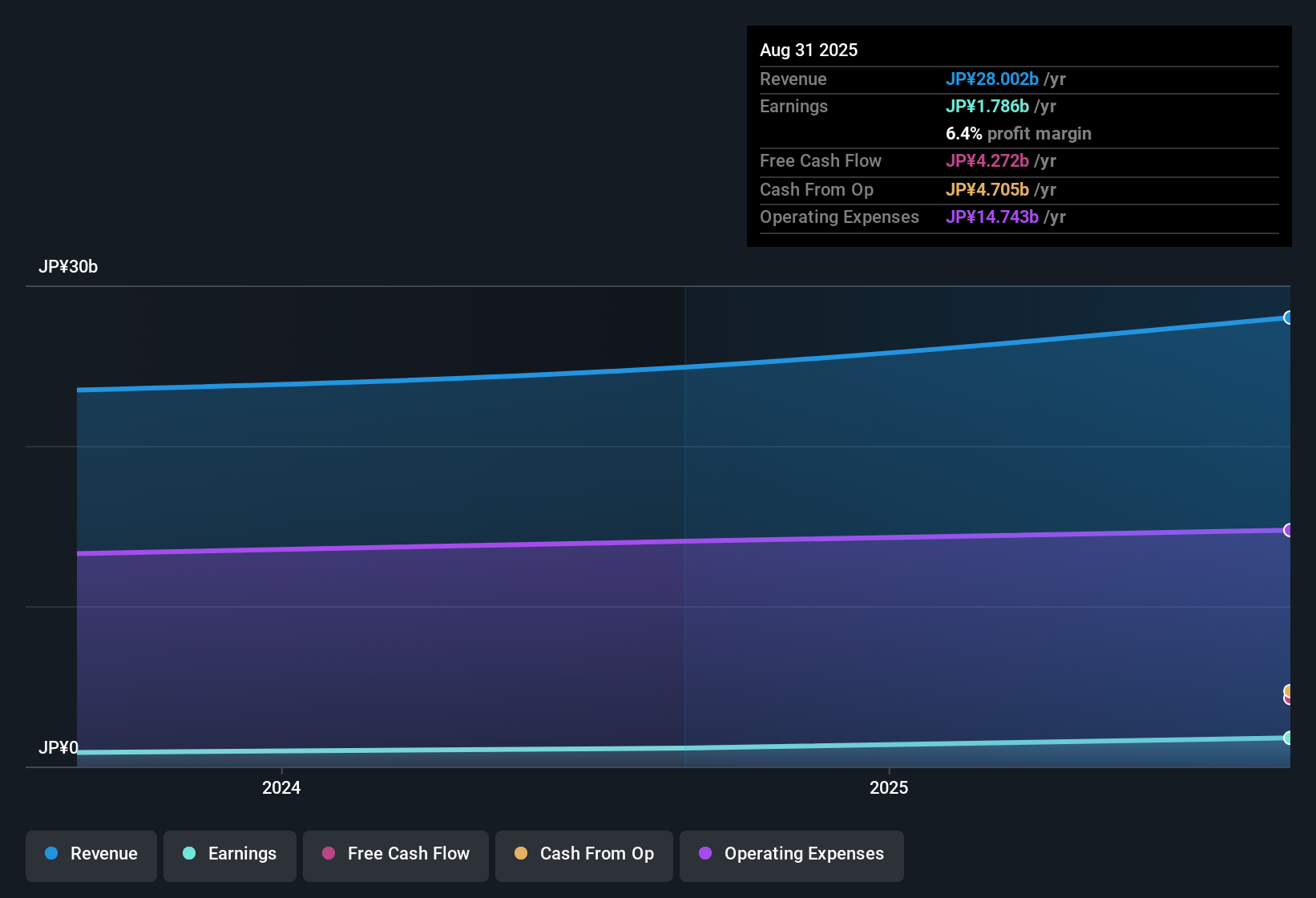

Primo Global Holdings (TSE:367A) posted a current net profit margin of 6.4%, up from 4.6% last year, highlighting improved profitability. The company's price-to-earnings ratio of 10.3x is well below the peer average of 23.4x and the JP Specialty Retail industry average of 14.4x. Shares currently trade at ¥2,097, which is notably under an estimated fair value of ¥7,092.09. With high-quality earnings, a favorable valuation, and only one minor risk identified in its financial position, investors are likely to view these results as a fundamentally positive update.

See our full analysis for Primo Global Holdings.Next, we will see how these headline numbers measure up against the wider market narratives for Primo Global Holdings and where investor expectations might diverge from the data.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Industry Trends

- Primo Global Holdings reported a current net profit margin of 6.4%, higher than the previous year's 4.6%, and stands out compared to the JP Specialty Retail industry average of 14.4%.

- Several factors in the latest figures support the argument that margin expansion puts the company ahead, such as:

- Compared to sector peers, Primo Global Holdings’ improvement in net margin signals operational strengths that bulls highlight as evidence of superior management or cost discipline.

- While the net margin remains lower than the broader specialty retail average, this clear upward movement may challenge those doubting the sustainability of profitability for firms in this sector.

Profit Quality and Risk Profile

- The company’s earnings are described as high quality, and only one minor risk was identified in its financial position, with no major risks present in the latest disclosure.

- The prevailing market view focuses on how this relatively clean risk profile stands out:

- Investors weighing sector uncertainties may find the absence of significant red flags especially notable when many competitors face broader headwinds or execution challenges.

- The single minor risk on record is unlikely to deter those prioritizing stability alongside margin and earnings quality, as ongoing profitability supports a constructive outlook for valuation durability.

Share Price Trades Well Below DCF Fair Value

- Shares are currently trading at ¥2,097, representing a substantial discount compared to the DCF fair value of approximately ¥7,092.09, with a price-to-earnings ratio of 10.3x that is far lower than both peers’ 23.4x and the industry average of 14.4x.

- Across prevailing market discussion, this valuation gap attracts attention as a possible opportunity:

- The significant fair value gap gives the company momentum in discussions about overlooked value plays, especially as peers trade at much richer valuations, reinforcing narratives centered on market mispricing.

- For investors seeking potential upside in specialty retail, the discount relative to DCF calculations suggests scope for rerating if margin trends are sustained and sector pressures ease.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Primo Global Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Though Primo Global Holdings is growing its margins, its net profit margin still trails the broader specialty retail average. This leaves room for improvement.

For investors focused on more consistent and reliable financial performance, check out stable growth stocks screener (2094 results) to discover companies that deliver steady results through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:367A

Primo Global Holdings

Sells bridal jewelry through its stores in Taiwan, Hong Kong, Mainland China, and Singapore.

Good value with acceptable track record.

Market Insights

Community Narratives