- Japan

- /

- Retail Distributors

- /

- TSE:3678

MEDIA DO (TSE:3678) Is Paying Out A Larger Dividend Than Last Year

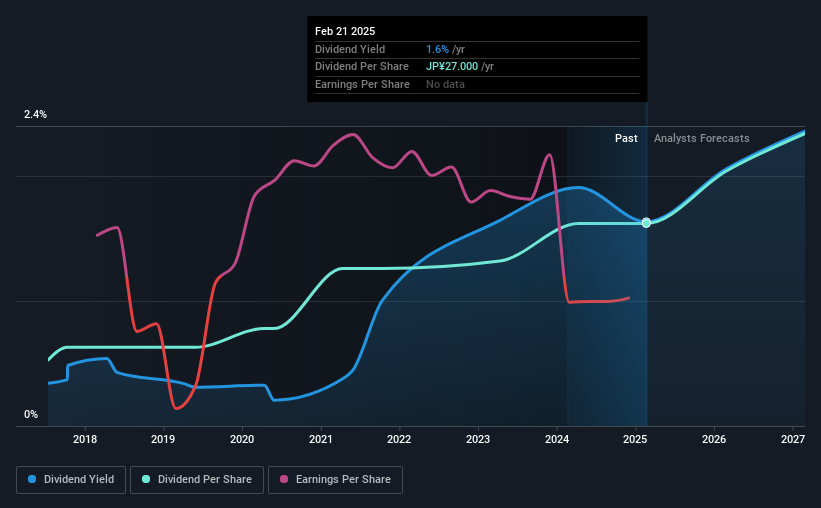

MEDIA DO Co., Ltd.'s (TSE:3678) dividend will be increasing from last year's payment of the same period to ¥35.00 on 8th of May. Although the dividend is now higher, the yield is only 1.6%, which is below the industry average.

See our latest analysis for MEDIA DO

MEDIA DO Might Find It Hard To Continue The Dividend

Even a low dividend yield can be attractive if it is sustained for years on end. While MEDIA DO is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Looking forward, earnings per share is forecast to expand by 29.1% over the next year. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The healthy cash flows are definitely a good sign though, so we wouldn't panic just yet, especially with the earnings growing.

MEDIA DO Is Still Building Its Track Record

MEDIA DO's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2017, the dividend has gone from ¥8.80 total annually to ¥27.00. This implies that the company grew its distributions at a yearly rate of about 15% over that duration. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though MEDIA DO's EPS has declined at around 24% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think MEDIA DO will make a great income stock. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think MEDIA DO is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in MEDIA DO in our latest insider ownership analysis. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3678

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives