Isetan Mitsukoshi Holdings Ltd.'s (TSE:3099) 28% Price Boost Is Out Of Tune With Earnings

Isetan Mitsukoshi Holdings Ltd. (TSE:3099) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 79%.

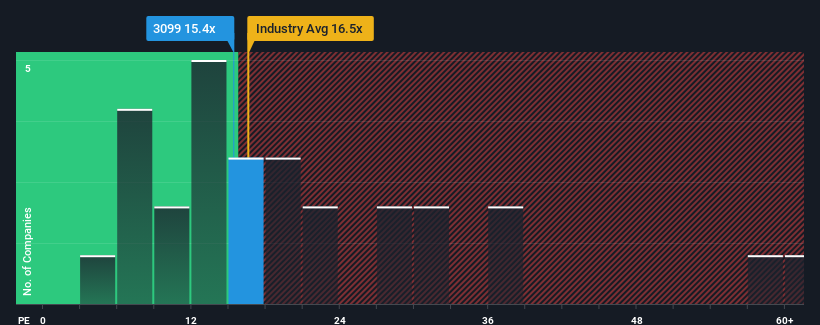

In spite of the firm bounce in price, there still wouldn't be many who think Isetan Mitsukoshi Holdings' price-to-earnings (or "P/E") ratio of 15.4x is worth a mention when the median P/E in Japan is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Isetan Mitsukoshi Holdings as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Isetan Mitsukoshi Holdings

How Is Isetan Mitsukoshi Holdings' Growth Trending?

Isetan Mitsukoshi Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 70%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 0.6% per annum during the coming three years according to the seven analysts following the company. That's not great when the rest of the market is expected to grow by 11% per annum.

With this information, we find it concerning that Isetan Mitsukoshi Holdings is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Isetan Mitsukoshi Holdings' P/E?

Isetan Mitsukoshi Holdings appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Isetan Mitsukoshi Holdings currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Isetan Mitsukoshi Holdings (1 is potentially serious!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3099

Isetan Mitsukoshi Holdings

Engages in the department store business in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives