Here's Why Isetan Mitsukoshi Holdings (TSE:3099) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Isetan Mitsukoshi Holdings (TSE:3099), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Isetan Mitsukoshi Holdings

Isetan Mitsukoshi Holdings' Improving Profits

Over the last three years, Isetan Mitsukoshi Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Isetan Mitsukoshi Holdings' EPS catapulted from JP¥87.82 to JP¥168, over the last year. It's not often a company can achieve year-on-year growth of 91%.

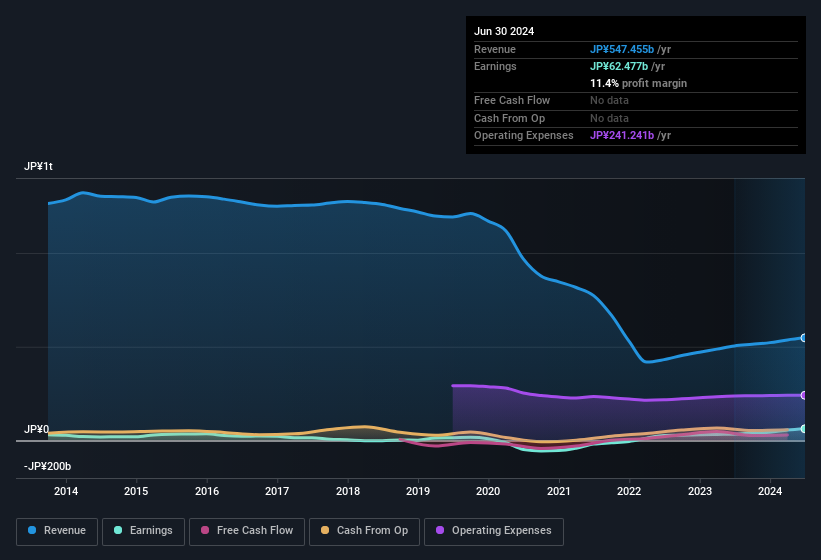

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Isetan Mitsukoshi Holdings shareholders can take confidence from the fact that EBIT margins are up from 6.8% to 12%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Isetan Mitsukoshi Holdings' forecast profits?

Are Isetan Mitsukoshi Holdings Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to Isetan Mitsukoshi Holdings, with market caps between JP¥575b and JP¥1.7t, is around JP¥158m.

Isetan Mitsukoshi Holdings offered total compensation worth JP¥125m to its CEO in the year to March 2024. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Isetan Mitsukoshi Holdings Worth Keeping An Eye On?

Isetan Mitsukoshi Holdings' earnings per share have been soaring, with growth rates sky high. This appreciable increase in earnings could be a sign of an upward trajectory for the company. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So Isetan Mitsukoshi Holdings looks like it could be a good quality growth stock, at first glance. That's worth watching. We should say that we've discovered 2 warning signs for Isetan Mitsukoshi Holdings (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in JP with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3099

Isetan Mitsukoshi Holdings

Engages in the department store business in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives