- Japan

- /

- Specialty Stores

- /

- TSE:3092

ZOZO (TSE:3092): Exploring Valuation and Market Perception After Recent Share Price Stability

Reviewed by Kshitija Bhandaru

ZOZO (TSE:3092) drew attention this week after its latest share price movement, prompting investors to take a closer look at the factors behind the stock's recent shifts. The discussion now turns to valuation and recent performance.

See our latest analysis for ZOZO.

ZOZO’s share price has been treading water this year, reflecting muted momentum as the market weighs company fundamentals and the outlook for growth. While the most recent price movements have been relatively quiet, the five-year total shareholder return of nearly 50% puts the current share price of ¥1,361 in a longer-term perspective.

If you’re curious about other pockets of market momentum, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The real question for investors is whether ZOZO’s share price fairly reflects its modest growth and long-term returns, or if there is a hidden opportunity for those willing to look past current market sentiment.

Most Popular Narrative: 9% Undervalued

With ZOZO’s last close at ¥1,361 and the most widely followed narrative targeting a fair value of ¥1,500, expectations are running ahead of the current market price. As analyst consensus estimates point to meaningful growth and a premium valuation, the focus shifts to what is fueling their conviction.

Operational efficiencies in logistics, including automation and inventory optimization, have reduced labor and shipping costs as a proportion of sales. This supports margin expansion and improved EBITDA. Sustained increase in the number of new shops and active members, alongside rising average order and retail prices, indicate ZOZO benefits from growing urban, digital-native populations and discretionary online spending. These factors directly support top-line growth and profitability.

Curious how high ZOZO’s earnings could climb? The narrative’s bold forecast is built on gains in both revenue and profit margins, as well as a forward PE multiple that is higher than the industry norm. Want to know which numbers set this valuation apart? Uncover the details that could reframe everything you think you know about ZOZO’s fair value.

Result: Fair Value of ¥1,500 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on domestic demand and persistent promotional costs could quickly weaken ZOZO’s profitability if international expansion or spending growth fails to meet expectations.

Find out about the key risks to this ZOZO narrative.

Another View: Multiple-Based Valuation Paints a Pricier Picture

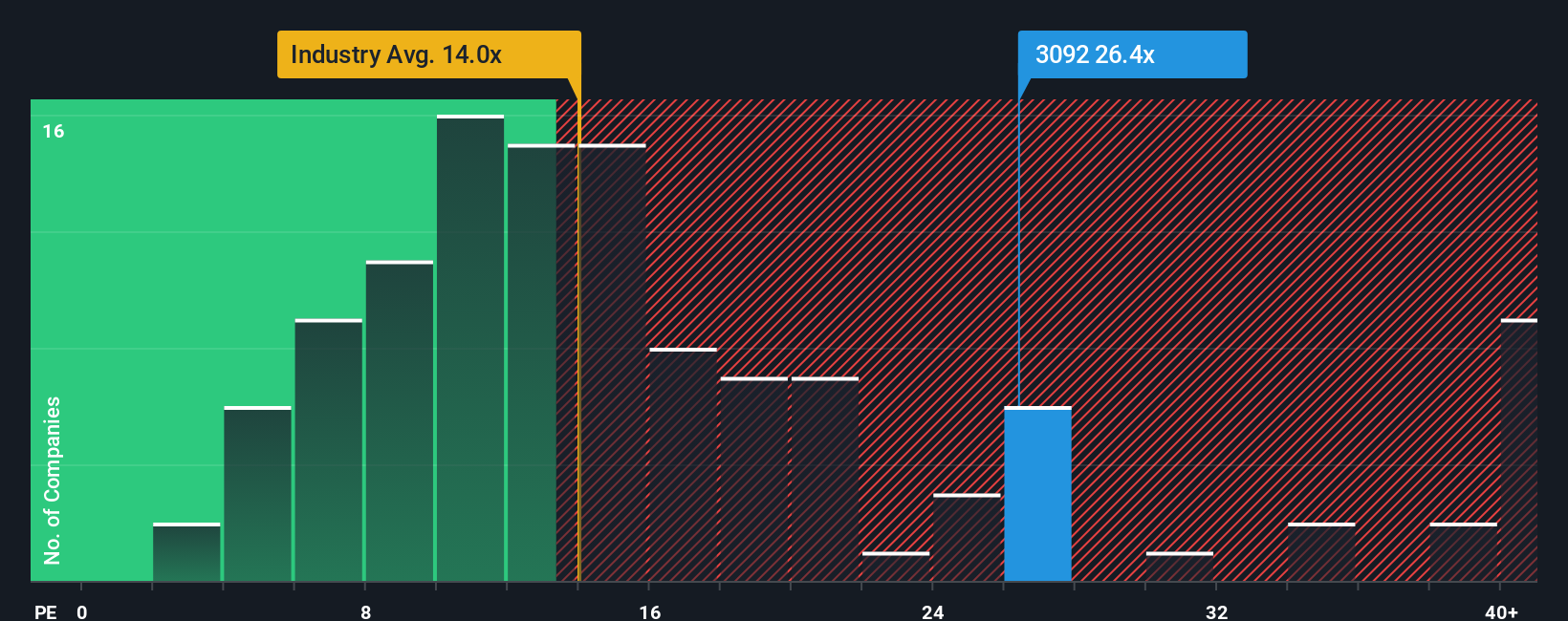

While the analyst consensus points to ZOZO being undervalued, a closer look at its price-to-earnings ratio tells a more cautious story. ZOZO trades at 26.4x earnings, noticeably higher than both the industry average of 13.8x and the calculated fair ratio of 20.9x. This gap suggests the market is demanding a premium, which creates more downside risk if growth slows or sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ZOZO Narrative

If you want to explore the numbers for yourself and craft a unique perspective, you can easily shape your own narrative in just a few minutes: Do it your way

A great starting point for your ZOZO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your search end here. Take charge of your investing journey with smart tools designed to uncover market winners that others might overlook.

- Capitalize on fresh AI breakthroughs by reviewing these 24 AI penny stocks, offering real opportunities in artificial intelligence innovation and scalable business models.

- Unlock attractive yields by reviewing these 19 dividend stocks with yields > 3%, delivering steady income from strong, dividend-paying companies with robust fundamentals.

- Position yourself early in digital finance by evaluating these 78 cryptocurrency and blockchain stocks, involved in the rise of cryptocurrencies and cutting-edge blockchain platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZOZO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3092

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives