- Japan

- /

- Specialty Stores

- /

- TSE:3046

JINS HOLDINGS Inc.'s (TSE:3046) 25% Share Price Plunge Could Signal Some Risk

JINS HOLDINGS Inc. (TSE:3046) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Longer-term, the stock has been solid despite a difficult 30 days, gaining 10% in the last year.

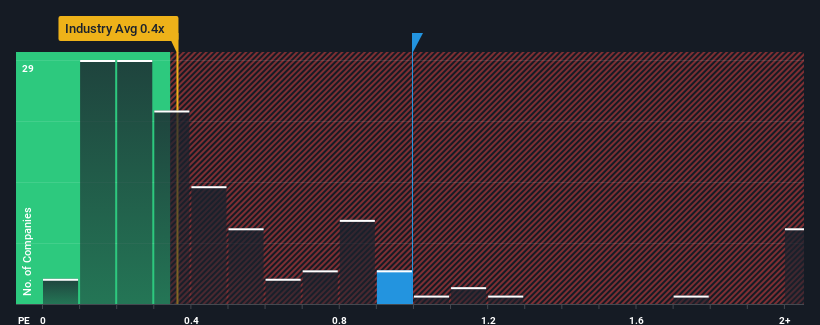

Even after such a large drop in price, when almost half of the companies in Japan's Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider JINS HOLDINGS as a stock probably not worth researching with its 1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for JINS HOLDINGS

What Does JINS HOLDINGS' Recent Performance Look Like?

Recent revenue growth for JINS HOLDINGS has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think JINS HOLDINGS' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like JINS HOLDINGS' to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Revenue has also lifted 27% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 7.7% during the coming year according to the four analysts following the company. That's shaping up to be similar to the 8.6% growth forecast for the broader industry.

In light of this, it's curious that JINS HOLDINGS' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Despite the recent share price weakness, JINS HOLDINGS' P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given JINS HOLDINGS' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 1 warning sign for JINS HOLDINGS that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3046

JINS HOLDINGS

Through its subsidiaries, engages in the planning, manufacturing, sales, and import/export of eyewear and fashion accessories in Japan and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives