- Japan

- /

- Specialty Stores

- /

- TSE:2726

PAL GROUP Holdings (TSE:2726): Assessing Current Valuation as Interest in Shares Grows

Reviewed by Simply Wall St

If you are following PAL GROUP Holdings (TSE:2726), you might have noticed the recent surge of interest around the stock. This latest move, though not tied to a major event or announcement, naturally raises eyebrows and prompts investors to wonder if it signals shifting expectations beneath the surface. When a stock attracts attention without an obvious catalyst, it can be a sign that the market sees something changing, even if the details are not immediately clear.

Stepping back, PAL GROUP Holdings has enjoyed an impressive trajectory, with steady momentum building over the past three years. The stock has delivered a robust 140% return in the past year, and the gains compound even further when you look at the nearly 406% return over three years and almost 993% over the past five years. While the last day’s move was modest, recent months have seen steady growth with a clear sense that buyers are still in control and confidence is on the rise.

With shares trading higher and market optimism apparent, the big question becomes whether PAL GROUP Holdings represents a genuine buying opportunity at today’s levels, or if the market has already priced in future growth.

Price-to-Earnings of 38.2x: Is it justified?

PAL GROUP Holdings is currently trading at a price-to-earnings (P/E) ratio of 38.2x, which is significantly higher than the Japanese Specialty Retail industry average of 14.6x as well as the estimated fair P/E ratio of 24.2x. This suggests that the market is placing a premium on the company’s future earnings potential compared to its sector peers.

The P/E ratio is a commonly used metric that compares a company’s current share price to its per-share earnings. It helps investors assess how much they are paying for each unit of a company’s earnings and is particularly important for companies in established, profitable sectors like retail, where earnings consistency is key.

- The current P/E of 38.2x is well above industry norms. This could imply the market may be overestimating near-term growth, or investors expect substantial future improvement in profitability or business fundamentals.

- Despite recent strong gains in share price and historical returns, this elevated multiple could mean there is limited margin for error if the company’s performance does not meet heightened expectations.

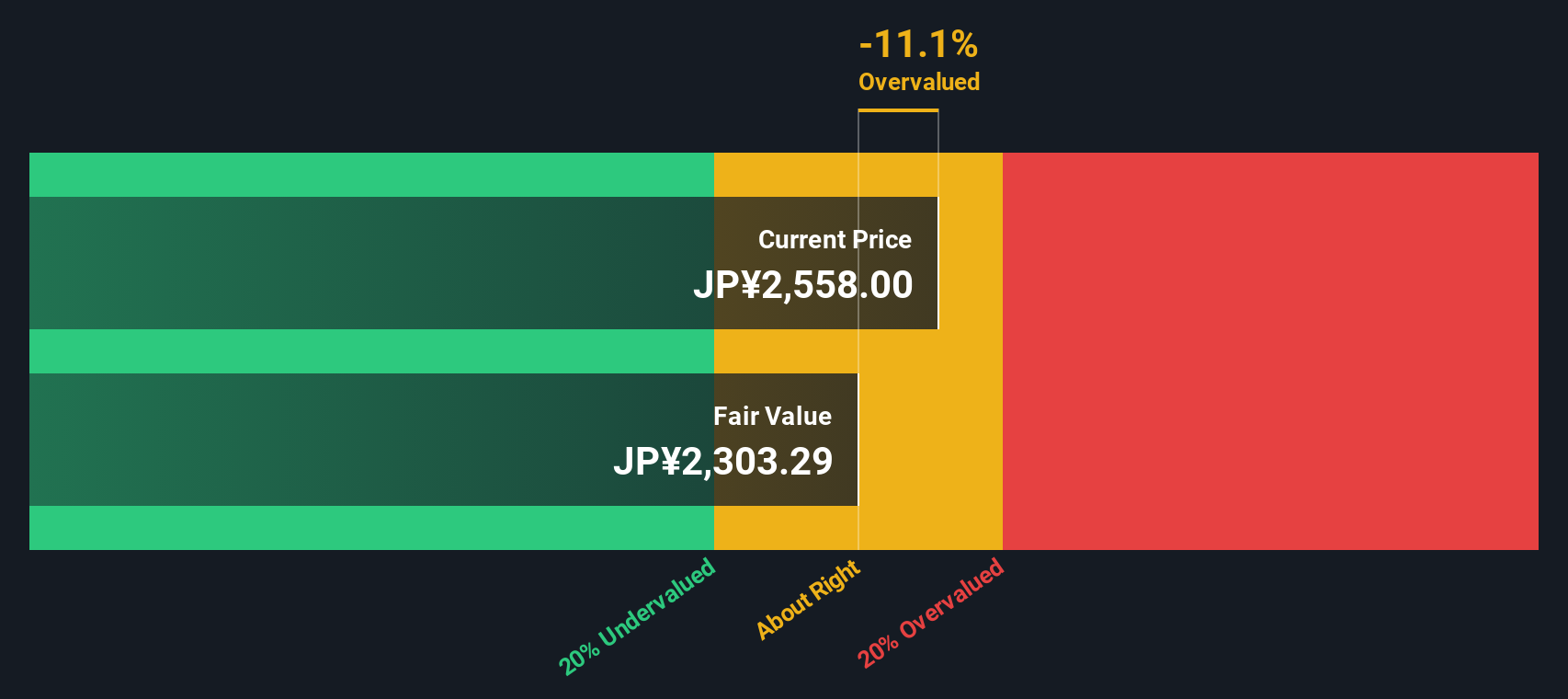

Result: Fair Value of ¥2,332.77 (OVERVALUED)

See our latest analysis for PAL GROUP Holdings.However, slowing revenue growth or any stumbles in profit margins could quickly challenge the bullish case. This could make recent optimism vulnerable to a rethink.

Find out about the key risks to this PAL GROUP Holdings narrative.Another View: What Does Our DCF Model Reveal?

While the recent price-to-earnings analysis points to PAL GROUP Holdings being richly valued, our SWS DCF model takes a different approach. This model also suggests the shares may be priced above fair value. Could multiple signals be pointing the same way, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PAL GROUP Holdings Narrative

If you have a different perspective or want to validate these findings yourself, you can dive into the numbers and build your own view in just a few minutes. Do it your way

A great starting point for your PAL GROUP Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Take your strategy to the next level and uncover promising stocks that fit your goals perfectly with these top picks.

- Capitalize on market underdogs by spotting exceptional companies trading below their intrinsic value through our list of undervalued stocks based on cash flows.

- Catch the momentum in healthcare innovation with stocks shaking up medicine and diagnostics in the age of artificial intelligence. See the possibilities at healthcare AI stocks.

- Tap into tomorrow’s tech breakthroughs by finding pioneers in quantum computing. Your chance to get ahead is at quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives