As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, small-cap stocks have shown resilience despite broader market challenges. In this environment, identifying undiscovered gems requires a keen eye for companies with solid fundamentals and potential growth catalysts that align well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| QuickLtd | 0.62% | 9.82% | 15.64% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Geo Holdings (TSE:2681)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Geo Holdings Corporation operates in the amusement sector within Japan and has a market capitalization of ¥65.60 billion.

Operations: Geo Holdings generates revenue primarily from its retail services segment, which accounted for ¥417.81 billion.

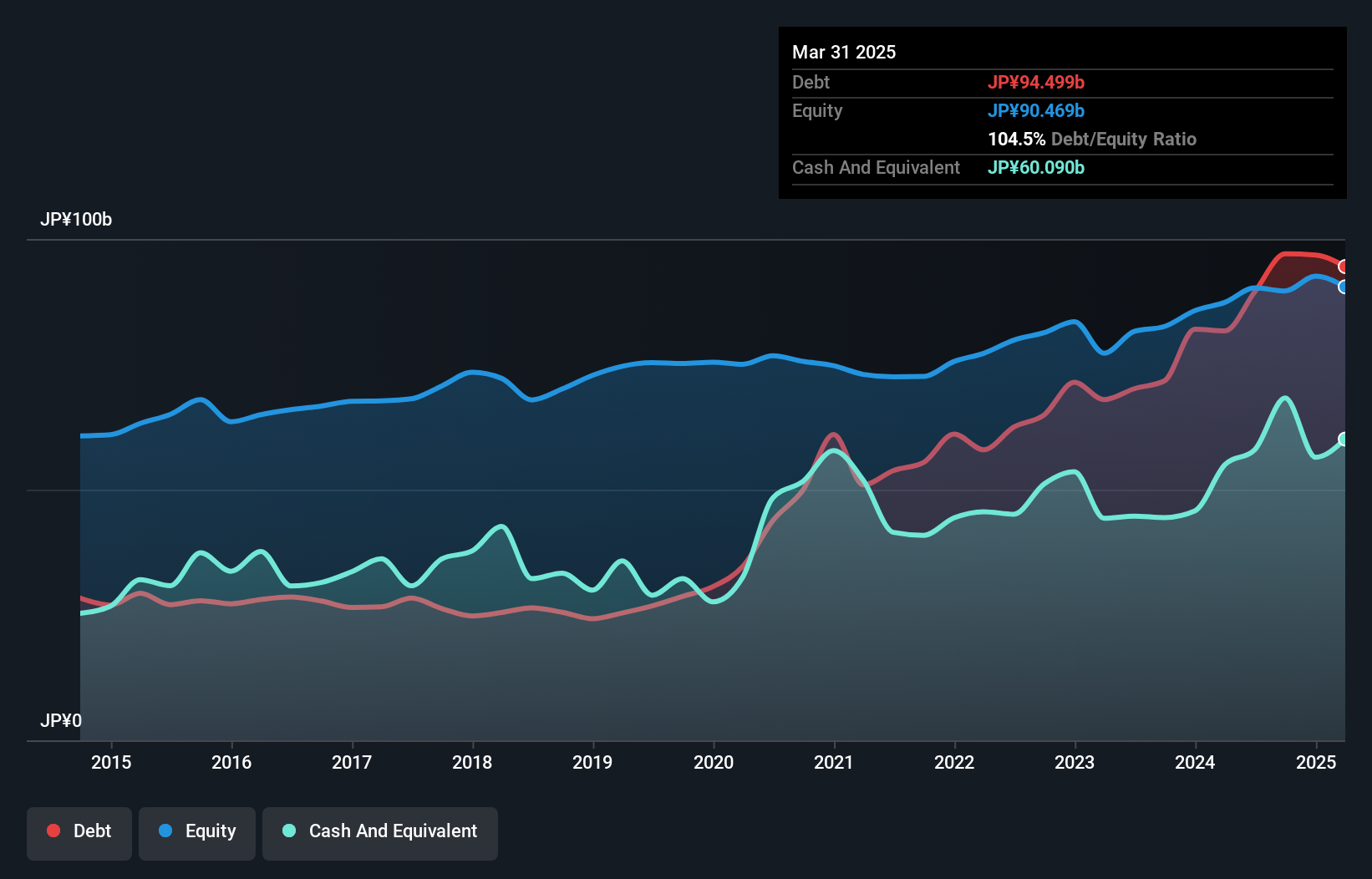

Geo Holdings, a dynamic player in the specialty retail sector, has demonstrated robust earnings growth of 16.5% over the past year, significantly outpacing the industry's 5.8%. This company is trading at an attractive 23.6% below its estimated fair value and boasts high-quality earnings. Its net debt to equity ratio stands at a satisfactory 32.1%, although it has increased from 38.2% to 108.2% over five years, indicating rising leverage concerns despite strong EBIT coverage of interest payments at an impressive 481 times. Recent news highlights a dividend increase to ¥17 per share, signaling confidence in future cash flows and profitability prospects.

- Dive into the specifics of Geo Holdings here with our thorough health report.

Explore historical data to track Geo Holdings' performance over time in our Past section.

SIGMAXYZ Holdings (TSE:6088)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGMAXYZ Holdings Inc. operates in Japan through its subsidiaries, focusing on consulting, investment, and M&A advisory services with a market capitalization of approximately ¥79.73 billion.

Operations: SIGMAXYZ Holdings generates revenue primarily from its Consulting Business, which contributes ¥24.30 billion, while the Investment Business adds ¥0.18 billion. The company's net profit margin is an important financial metric to consider when analyzing its overall profitability.

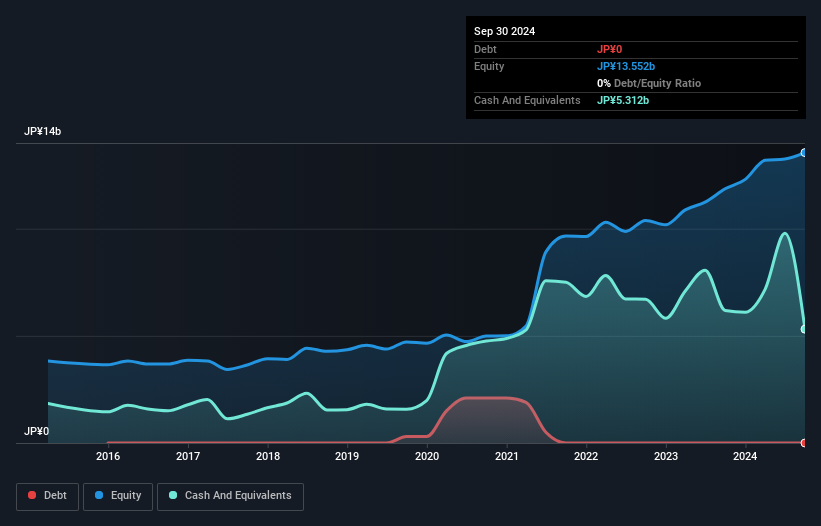

SIGMAXYZ Holdings, a nimble player in the professional services sector, has shown impressive earnings growth of 41.2% over the past year, outpacing industry peers at 8.8%. The company is debt-free now compared to a debt-to-equity ratio of 6.4% five years ago and trades at an attractive 34% below its estimated fair value. Recent corporate actions include a stock split on November 28, and a share buyback completed in September for ¥637 million covering over 1% of shares. Looking ahead, SIGMAXYZ anticipates revenue reaching ¥26 billion with operating profit forecasted at ¥5.45 billion for fiscal year ending March 2025.

Fuji Seal International (TSE:7864)

Simply Wall St Value Rating: ★★★★★★

Overview: Fuji Seal International, Inc. specializes in providing packaging solutions for the food, beverages, home and personal care, and medical fluid diet markets with a market capitalization of ¥1.38 trillion.

Operations: Fuji Seal International generates revenue primarily from its operations in Japan (¥101.25 billion), followed by the Americas (¥63.53 billion), Europe (¥33.92 billion), and ASEAN regions (¥19.32 billion).

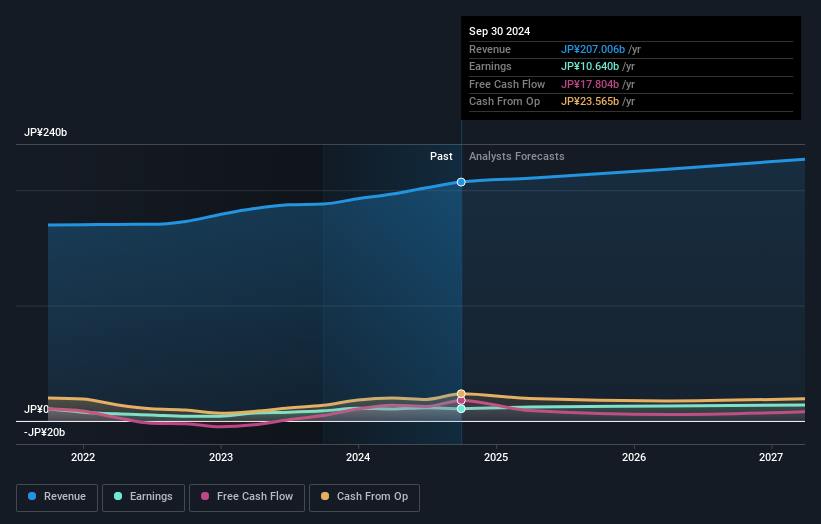

Fuji Seal, a player in the packaging industry, has shown impressive financial resilience. Over the past year, its earnings grew by 22%, outpacing the industry's 19.5% growth rate. The company's price-to-earnings ratio stands at 13x, which is slightly below Japan's market average of 13.6x, indicating potential value for investors. With a significant reduction in its debt-to-equity ratio from 10.8% to 2.8% over five years and positive free cash flow reported recently at ¥17 billion as of September 2024, Fuji Seal demonstrates strong fiscal management and quality earnings despite no recent share buybacks being executed this year.

- Take a closer look at Fuji Seal International's potential here in our health report.

Learn about Fuji Seal International's historical performance.

Seize The Opportunity

- Discover the full array of 4629 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7864

Fuji Seal International

Provides packaging solutions primarily for food, beverages, home and personal care, and medical fluid diet markets.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives