3 Stocks That May Be Trading Below Their Estimated Value In January 2025

Reviewed by Simply Wall St

As global markets react to recent political developments and economic shifts, U.S. stocks have been climbing toward record highs, fueled by optimism around trade policies and advancements in artificial intelligence. In this environment of cautious optimism, identifying stocks that might be trading below their estimated value can present opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.86 | TRY77.57 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.58 | £13.12 | 49.9% |

| Atea (OB:ATEA) | NOK139.40 | NOK278.37 | 49.9% |

| PDS (NSEI:PDSL) | ₹492.20 | ₹983.09 | 49.9% |

| East Side Games Group (TSX:EAGR) | CA$0.57 | CA$1.14 | 50% |

| Kinaxis (TSX:KXS) | CA$170.04 | CA$339.70 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.03 | 49.8% |

| IDP Education (ASX:IEL) | A$13.17 | A$26.31 | 50% |

| Shinko Electric Industries (TSE:6967) | ¥5859.00 | ¥11720.14 | 50% |

| Cavotec (OM:CCC) | SEK20.00 | SEK39.88 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

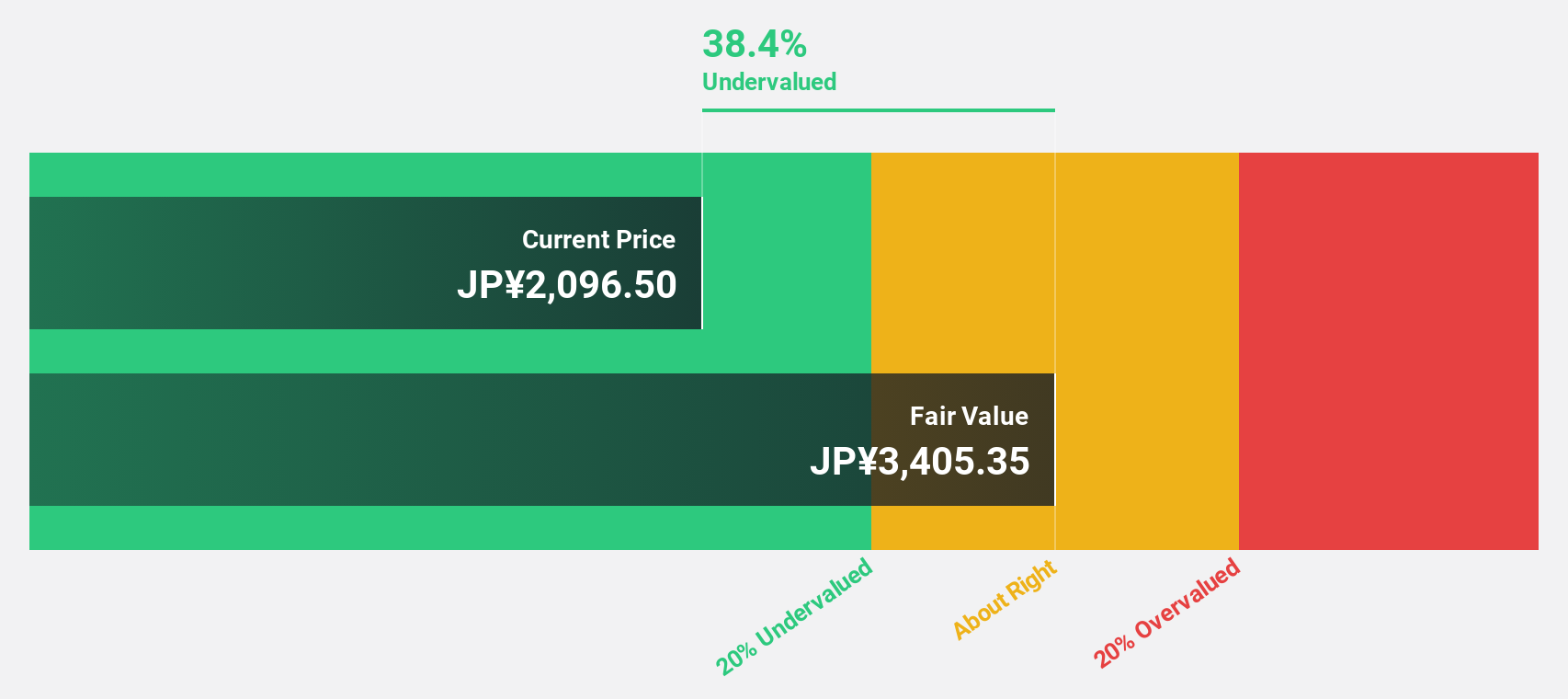

Geo Holdings (TSE:2681)

Overview: Geo Holdings Corporation operates in the amusement businesses sector in Japan with a market capitalization of ¥70.64 billion.

Operations: Geo Holdings Corporation generates revenue from its Retail Services segment, amounting to ¥417.81 million.

Estimated Discount To Fair Value: 15.5%

Geo Holdings is trading at ¥1873, approximately 15.5% below its estimated fair value of ¥2216.72, suggesting it is undervalued based on cash flows. Despite a volatile share price recently, earnings have grown by 16.5% over the past year and are forecast to grow significantly at 20.6% annually over the next three years, outpacing the Japanese market's growth rate of 8.2%. However, its dividend yield of 1.82% isn't well covered by free cash flows.

- Our earnings growth report unveils the potential for significant increases in Geo Holdings' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Geo Holdings.

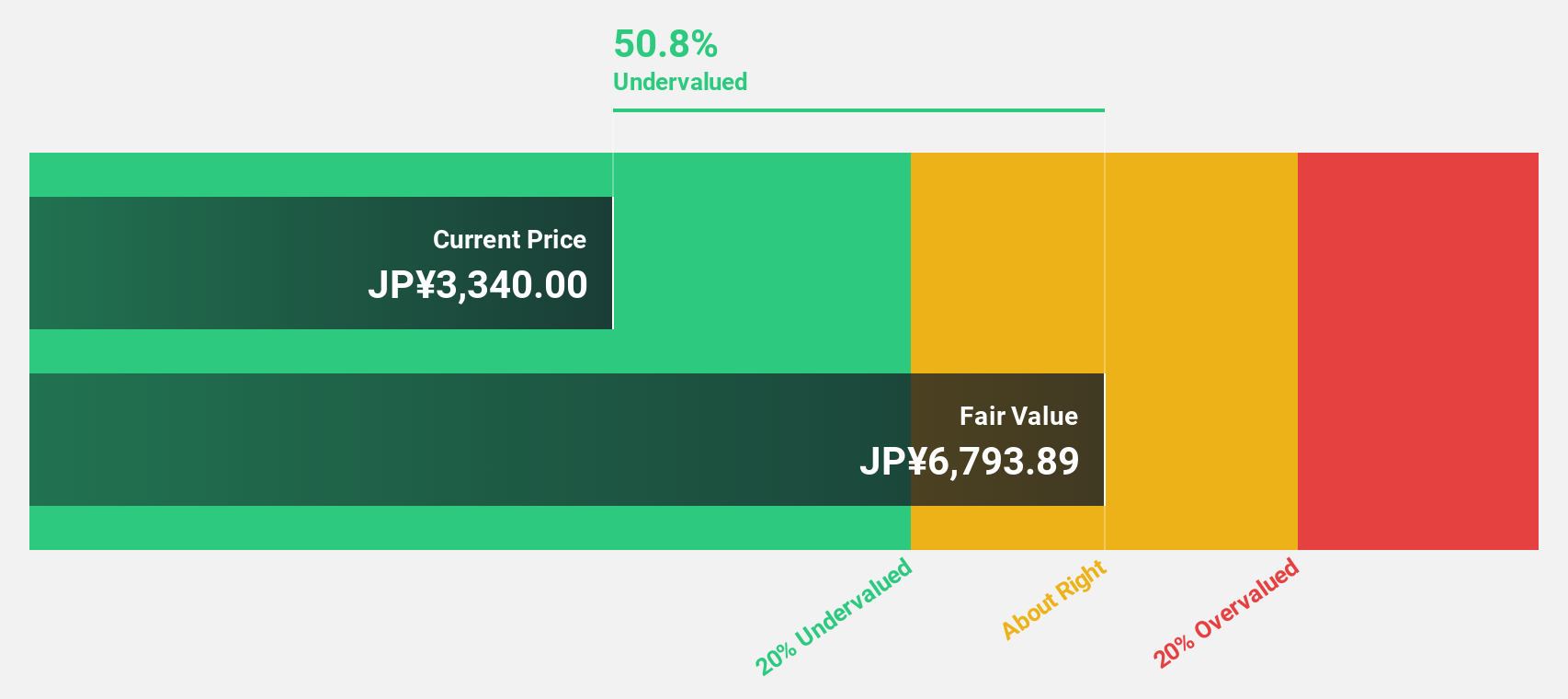

KeePer Technical Laboratory (TSE:6036)

Overview: KeePer Technical Laboratory Co., Ltd. is a Japanese company that develops, manufactures, and sells car coatings, car washing chemicals and equipment, with a market cap of ¥122.54 billion.

Operations: Revenue Segments (in millions of ¥): Car coatings: ¥9,500; Car washing chemicals and equipment: ¥3,200.

Estimated Discount To Fair Value: 40.7%

KeePer Technical Laboratory is trading at ¥4,535, significantly below its estimated fair value of ¥7,652.65, indicating it is undervalued based on cash flows. Despite recent share price volatility, earnings grew by 17.6% last year and are expected to grow annually by 17.56%, surpassing the Japanese market's rate of 8.2%. Recent expansions in Nagasaki and Toyota City could bolster future revenue growth projected at 14.9% per year, outpacing the market's average growth rate.

- The analysis detailed in our KeePer Technical Laboratory growth report hints at robust future financial performance.

- Dive into the specifics of KeePer Technical Laboratory here with our thorough financial health report.

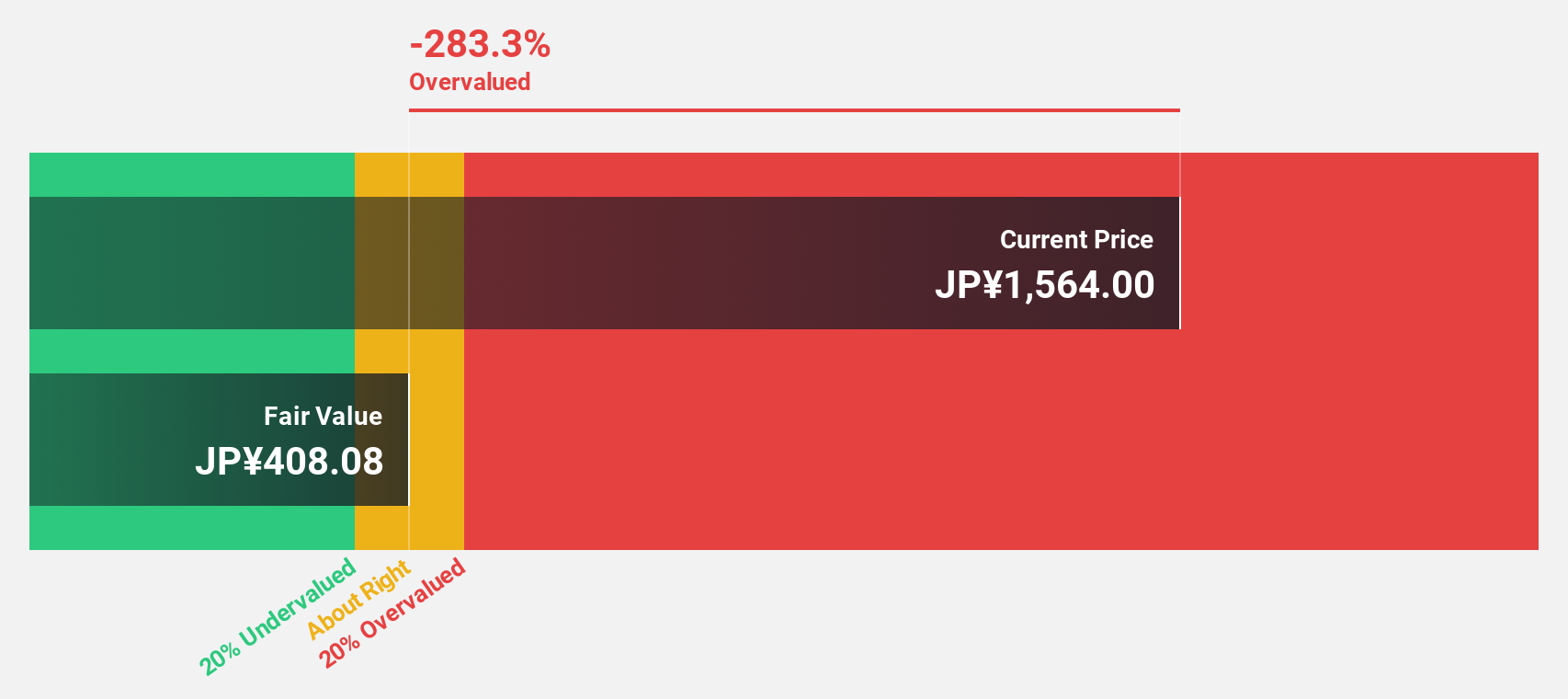

Aozora Bank (TSE:8304)

Overview: Aozora Bank, Ltd., along with its subsidiaries, offers a range of banking products and services both in Japan and internationally, with a market cap of ¥329.90 billion.

Operations: The company's revenue segments include the Customer Relations Group with ¥8.51 billion, Structured Finance Group contributing ¥35.68 billion, and International Business Group generating ¥18.24 billion.

Estimated Discount To Fair Value: 28.0%

Aozora Bank is trading at ¥2,397, notably below its estimated fair value of ¥3,327.06, suggesting it is undervalued based on cash flows. Forecasted revenue growth of 15.4% annually surpasses the Japanese market's average and earnings are expected to grow by 72.6% per year as the bank becomes profitable over the next three years. However, challenges include a high bad loans ratio of 2.9% and recent shareholder dilution impacting equity returns.

- Our growth report here indicates Aozora Bank may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Aozora Bank stock in this financial health report.

Make It Happen

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 893 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeePer Technical Laboratory might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6036

KeePer Technical Laboratory

Develops, manufactures, and sells car coatings, car washing chemicals and equipment, and other products in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives