United Urban Investment (TSE:8960): Evaluating Premium Valuation After Dividend Increase and Rising Investor Optimism

Reviewed by Simply Wall St

If you have been keeping an eye on United Urban Investment (TSE:8960), the past few weeks may have felt like a reveal party for the company’s ambitions. News just broke of a semi-annual dividend hike, sending a fresh signal to the market that management feels confident about growth and profitability in the near term. At the same time, United Urban Investment has been trading at a premium compared to its real estate peers, a clear vote of confidence from investors banking on continued strong earnings and improved margins.

This momentum has not come out of nowhere. The stock has gained serious ground both over the past month and in the year overall, outpacing much of the real estate sector and the broader market. With short- and long-term returns alike building, investor sentiment seems to be firmly in the camp that United Urban Investment’s prospects are bright. Earlier dividend increases, combined with ongoing share price advances, are reinforcing perceptions that this REIT stands out in a crowded field.

But with so much optimism already baked in, it is worth asking whether we are looking at an attractive entry point here, or if the market has priced in every bit of expected future growth.

Price-to-Earnings of 22.7x: Is it justified?

United Urban Investment is currently valued at a price-to-earnings ratio of 22.7x, placing it above both its peer average of 22x and the broader JP REITs industry average of 19.9x. This higher valuation suggests the market may be expecting stronger performance or growth compared to similar companies.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of a company's earnings. For a real estate investment trust like United Urban Investment, it is an important metric because REITs are generally assessed based on the consistency and growth of their income streams. A higher P/E can reflect robust profit growth expectations or indicate that the market is pricing in future expansion ahead of current fundamentals.

Since United Urban Investment trades at a premium versus its sector and industry, the market appears to be factoring in strong prospects for ongoing returns and earnings growth. However, investors should consider whether these expectations are sustainable or if the current premium limits the potential for further upside unless the company delivers results exceeding even elevated forecasts.

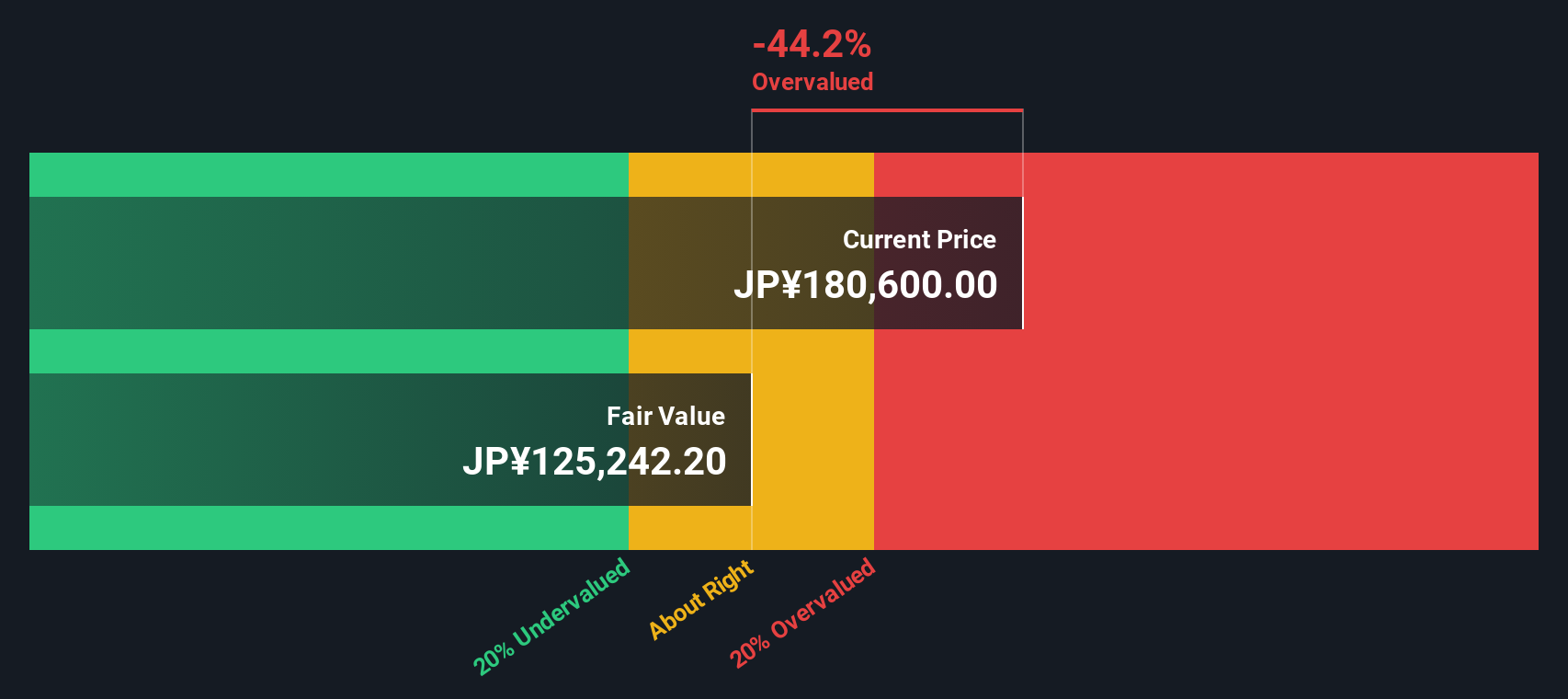

Result: Fair Value of ¥125,251.85 (OVERVALUED)

See our latest analysis for United Urban Investment.However, if revenue growth slows or investor sentiment reverses, it could quickly test whether United Urban Investment's premium valuation is truly justified.

Find out about the key risks to this United Urban Investment narrative.Another View: Discounted Cash Flow Model

Taking a different approach, our DCF model also suggests United Urban Investment is trading above its fair value right now. When two methods echo the same caution, does that indicate an opportunity or a risk ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own United Urban Investment Narrative

If you would rather rely on your own analysis or want to dig deeper into the numbers, you can craft a personalized view in just a few minutes. Do it your way.

A great starting point for your United Urban Investment research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your opportunities to just one stock. See what else is out there. You could miss out on the next big winner if you don’t cast a wider net.

- Boost your search for steady payouts and spot top income generators with our handpicked list of dividend stocks with yields > 3% you might not have considered yet.

- Get ahead of the curve by uncovering companies shaping tomorrow’s technology through our exclusive lineup of AI penny stocks set to transform industries.

- Unlock hidden gems trading below their worth with a tailored look at undervalued stocks based on cash flows to help you seize true value that the market overlooks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8960

United Urban Investment

United Urban Investment Corporation was established on November 4, 2003 in accordance with the Act on Investment Trusts and Investment Corporations (Act No.

Solid track record average dividend payer.

Market Insights

Community Narratives