A Closer Look at Sekisui House Reit (TSE:3309) Valuation Following Lease Structure Shift for Growth

Reviewed by Kshitija Bhandaru

Sekisui House Reit (TSE:3309) is switching the master lease for Sha Maison Stage Hakata from a fixed-rent type to a pass-through type. The change reflects strong occupancy figures and rising rent momentum in its residential portfolio.

See our latest analysis for Sekisui House Reit.

Recent months have seen Sekisui House Reit repay part of its debt and approve the cancellation of investment units. These moves signal disciplined balance sheet management. While the share price has only edged up this year, the real story is its 11.9% total return over the past twelve months and a solid 33% total return over five years. This suggests steady long-term momentum is building alongside operational changes.

If you’re keen to see what else is gaining traction beyond real estate, now’s a great opportunity to broaden your watchlist and discover fast growing stocks with high insider ownership

This momentum puts the focus squarely on valuation, raising the question of whether Sekisui House Reit is trading below its true worth or if recent gains mean the market is already pricing in the next phase of growth.

Price-to-Earnings of 15.8x: Is it justified?

Sekisui House Reit’s last close price reflects a price-to-earnings ratio of 15.8x, placing it significantly below both industry peers and the broader peer group. This positions the stock as an apparent value standout relative to the REITs sector.

The price-to-earnings ratio measures the price investors are willing to pay for every ¥1 of company earnings. For REITs, this multiple is especially important, as these companies tend to deliver stable earnings streams but often face sector-wide valuation constraints. A lower price-to-earnings ratio can indicate undervaluation if quality and growth are intact.

With Sekisui House Reit’s multiple at 15.8x compared to an industry average of 20x and a peer average of 21.8x, the market is pricing in less growth or more risk compared to rivals. However, regression-based analysis puts a fair value multiple closer to 18.5x, suggesting the current level might not last if momentum continues.

Explore the SWS fair ratio for Sekisui House Reit

Result: Price-to-Earnings of 15.8x (UNDERVALUED)

However, revenue and net income have both declined over the past year. This could signal challenges if this trend continues or worsens.

Find out about the key risks to this Sekisui House Reit narrative.

Another View: What Does the SWS DCF Model Say?

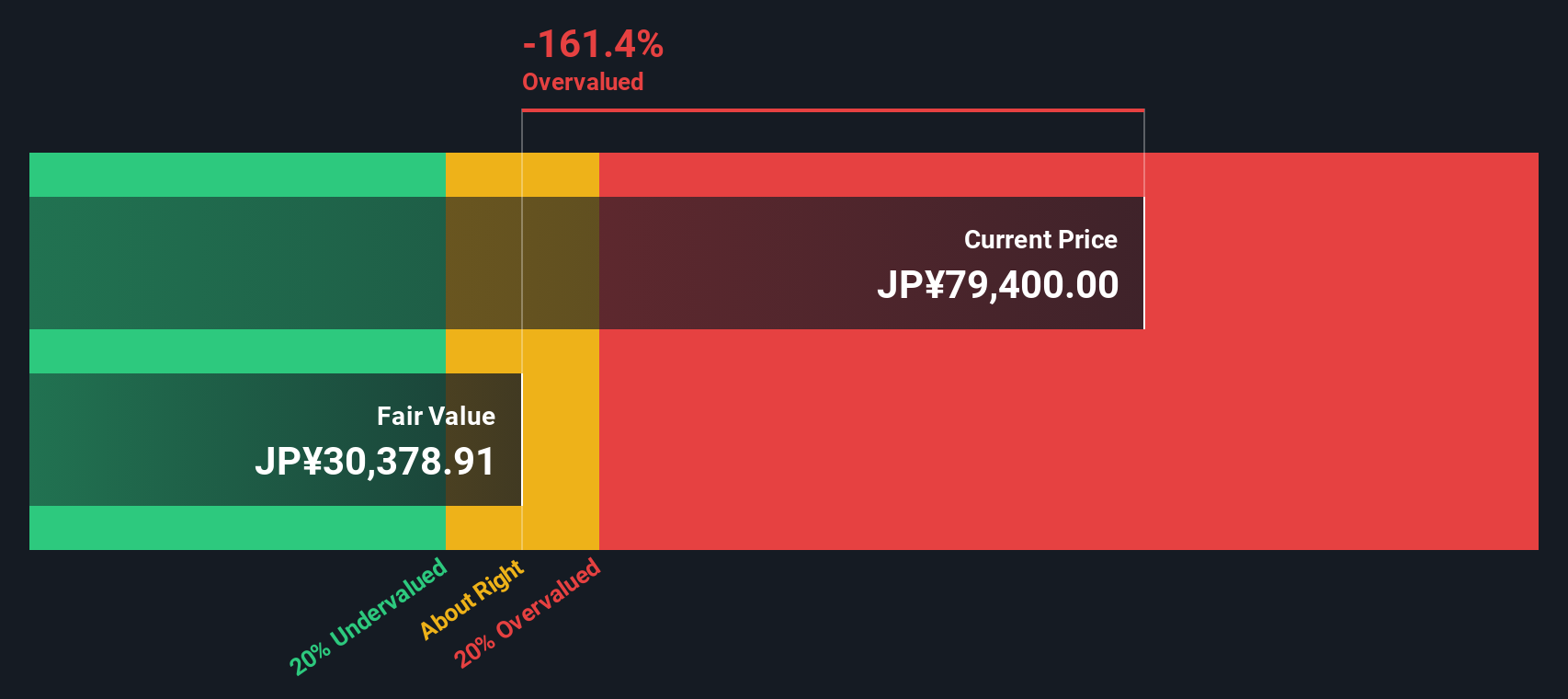

Looking from another angle, our SWS DCF model values Sekisui House Reit well below its current price. This approach estimates fair value at ¥30,107 compared to the market's ¥79,400, hinting that the shares may be overvalued right now. Could this indicate that the market’s optimism has overshot the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sekisui House Reit for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sekisui House Reit Narrative

If you see the numbers differently or want your own perspective, crafting a fresh narrative takes just a few minutes. Do it your way

A great starting point for your Sekisui House Reit research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. Step up your strategy and gain an edge by tapping into unique growth themes across emerging sectors with these handpicked ideas:

- Jumpstart your search for reliable income by checking out these 19 dividend stocks with yields > 3% with proven yields above 3%.

- Spot digital transformation at its source and tap into the momentum of artificial intelligence by scanning these 25 AI penny stocks that are powering the sector forward.

- Capitalize on future-focused disruption by tracking these 79 cryptocurrency and blockchain stocks at the forefront of blockchain innovation and next-generation finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3309

Sekisui House Reit

Sekisui House Reit, Inc. ("SHR") was established on September 8, 2014 as an investment corporation investing primarily in commercial properties including office buildings, hotels and retail and other properties, sponsored by Sekisui House, Ltd.

6 star dividend payer with solid track record.

Market Insights

Community Narratives