- South Korea

- /

- Pharma

- /

- KOSE:A326030

Asian Stocks Trading At Estimated Discounts For Value Investors

Reviewed by Simply Wall St

As global markets navigate a landscape marked by economic uncertainties and mixed signals, Asian stock markets present intriguing opportunities for value investors. In this environment, identifying undervalued stocks that trade at estimated discounts can be a strategic approach to potentially capitalize on market inefficiencies and economic developments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Modetour Network (KOSDAQ:A080160) | ₩10850.00 | ₩21610.74 | 49.8% |

| Chison Medical Technologies (SHSE:688358) | CN¥31.13 | CN¥61.48 | 49.4% |

| RACCOON HOLDINGS (TSE:3031) | ¥957.00 | ¥1890.67 | 49.4% |

| STI (KOSDAQ:A039440) | ₩22050.00 | ₩43991.58 | 49.9% |

| S Foods (TSE:2292) | ¥2559.00 | ¥5084.09 | 49.7% |

| Bide Pharmatech (SHSE:688073) | CN¥54.44 | CN¥106.91 | 49.1% |

| Takara Bio (TSE:4974) | ¥847.00 | ¥1680.23 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.43 | SGD0.85 | 49.3% |

| ALUX (KOSDAQ:A475580) | ₩11250.00 | ₩22180.19 | 49.3% |

| Zhejiang Juhua (SHSE:600160) | CN¥23.90 | CN¥47.58 | 49.8% |

Let's dive into some prime choices out of the screener.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on researching and developing drugs for central nervous system disorders, with a market cap of approximately ₩8.41 trillion.

Operations: The company's revenue is primarily derived from its New Drug Development segment, which generated approximately ₩547.60 million.

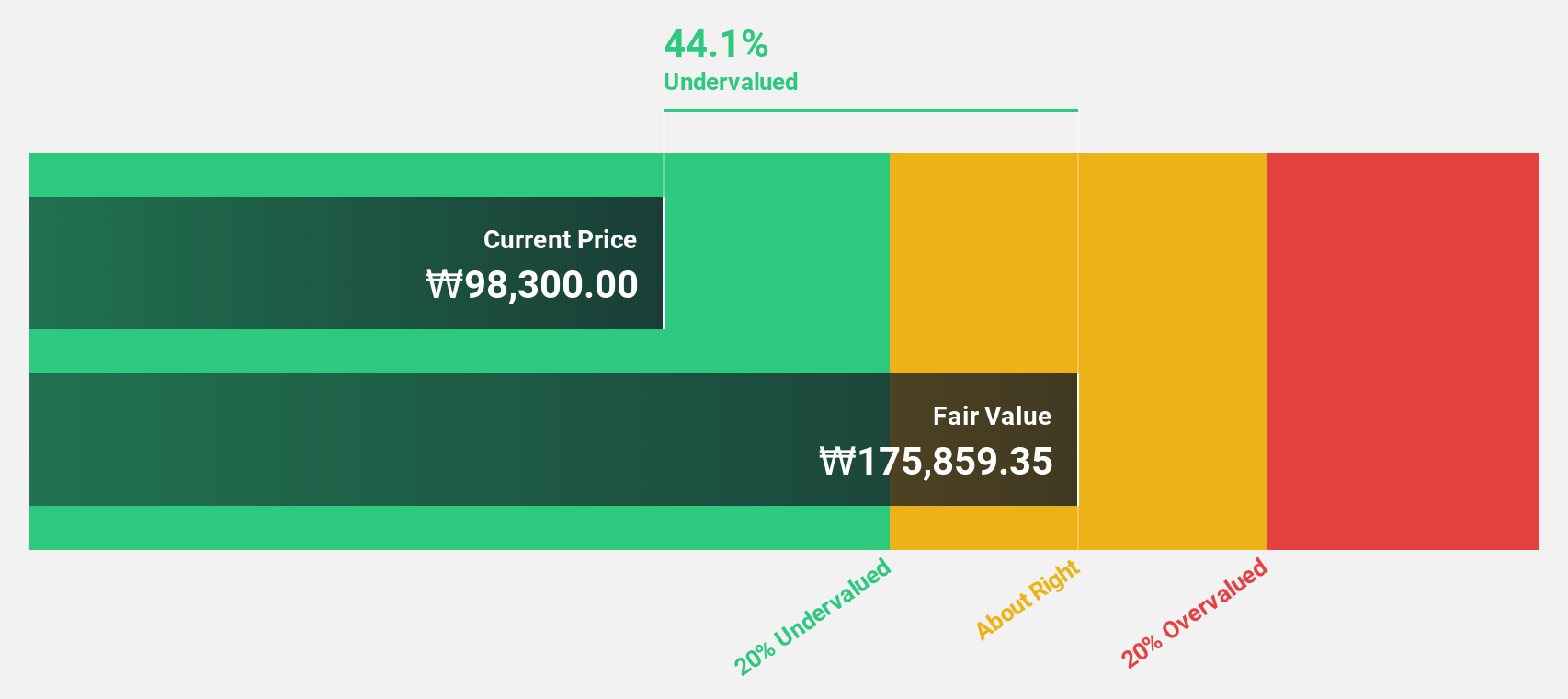

Estimated Discount To Fair Value: 24.6%

SK Biopharmaceuticals is trading at 24.6% below its estimated fair value of ₩142,406.37, making it an attractive option for investors seeking undervalued stocks based on cash flows. Its earnings are expected to grow by 6.59% annually, though slower than the Korean market average of 23.2%. The company recently became profitable and forecasts a high return on equity of 34.4% in three years, with revenue growth anticipated at 21.9% per year, outpacing the market's growth rate.

- Our expertly prepared growth report on SK Biopharmaceuticals implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in SK Biopharmaceuticals' balance sheet health report.

Shanghai Aohua Photoelectricity Endoscope (SHSE:688212)

Overview: Shanghai Aohua Photoelectricity Endoscope Co., Ltd. operates in the medical equipment industry, specializing in the development and production of endoscopic devices, with a market cap of CN¥5.75 billion.

Operations: The company's revenue primarily comes from its Diagnostic Kits / Equipment segment, generating CN¥748.56 million.

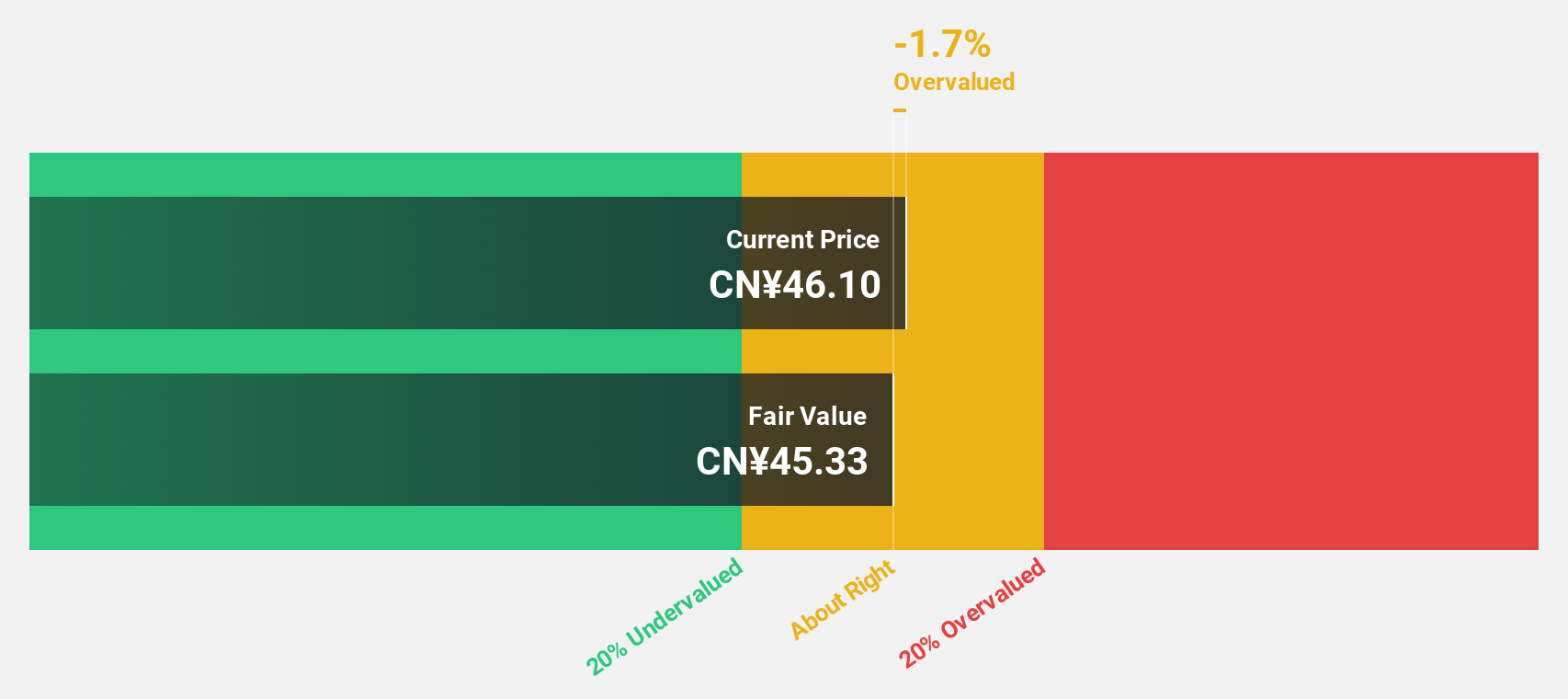

Estimated Discount To Fair Value: 24.7%

Shanghai Aohua Photoelectricity Endoscope is trading 24.7% below its estimated fair value of CNY 56.7, presenting an opportunity for those interested in undervalued stocks based on cash flows. Despite a recent decline in net income to CNY 21.32 million, earnings are forecasted to grow significantly at 78.8% annually over the next three years, outpacing the Chinese market's growth rate of 24.9%. However, its profit margins have decreased from last year’s figures.

- Insights from our recent growth report point to a promising forecast for Shanghai Aohua Photoelectricity Endoscope's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanghai Aohua Photoelectricity Endoscope.

KATITAS (TSE:8919)

Overview: KATITAS CO., Ltd. specializes in surveying, purchasing, refurbishing, remodeling, and selling used homes to individuals and families in Japan, with a market cap of ¥158.19 billion.

Operations: The company's revenue is primarily generated from its House for Resale Reproduction Business, amounting to ¥129.69 billion.

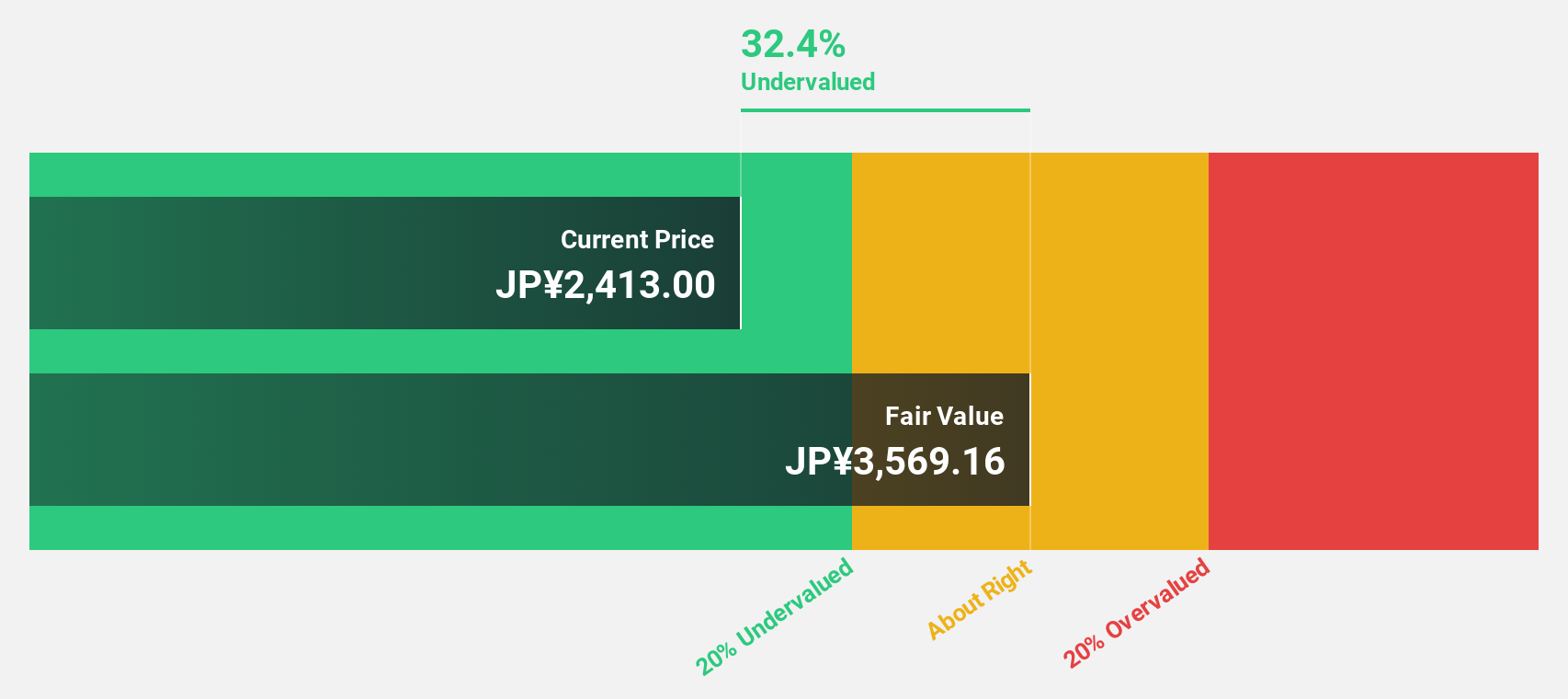

Estimated Discount To Fair Value: 25.6%

KATITAS is trading at 25.6% below its estimated fair value of ¥2720.02, indicating it may be undervalued based on cash flows. The company has shown strong past earnings growth of 81.3% and is expected to grow earnings by 9.23% annually, surpassing the Japanese market's growth rate of 8%. While revenue growth is forecasted at a moderate pace of 8.1%, the unstable dividend track record remains a concern for some investors.

- According our earnings growth report, there's an indication that KATITAS might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of KATITAS.

Turning Ideas Into Actions

- Dive into all 284 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A326030

SK Biopharmaceuticals

A pharmaceutical company, engages in the research and development of drugs for the treatment of central nervous system disorders.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives