- Japan

- /

- Real Estate

- /

- TSE:3750

Revenues Tell The Story For Cytori Cell Research Institute, Inc. (TSE:3750)

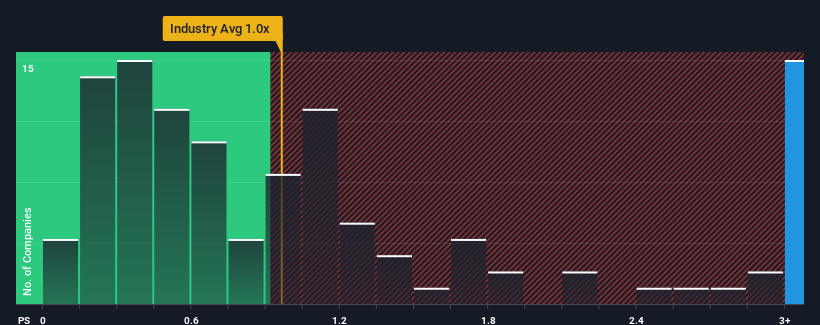

When close to half the companies in the Real Estate industry in Japan have price-to-sales ratios (or "P/S") below 1x, you may consider Cytori Cell Research Institute, Inc. (TSE:3750) as a stock to avoid entirely with its 4.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cytori Cell Research Institute

How Has Cytori Cell Research Institute Performed Recently?

For example, consider that Cytori Cell Research Institute's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Cytori Cell Research Institute, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Cytori Cell Research Institute?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Cytori Cell Research Institute's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.2% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 6.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Cytori Cell Research Institute is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cytori Cell Research Institute maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Having said that, be aware Cytori Cell Research Institute is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3750

Cytori Cell Research Institute

Engages in the research, development, production, and sale of cell therapy related medical devices in Japan.

Low with questionable track record.

Market Insights

Community Narratives