- Finland

- /

- General Merchandise and Department Stores

- /

- HLSE:PUUILO

Discovering 3 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week with moderate gains in major indices, the decline in U.S. consumer confidence and manufacturing signals potential challenges ahead for small-cap companies. Amidst these economic indicators, investors may find opportunities by identifying stocks that demonstrate resilience and growth potential despite broader market fluctuations. In this context, uncovering lesser-known stocks with strong fundamentals and innovative business models can offer promising prospects for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dr. Miele Cosmed Group | 21.75% | 8.35% | 15.31% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Puuilo Oyj (HLSE:PUUILO)

Simply Wall St Value Rating: ★★★★★★

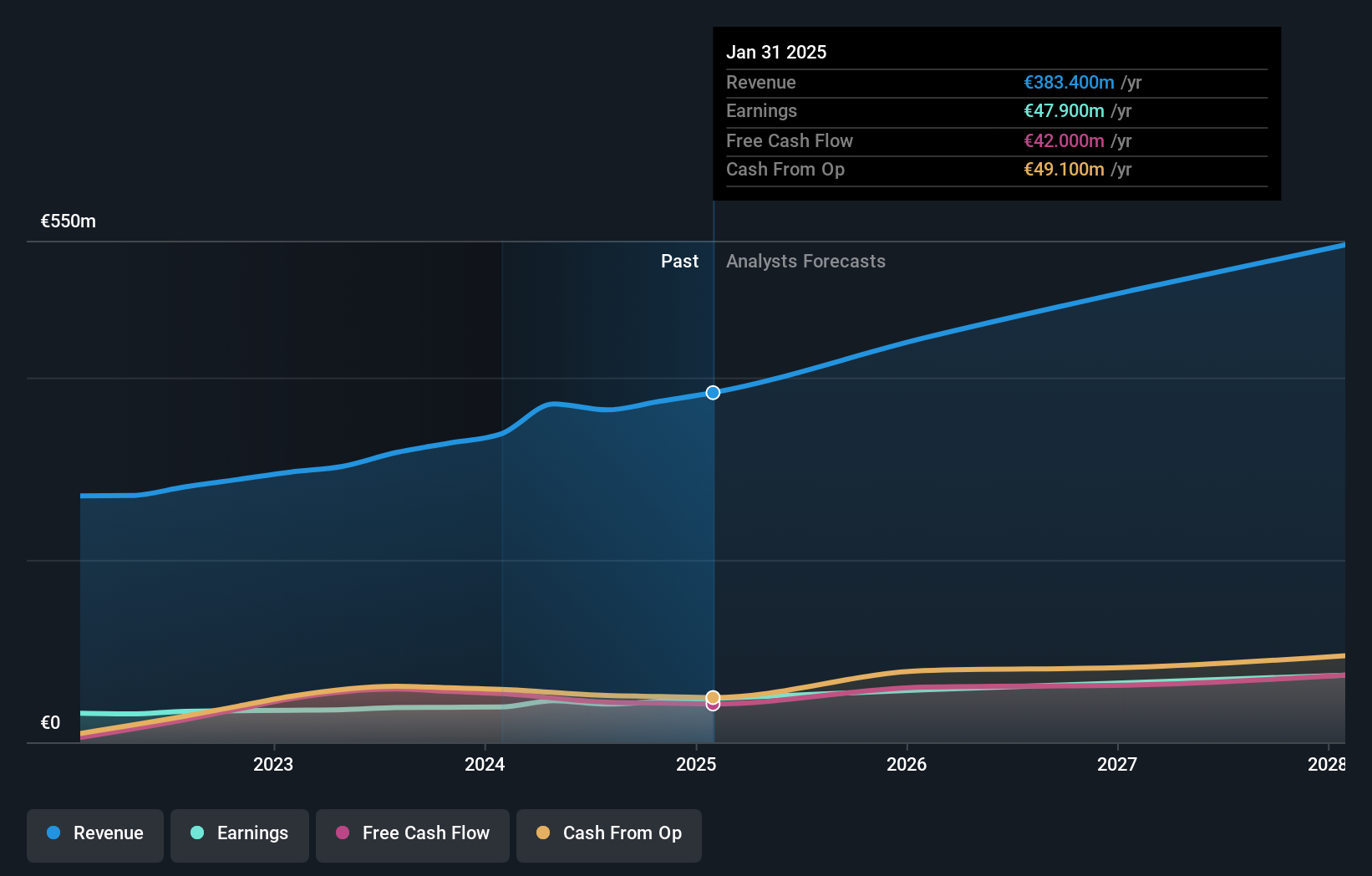

Overview: Puuilo Oyj operates a discount retail chain in Finland with a market capitalization of €860.75 million.

Operations: The company generates revenue primarily from its retail department stores, amounting to €364.50 million.

Puuilo Oyj, a promising player in the retail sector, has demonstrated robust financial health with its interest payments well covered by EBIT at 13 times. Over the past five years, its debt to equity ratio impressively decreased from 165.6% to 65%, indicating prudent financial management. The company trades at a compelling valuation, being 26% below estimated fair value. Earnings grew by 10.3% last year, outpacing the industry average of -10.5%, showcasing high-quality earnings and solid growth prospects with forecasts suggesting a further annual increase of around 14.56%.

- Navigate through the intricacies of Puuilo Oyj with our comprehensive health report here.

Assess Puuilo Oyj's past performance with our detailed historical performance reports.

TKP (TSE:3479)

Simply Wall St Value Rating: ★★★★★☆

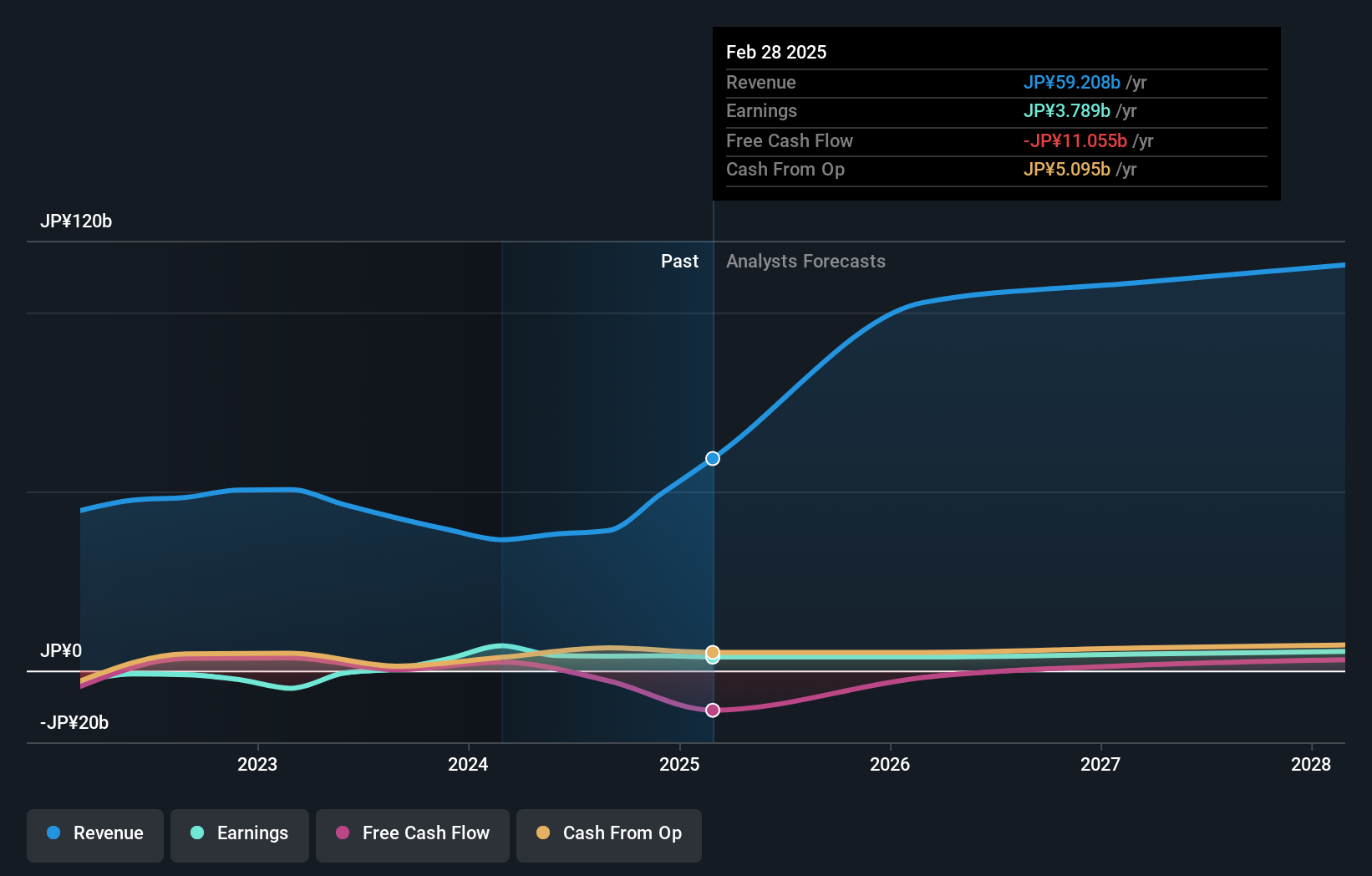

Overview: TKP Corporation offers meeting room rental services both in Japan and internationally, with a market cap of ¥52.97 billion.

Operations: TKP generates revenue primarily through its meeting room rental services in Japan and abroad. The company has experienced fluctuations in its net profit margin, which was recorded at 5.6% in the most recent period.

With a remarkable earnings growth of 656% over the past year, TKP stands out in its industry. This growth significantly surpasses the Real Estate sector's average of 22%, showcasing its potential. The company's net debt to equity ratio has improved from 296% to a satisfactory 77% over five years, indicating better financial management. Trading at nearly 60% below estimated fair value, it presents an attractive opportunity for investors seeking undervalued stocks. Despite high-quality earnings and well-covered interest payments (18x EBIT), volatility remains a concern, suggesting careful consideration is needed for prospective investors.

eGuarantee (TSE:8771)

Simply Wall St Value Rating: ★★★★★★

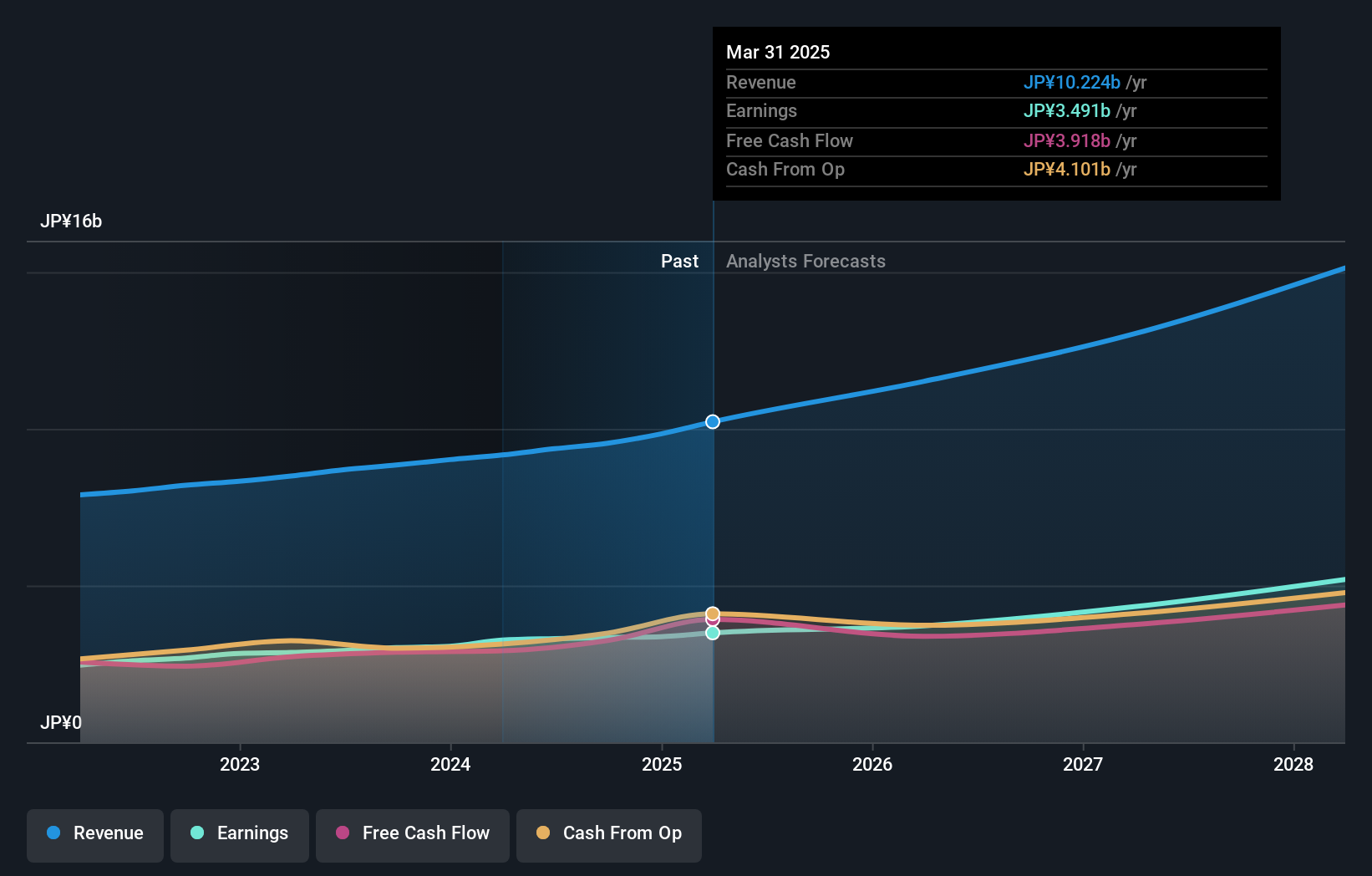

Overview: eGuarantee, Inc., along with its subsidiaries, operates in the credit risk entrustment and securitization sector in Japan, with a market capitalization of approximately ¥85.04 billion.

Operations: eGuarantee generates revenue primarily from its credit risk entrustment and securitization services. It focuses on managing financial risks and providing solutions that help clients mitigate potential credit losses. The company's cost structure is influenced by operational expenses related to these services, impacting its profitability metrics.

eGuarantee stands out with its high-quality earnings and a debt-free status that eliminates concerns over interest payments. Over the past five years, the company has seen earnings grow at a solid 10.7% annually, although recent growth of 10.8% lagged behind the broader Diversified Financial industry at 28.6%. Looking ahead, forecasts suggest an impressive annual growth rate of 12.8%, positioning eGuarantee for potential expansion in its niche market segment. The company's strong free cash flow position further supports its financial health, indicating robust operational efficiency and capacity for reinvestment or strategic initiatives in the coming years.

- Click to explore a detailed breakdown of our findings in eGuarantee's health report.

Understand eGuarantee's track record by examining our Past report.

Where To Now?

- Access the full spectrum of 4636 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:PUUILO

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)