- Japan

- /

- Real Estate

- /

- TSE:3475

Good Com Asset (TSE:3475) Margin Compression Reinforces Bearish Profitability Narrative

Reviewed by Simply Wall St

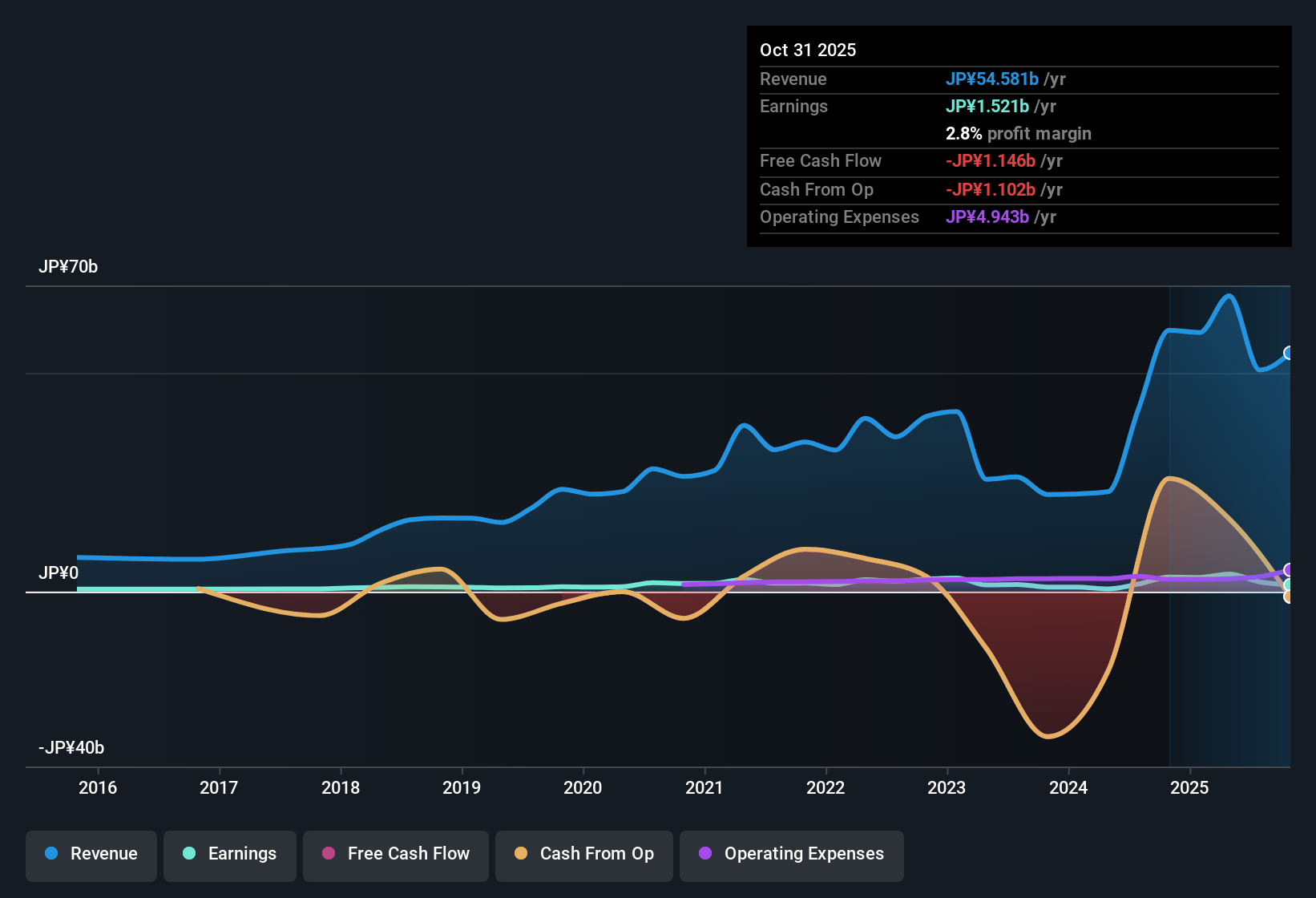

Good Com Asset (TSE:3475) has just posted its FY 2025 numbers, with fourth quarter revenue of about ¥29.7 billion and Basic EPS of ¥34.82. This caps off a trailing twelve month stretch that saw revenue at roughly ¥54.6 billion and EPS of ¥53.29, while margins slipped from 5.6% to 2.8% over the year. The company has seen revenue move from about ¥59.8 billion and EPS of ¥115.25 in the FY 2024 fourth quarter to the latest trailing twelve month levels, while the share price sits around ¥1,261 as investors weigh that softer profitability. With earnings quality still flagged as high and the stock trading well below one fair value estimate, the latest results set up a nuanced margins story that investors will be dissecting closely.

See our full analysis for Good Com Asset.With the headline figures on the table, the next step is to see how this earnings print lines up with the dominant narratives around Good Com Asset and whether the numbers back up or challenge what the market has been assuming.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Halve as Net Profit Shrinks to ¥1.5 billion

- On a trailing twelve month basis, net income has dropped from about ¥3.3 billion a year ago to roughly ¥1.5 billion, with the net profit margin falling from 5.6% to 2.8% over the same period.

- Bears point to this compression in profitability as a sign that the business is under pressure, yet the data shows a more mixed picture:

- Over the past five years, earnings still managed to grow at an average rate of 2.5% per year, which contrasts with the weaker most recent year.

- The latest fiscal year also included a negative third quarter, where net income was about minus ¥524 million, highlighting that short term swings can be sharp even within a longer term growth record.

Sharp Swings in Quarterly EPS Around a Positive Full Year

- Within FY 2025, Basic EPS ranged from roughly minus ¥18.3 in Q3 to about ¥39.9 in Q2, ending the year at about ¥34.8 in Q4 and ¥53.3 on a trailing twelve month basis.

- What stands out for a bearish view is how these quarter to quarter moves complicate the story of steady progress:

- Q3 saw both negative EPS and net income of around minus ¥524 million, yet the company still reported positive net income of about ¥998 million in Q4 and a positive trailing twelve month profit overall.

- This pattern shows that while individual quarters can be weak, the annual picture is not one of persistent losses, which challenges a simple bearish narrative that the business is structurally unprofitable.

Deep Price Discount but Premium P/E Multiple

- The shares trade near ¥1,261 compared with a DCF fair value of about ¥7,292.76, yet the trailing P E of 23.7 times still sits above both the JP real estate industry average of 11.7 times and the peer average of 7.4 times.

- Consensus style thinking around the stock often focuses on this tension between the big valuation gap and weaker fundamentals:

- On one hand, trading roughly 82.7 percent below the DCF fair value looks like potential upside if margins and earnings recover from the current 2.8 percent net margin.

- On the other, the combination of elevated leverage and a P E richer than industry and peers despite lower recent profit levels gives support to cautious investors who see reasons for the discount to persist.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Good Com Asset's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternative Opportunities

Good Com Asset faces compressed margins, volatile quarterly earnings, and a premium valuation multiple that leaves little room for error if profitability stays subdued.

If this combination makes you uneasy, use our these 916 undervalued stocks based on cash flows to quickly zero in on undervalued companies where stronger fundamentals and pricing leave more upside and less downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3475

Good Com Asset

Plans, develops, and sells condominiums under the GENOVIA brand name in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)