- Japan

- /

- Real Estate

- /

- TSE:2970

It's Down 26% But Good Life Company,Inc. (TSE:2970) Could Be Riskier Than It Looks

The Good Life Company,Inc. (TSE:2970) share price has fared very poorly over the last month, falling by a substantial 26%. Still, a bad month hasn't completely ruined the past year with the stock gaining 72%, which is great even in a bull market.

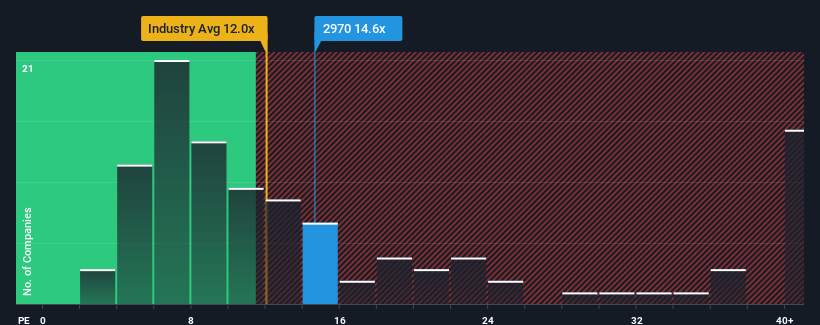

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Good Life CompanyInc's P/E ratio of 14.6x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Good Life CompanyInc has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Good Life CompanyInc

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Good Life CompanyInc's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 58%. Pleasingly, EPS has also lifted 253% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 9.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that Good Life CompanyInc is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Good Life CompanyInc's P/E

Good Life CompanyInc's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Good Life CompanyInc currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You need to take note of risks, for example - Good Life CompanyInc has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2970

Good Life CompanyInc

Engages in the design, planning, supervising, purchasing, construction, and sale of rental condominiums in Japan.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives