- Japan

- /

- Real Estate

- /

- TSE:2970

Good Life Company,Inc. (TSE:2970) Stocks Pounded By 26% But Not Lagging Market On Growth Or Pricing

The Good Life Company,Inc. (TSE:2970) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 104% in the last twelve months.

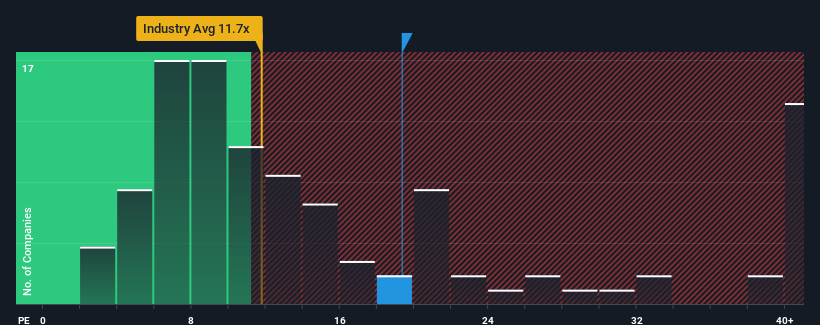

In spite of the heavy fall in price, given around half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may still consider Good Life CompanyInc as a stock to potentially avoid with its 19.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Good Life CompanyInc certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Good Life CompanyInc

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Good Life CompanyInc would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 126% last year. Pleasingly, EPS has also lifted 475% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 11% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Good Life CompanyInc is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Good Life CompanyInc's P/E

There's still some solid strength behind Good Life CompanyInc's P/E, if not its share price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Good Life CompanyInc maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 4 warning signs for Good Life CompanyInc (3 make us uncomfortable!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2970

Good Life CompanyInc

Engages in the design, planning, supervising, purchasing, construction, and sale of rental condominiums in Japan.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives