- Japan

- /

- Real Estate

- /

- TSE:2970

Good Life Company,Inc. (TSE:2970) Stock Rockets 30% But Many Are Still Ignoring The Company

Good Life Company,Inc. (TSE:2970) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 89% in the last year.

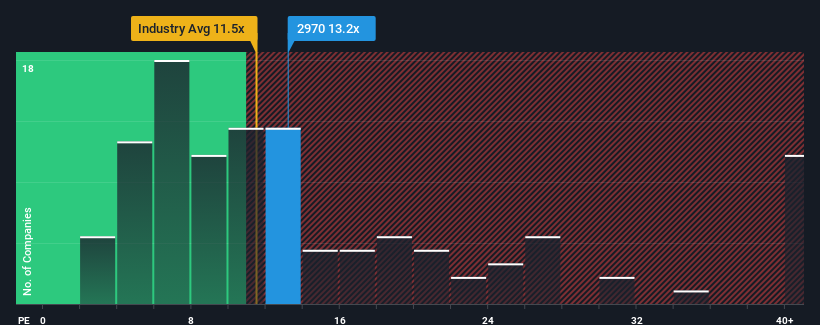

Although its price has surged higher, there still wouldn't be many who think Good Life CompanyInc's price-to-earnings (or "P/E") ratio of 13.2x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Good Life CompanyInc certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Good Life CompanyInc

Does Growth Match The P/E?

Good Life CompanyInc's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 46% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 196% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Good Life CompanyInc is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Good Life CompanyInc's P/E?

Its shares have lifted substantially and now Good Life CompanyInc's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Good Life CompanyInc currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for Good Life CompanyInc you should be aware of, and 3 of them are a bit unpleasant.

If you're unsure about the strength of Good Life CompanyInc's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2970

Good Life CompanyInc

Engages in the design, planning, supervising, purchasing, construction, and sale of rental condominiums in Japan.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives