Health Check: How Prudently Does Oncolys BioPharma (TSE:4588) Use Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Oncolys BioPharma Inc. (TSE:4588) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Oncolys BioPharma

What Is Oncolys BioPharma's Debt?

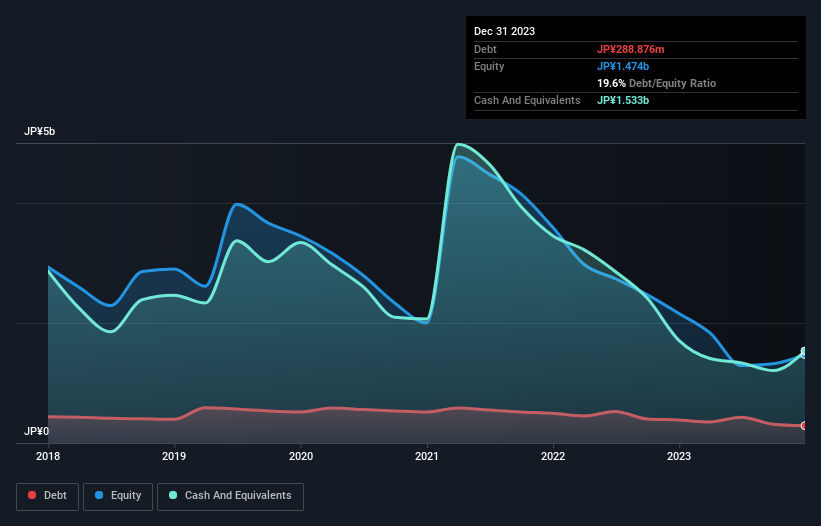

You can click the graphic below for the historical numbers, but it shows that Oncolys BioPharma had JP¥288.9m of debt in December 2023, down from JP¥383.3m, one year before. But on the other hand it also has JP¥1.53b in cash, leading to a JP¥1.24b net cash position.

How Strong Is Oncolys BioPharma's Balance Sheet?

We can see from the most recent balance sheet that Oncolys BioPharma had liabilities of JP¥378.5m falling due within a year, and liabilities of JP¥188.0m due beyond that. On the other hand, it had cash of JP¥1.53b and JP¥101.7m worth of receivables due within a year. So it actually has JP¥1.07b more liquid assets than total liabilities.

This surplus suggests that Oncolys BioPharma has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Oncolys BioPharma has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is Oncolys BioPharma's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Oncolys BioPharma made a loss at the EBIT level, and saw its revenue drop to JP¥63m, which is a fall of 94%. To be frank that doesn't bode well.

So How Risky Is Oncolys BioPharma?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Oncolys BioPharma had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through JP¥1.3b of cash and made a loss of JP¥1.9b. However, it has net cash of JP¥1.24b, so it has a bit of time before it will need more capital. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Oncolys BioPharma you should be aware of, and 2 of them are a bit concerning.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4588

Oncolys BioPharma

Engages in the research, development, manufacturing, and sale of viral infectious disease treatment drugs in Japan, the United States, and Asia.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026