KYORIN Pharmaceutical Co., Ltd.'s (TSE:4569) Business Is Trailing The Market But Its Shares Aren't

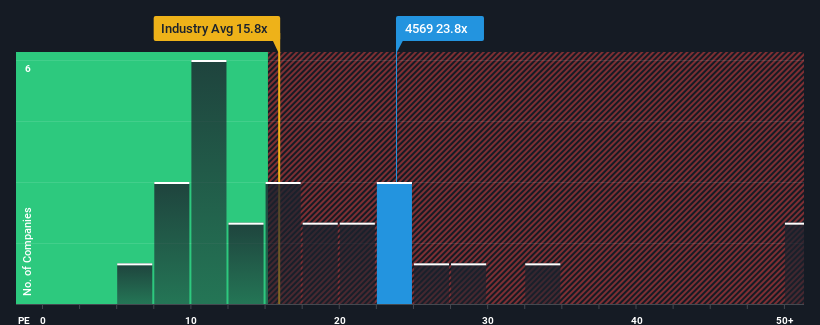

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider KYORIN Pharmaceutical Co., Ltd. (TSE:4569) as a stock to avoid entirely with its 23.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

KYORIN Pharmaceutical hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for KYORIN Pharmaceutical

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, KYORIN Pharmaceutical would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 9.8% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 6.6% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 5.3% per year over the next three years. Meanwhile, the broader market is forecast to expand by 9.2% per year, which paints a poor picture.

With this information, we find it concerning that KYORIN Pharmaceutical is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that KYORIN Pharmaceutical currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for KYORIN Pharmaceutical you should be aware of, and 1 of them is a bit unpleasant.

If you're unsure about the strength of KYORIN Pharmaceutical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if KYORIN Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4569

KYORIN Pharmaceutical

Through its subsidiaries, researches and develops, manufactures, and sells ethical and generic drugs in Japan and internationally.

Adequate balance sheet low.