Global Value Stocks Trading At Estimated Discounts In May 2025

Reviewed by Simply Wall St

In May 2025, global markets are navigating a turbulent landscape marked by renewed tariff threats and volatility in the Treasury market, which have contributed to declines in major stock indexes. Amid these challenges, investors may find opportunities in undervalued stocks that offer potential value based on their fundamentals and current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥14.19 | CN¥28.32 | 49.9% |

| Sanil Electric (KOSE:A062040) | ₩66100.00 | ₩130358.74 | 49.3% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.35 | €104.47 | 49.9% |

| Sahara International Petrochemical (SASE:2310) | SAR18.80 | SAR37.34 | 49.7% |

| H.U. Group Holdings (TSE:4544) | ¥3056.00 | ¥6024.98 | 49.3% |

| Dive (TSE:151A) | ¥921.00 | ¥1821.20 | 49.4% |

| BalnibarbiLtd (TSE:3418) | ¥1160.00 | ¥2296.58 | 49.5% |

| Cosmax (KOSE:A192820) | ₩202500.00 | ₩404786.42 | 50% |

| J&T Global Express (SEHK:1519) | HK$6.65 | HK$13.21 | 49.7% |

| Northern Data (DB:NB2) | €25.02 | €49.53 | 49.5% |

Let's uncover some gems from our specialized screener.

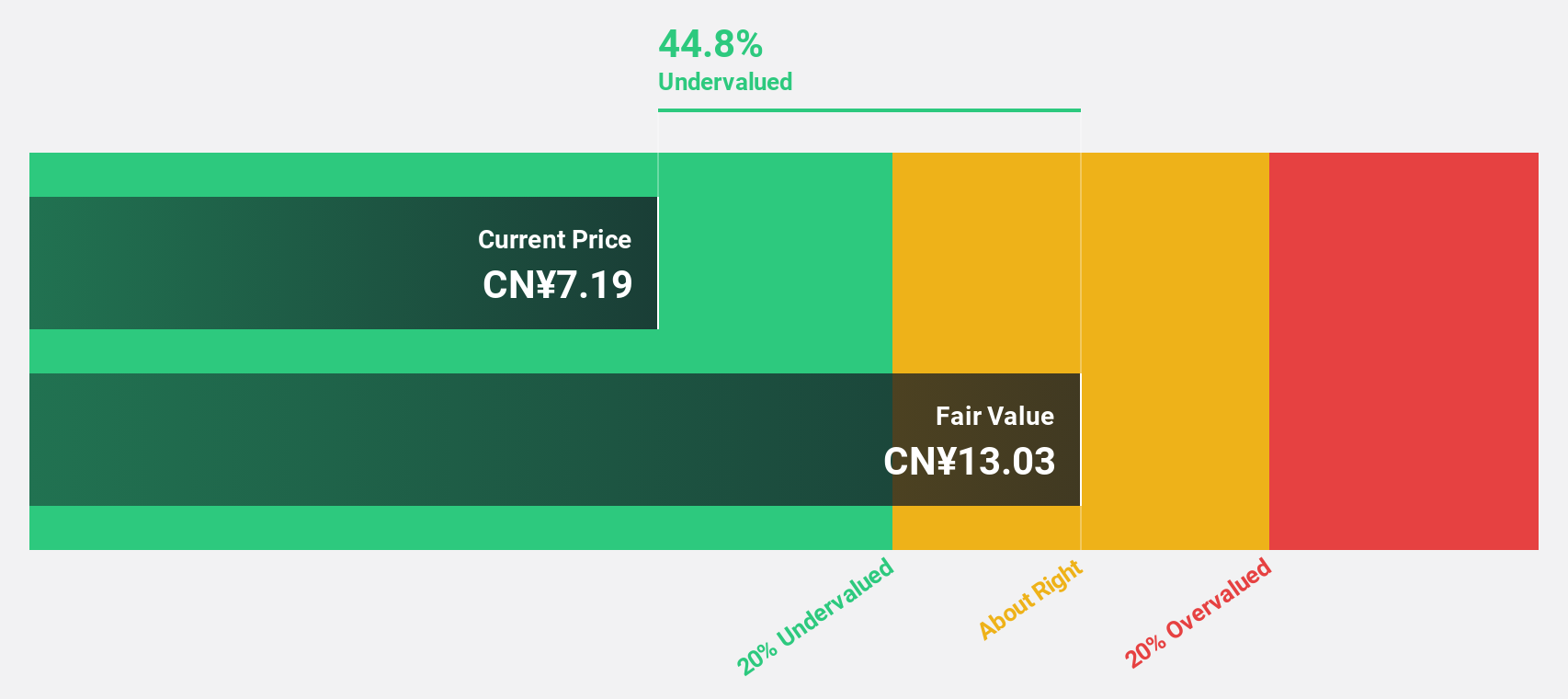

Tsinghua Tongfang (SHSE:600100)

Overview: Tsinghua Tongfang Co., Ltd. operates in digital information, civil nuclear technology, energy conservation and environmental protection, and technology and finance sectors with a market cap of CN¥24.02 billion.

Operations: The company's revenue segments include digital information, civil nuclear technology, energy conservation and environmental protection, and technology and finance businesses.

Estimated Discount To Fair Value: 44.4%

Tsinghua Tongfang is trading at a significant discount, with its current price of CN¥7.23 well below the estimated fair value of CN¥13.01, indicating potential undervaluation based on cash flows. Despite recent financial challenges, including a net loss of CNY 287.6 million in Q1 2025, earnings are forecast to grow substantially at 93.8% annually over the next three years, outpacing both industry peers and the broader Chinese market growth rates.

- Our expertly prepared growth report on Tsinghua Tongfang implies its future financial outlook may be stronger than recent results.

- Take a closer look at Tsinghua Tongfang's balance sheet health here in our report.

Jiangsu Shentong Valve (SZSE:002438)

Overview: Jiangsu Shentong Valve Co., Ltd. is engaged in the research, development, production, and sale of special valves both in China and internationally, with a market cap of CN¥5.79 billion.

Operations: The company generates revenue from the research, development, production, and sale of special valves within China and on an international scale.

Estimated Discount To Fair Value: 14.3%

Jiangsu Shentong Valve is trading at CN¥11.87, below its estimated fair value of CN¥13.85, suggesting it may be undervalued based on cash flows. The company reported Q1 2025 earnings with a net income increase to CN¥89.5 million from the previous year’s CN¥83.69 million, and revenue growth outpacing the market at 20.4% annually. Analysts expect significant annual profit growth of 24.8%, supported by a reliable dividend payout and strong earnings forecasts relative to peers.

- According our earnings growth report, there's an indication that Jiangsu Shentong Valve might be ready to expand.

- Navigate through the intricacies of Jiangsu Shentong Valve with our comprehensive financial health report here.

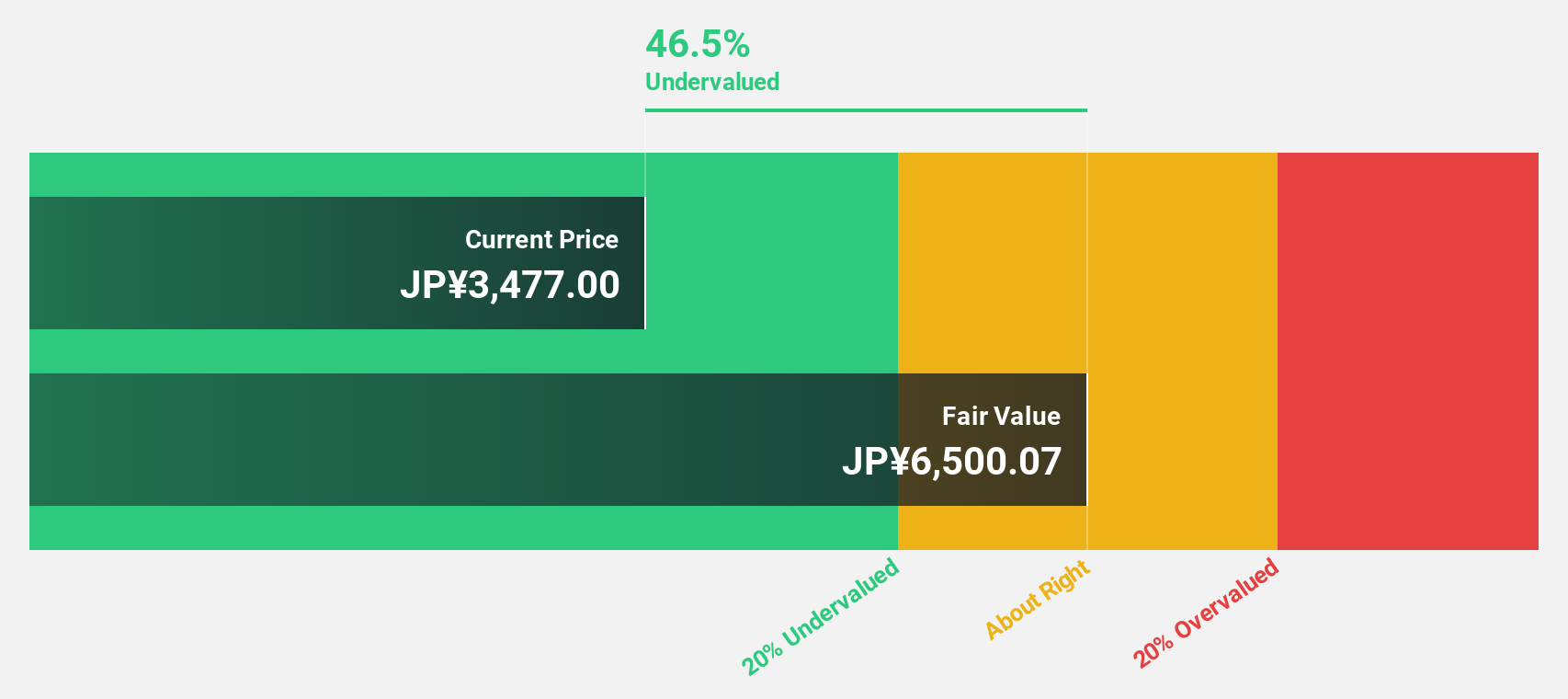

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a pharmaceutical manufacturer and seller operating in Japan, North America, Europe, and internationally with a market cap of ¥7.11 trillion.

Operations: The company's pharmaceutical operation generates revenue of ¥1.89 trillion.

Estimated Discount To Fair Value: 48.6%

Daiichi Sankyo, trading at ¥3,945, is valued below its estimated fair value of ¥7,679.39 according to cash flow analysis. The company's earnings grew by 47.3% last year and are forecasted to grow annually by 12.88%. Despite a dividend yield of 1.98% not being well-covered by free cash flows, the company has initiated share buybacks worth ¥200 billion to enhance shareholder value amidst ongoing legal challenges and promising oncology developments like ENHERTU's clinical success.

- Our growth report here indicates Daiichi Sankyo Company may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Daiichi Sankyo Company stock in this financial health report.

Make It Happen

- Discover the full array of 516 Undervalued Global Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives