Daiichi Sankyo Company And 2 Other Stocks Considered To Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

In recent weeks, global markets have faced pressure from rising U.S. Treasury yields, with the S&P 500 Index experiencing a decline after six consecutive weeks of gains. Amid this environment of cautious economic growth and fluctuating interest rates, investors are increasingly on the lookout for stocks that may be trading below their fair value estimates, offering potential opportunities in an otherwise volatile market landscape. Identifying undervalued stocks involves assessing companies that demonstrate strong fundamentals yet remain overlooked by the market, which could present attractive prospects for long-term growth as conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Alibaba Pictures Group (SEHK:1060) | HK$0.48 | HK$0.95 | 49.7% |

| Enento Group Oyj (HLSE:ENENTO) | €18.40 | €36.57 | 49.7% |

| WEX (NYSE:WEX) | US$172.60 | US$343.98 | 49.8% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.72 | CN¥9.42 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3970.00 | ¥7922.08 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1438.00 | ₩2858.97 | 49.7% |

| Sinch (OM:SINCH) | SEK31.45 | SEK62.48 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

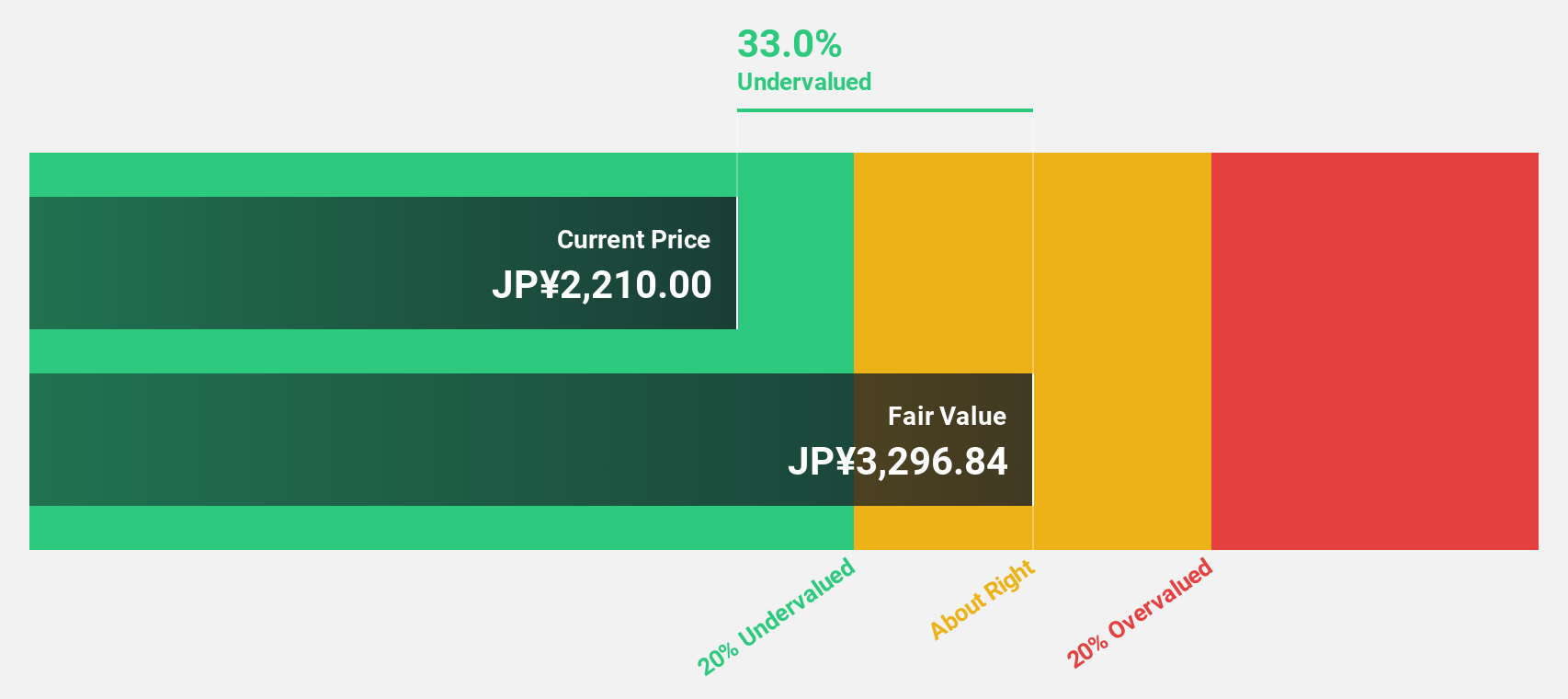

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a global pharmaceutical manufacturer and seller operating in Japan, North America, Europe, and other international markets with a market cap of ¥9.44 trillion.

Operations: The company generates revenue from its pharmaceutical operations, amounting to ¥1.69 trillion.

Estimated Discount To Fair Value: 38%

Daiichi Sankyo appears undervalued based on cash flows, trading at ¥4,869 against an estimated fair value of ¥7,851.18. Recent earnings growth of 55.5% and a forecasted annual profit increase of 20% suggest strong financial health compared to the Japanese market's average growth rates. The company's strategic advancements in oncology, notably with ENHERTU's priority review by the FDA for breast cancer treatment, highlight potential future revenue streams that could enhance its valuation further.

- The growth report we've compiled suggests that Daiichi Sankyo Company's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Daiichi Sankyo Company stock in this financial health report.

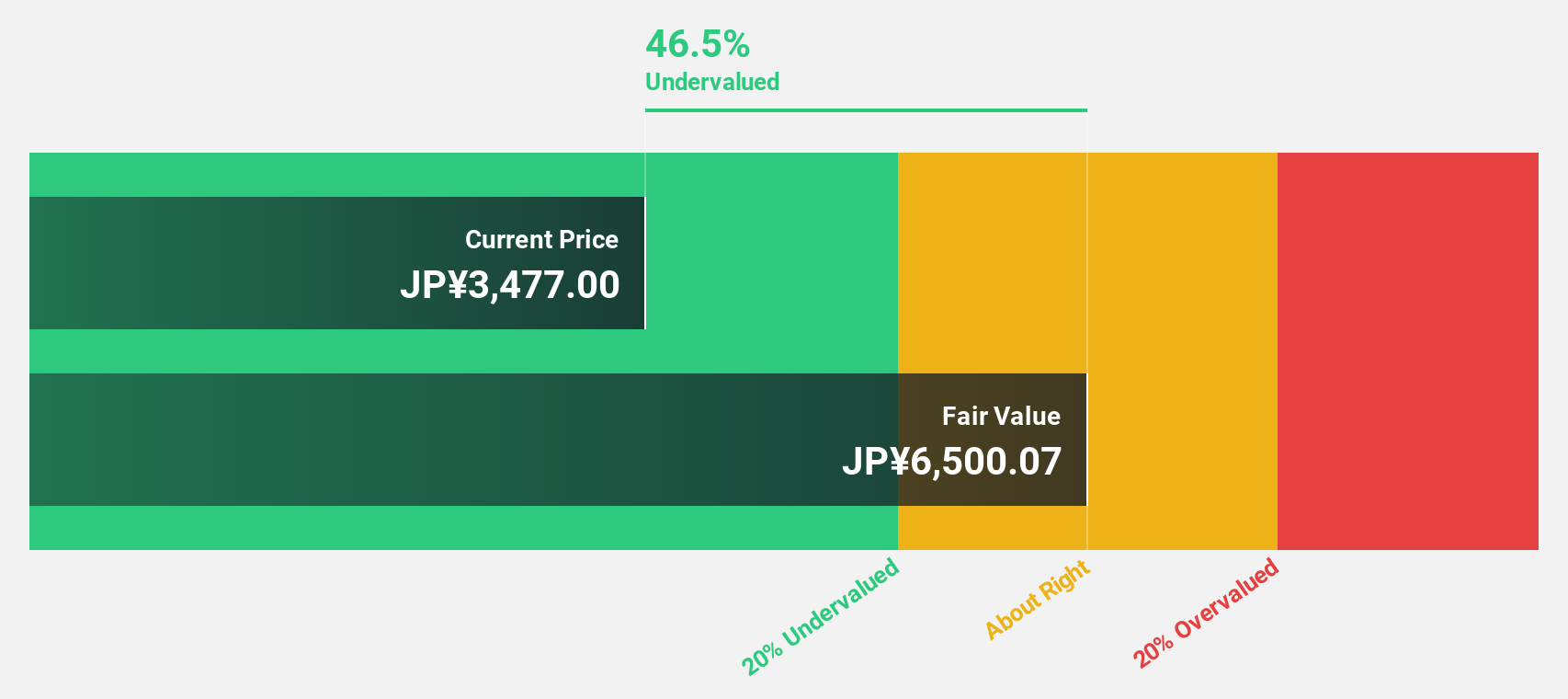

COVER (TSE:5253)

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market cap of ¥119.34 billion.

Operations: The company's revenue segments include virtual platform, VTuber production, and media mix businesses.

Estimated Discount To Fair Value: 45.1%

COVER is trading at ¥2,094, significantly below its estimated fair value of ¥3,812.42. The company has shown robust earnings growth of 40.1% over the past year and is projected to maintain a strong annual profit growth rate of 20.2%, outpacing the broader Japanese market's expectations. Despite a highly volatile share price recently, COVER's substantial undervaluation based on discounted cash flow analysis and high future return on equity forecasts underscore its potential for investors focused on cash flow metrics.

- Insights from our recent growth report point to a promising forecast for COVER's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of COVER.

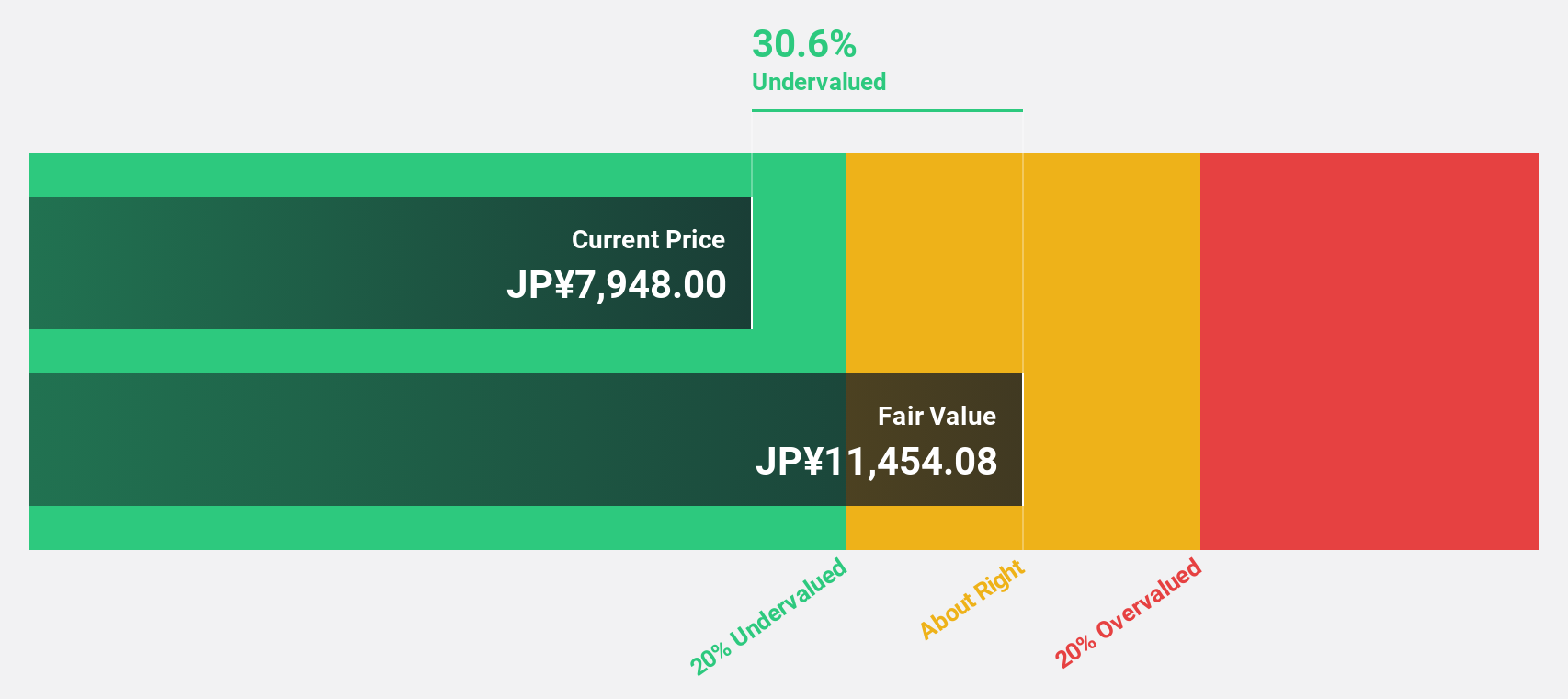

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. offers HR technology and business solutions aimed at transforming the world of work, with a market cap of ¥14.20 trillion.

Operations: The company's revenue is primarily derived from its Staffing segment at ¥1.66 trillion, followed by HR Technology at ¥1.04 trillion, and Matching & Solutions at ¥810.84 billion.

Estimated Discount To Fair Value: 10.1%

Recruit Holdings is trading at ¥9,141, slightly below its estimated fair value of ¥10,166.42. The company recently completed a share buyback program worth ¥436.78 billion, which may enhance shareholder value. Despite moderate undervaluation based on discounted cash flow analysis and a forecasted earnings growth rate of 9.11% annually—exceeding the Japanese market's average—its revenue growth remains modest at 4.6% per year with high future return on equity projections (24.4%).

- In light of our recent growth report, it seems possible that Recruit Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Recruit Holdings' balance sheet health report.

Where To Now?

- Investigate our full lineup of 958 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives