- Japan

- /

- Construction

- /

- TSE:1934

Exploring 3 Undiscovered Gems In Global Markets

Reviewed by Simply Wall St

As global markets navigate a landscape marked by declining consumer confidence, persistent inflation, and policy uncertainties, small-cap stocks have faced unique challenges and opportunities. Amid these dynamics, identifying potential undervalued stocks requires a keen understanding of market conditions and the ability to spot companies with strong fundamentals that can thrive even in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to both domestic and international airlines and private air cargo companies primarily in Turkey, with a market capitalization of TRY50.18 billion.

Operations: Çelebi Hava Servisi A.S. generates revenue primarily from airport ground services, including ground handling services, amounting to TRY11.33 billion, and cargo and warehouse services contributing TRY5.90 billion. The company's financial performance is influenced by its ability to manage costs effectively within these segments.

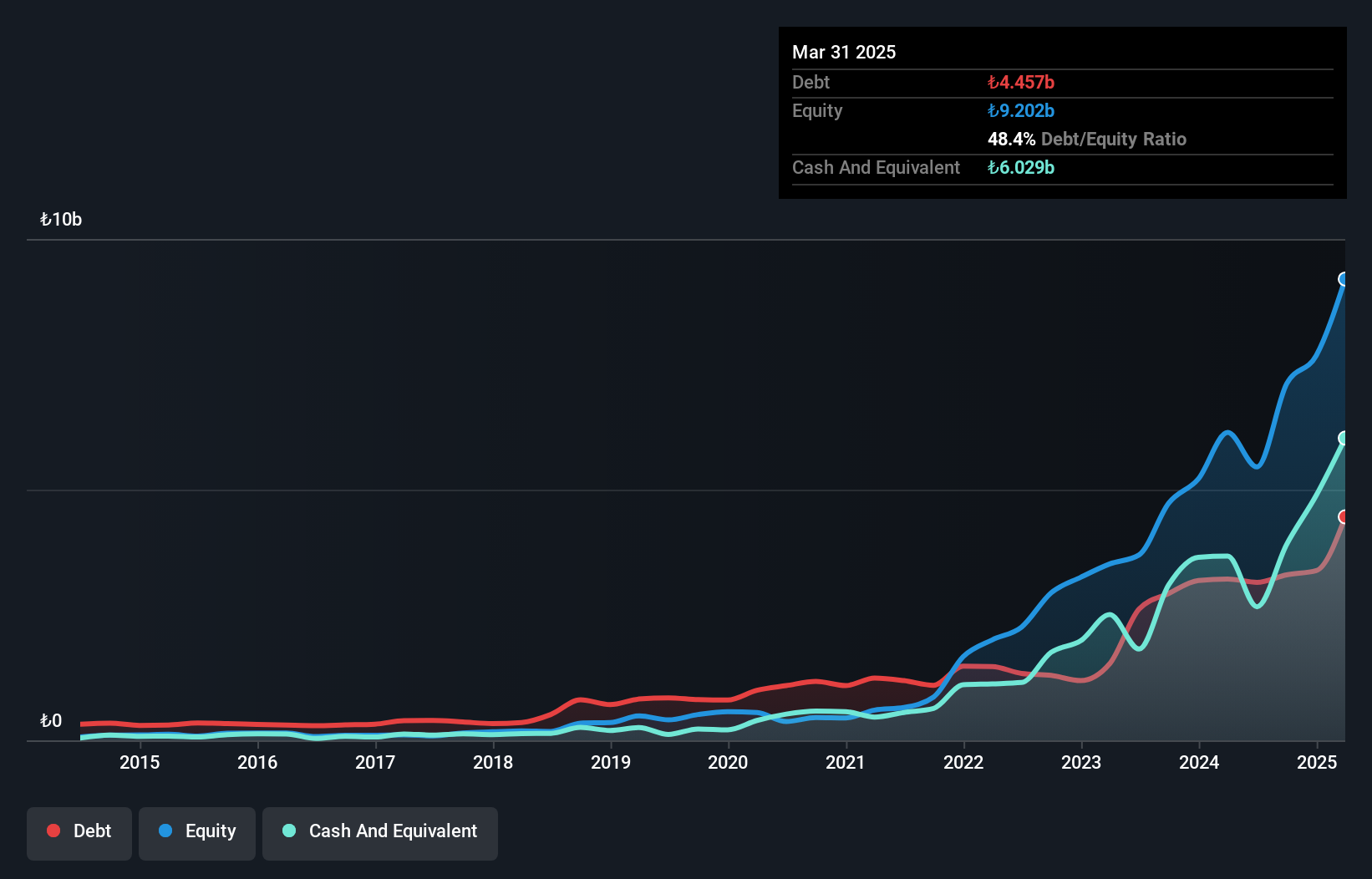

Çelebi Hava Servisi, a company in the infrastructure sector, has shown impressive financial health with earnings growth of 105% over the past year, outpacing the industry's 4% growth. This performance is supported by high-quality earnings and a reduced debt-to-equity ratio from 157.6% to 46.4% over five years, indicating effective debt management. The firm also enjoys positive free cash flow and more cash than total debt, suggesting solid financial footing. With its interest payments well-covered by profits, Çelebi appears well-positioned within its industry despite being relatively under-the-radar compared to larger peers.

Yurtec (TSE:1934)

Simply Wall St Value Rating: ★★★★★★

Overview: Yurtec Corporation is a facility engineering company that operates both in Japan and internationally, with a market capitalization of ¥114.26 billion.

Operations: Yurtec generates revenue primarily from its Facilities Engineering segment, amounting to ¥249.09 billion.

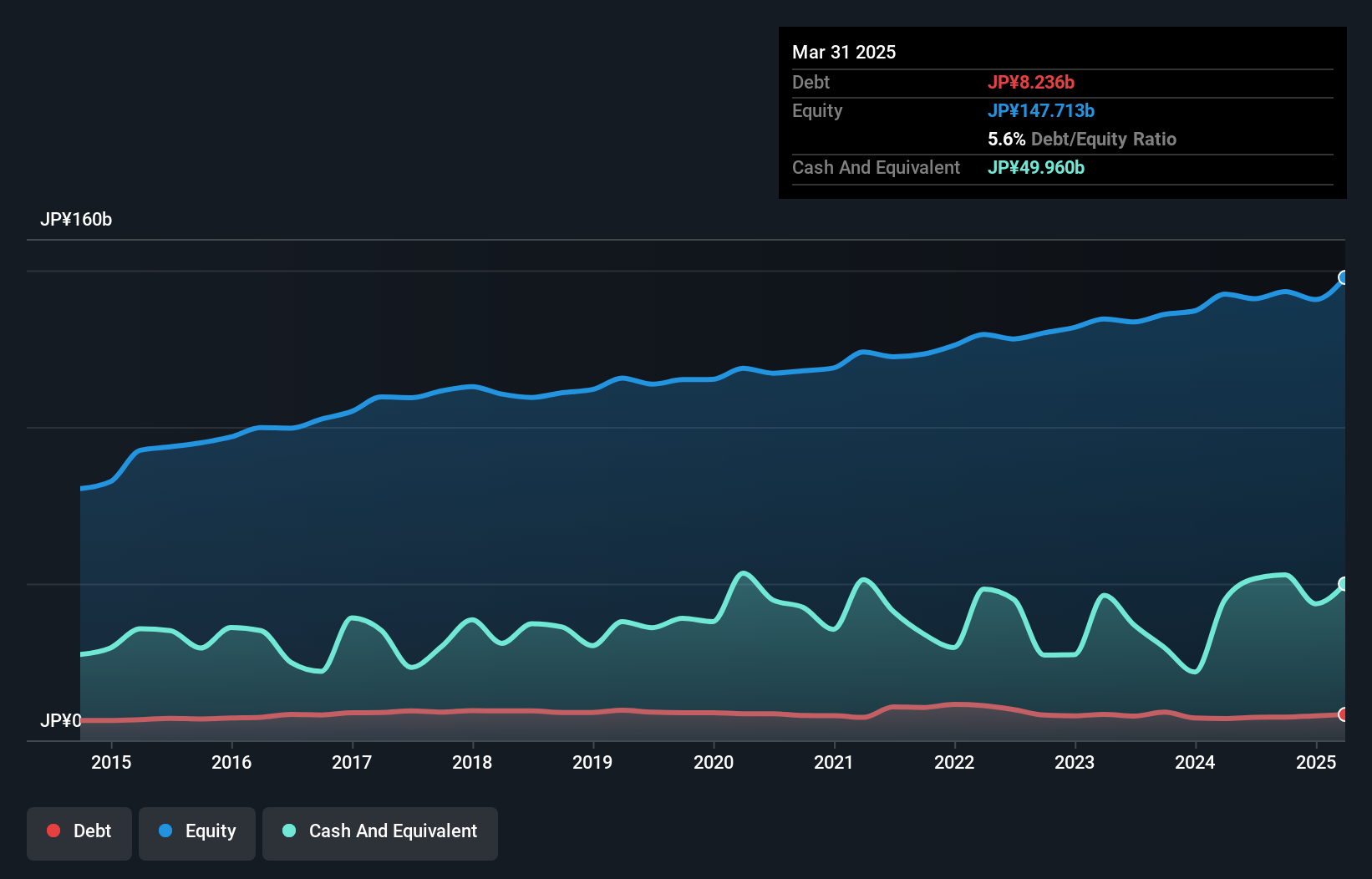

In the construction sector, Yurtec stands out with its impressive 42% earnings growth over the past year, surpassing the industry's 23.7%. This growth is supported by a reduction in its debt-to-equity ratio from 7.6 to 5.6 over five years, indicating prudent financial management. Despite a highly volatile share price recently, Yurtec remains a good value play with a price-to-earnings ratio of 11.6x compared to the JP market's average of 13.1x. The company has more cash than total debt and generates positive free cash flow, suggesting robust financial health and potential for sustained performance in its industry niche.

- Navigate through the intricacies of Yurtec with our comprehensive health report here.

Review our historical performance report to gain insights into Yurtec's's past performance.

Kaken Pharmaceutical (TSE:4521)

Simply Wall St Value Rating: ★★★★★★

Overview: Kaken Pharmaceutical Co., Ltd. engages in the production, marketing, and sale of medical products, medical devices, and agrochemicals both in Japan and internationally with a market cap of ¥176.23 billion.

Operations: The primary revenue streams for Kaken Pharmaceutical are derived from its medical products, medical devices, and agrochemicals. The company has a market cap of ¥176.23 billion.

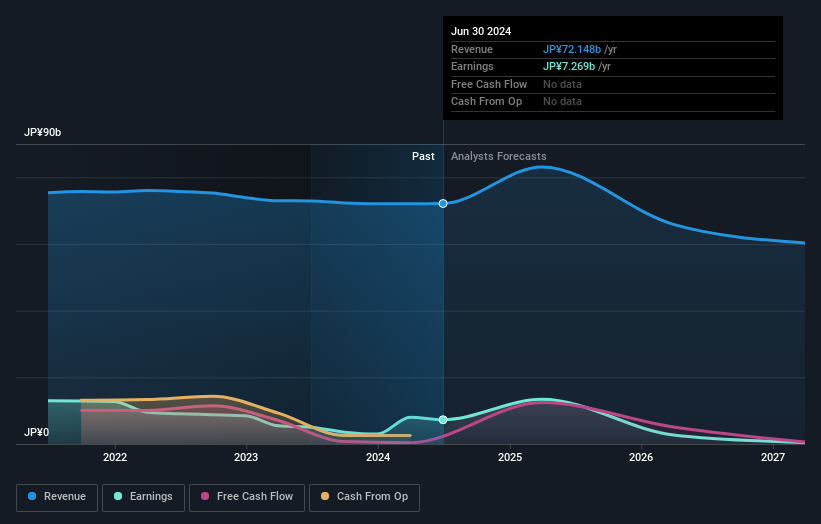

Kaken Pharma, a small cap player in the pharmaceuticals sector, has seen impressive earnings growth of 592% over the past year, surpassing industry averages. With a price-to-earnings ratio of 8.9x, it offers good value compared to the JP market's 13.1x. The company is set to repurchase 1.8 million shares for ¥9 billion by September 2025 to enhance shareholder returns and capital efficiency. Despite forecasts predicting a decline in earnings by an average of 56.7% annually over three years, Kaken remains profitable with high-quality past earnings and reduced debt levels from 3.1% to 2.5%.

Where To Now?

- Embark on your investment journey to our 3196 Global Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1934

Yurtec

Operates as a facility engineering company in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives