Sumitomo Pharma (TSE:4506) Eyes Growth with ORGOVYX Success and Key Alliances Despite Financial Strain

Reviewed by Simply Wall St

Sumitomo Pharma (TSE:4506) is experiencing a notable upswing in its financial performance, with a significant revenue increase driven by key products such as ORGOVYX, MYFEMBREE, and GEMTESA, particularly in North America. Despite these gains, the company faces financial challenges, including a high net debt to equity ratio and ongoing losses, which highlight the need for strategic financial management. This report will explore Sumitomo Pharma's growth opportunities, financial health, and regulatory challenges, providing a comprehensive overview of the company's current position and future prospects.

Navigate through the intricacies of Sumitomo Pharma with our comprehensive report here.

Key Assets Propelling Sumitomo Pharma Forward

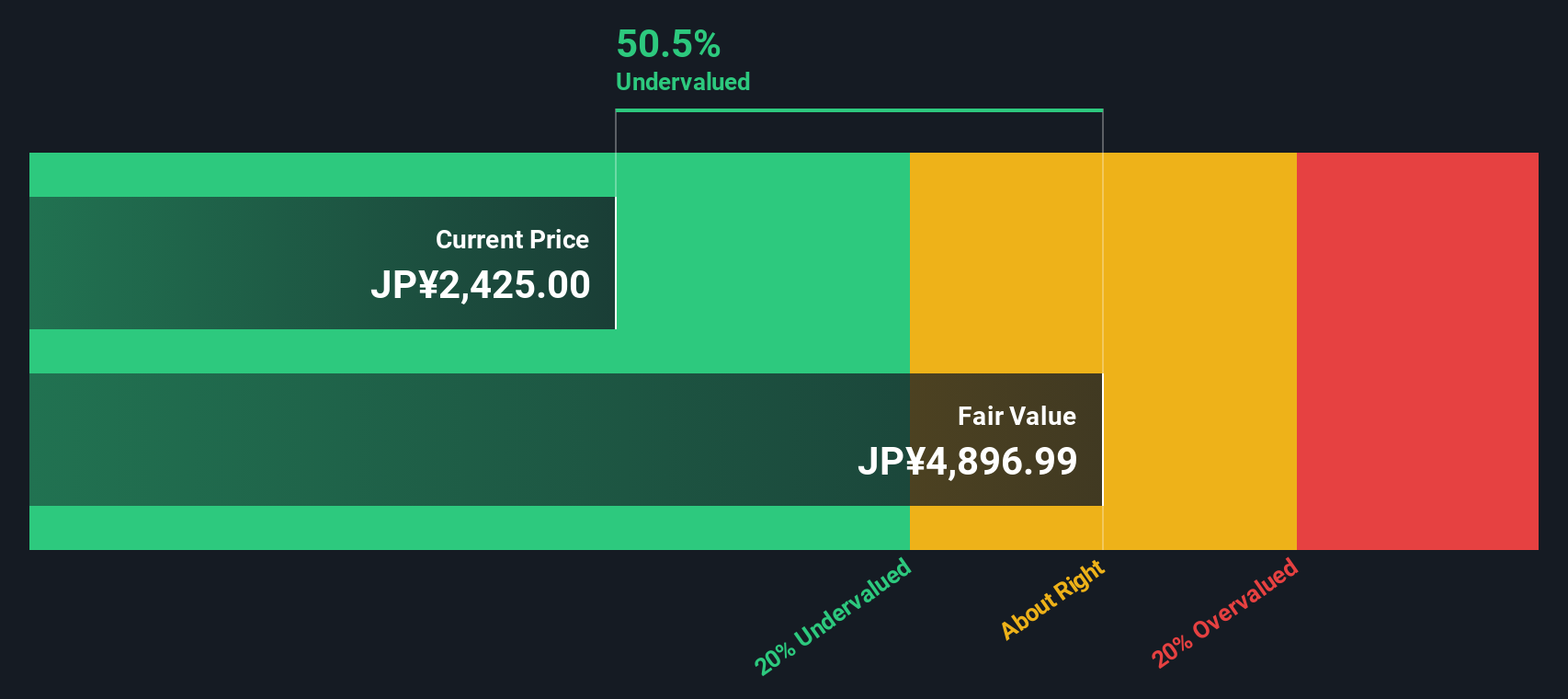

Sumitomo Pharma's recent performance highlights a strong trajectory, with revenue reaching ¥180.7 billion, marking a significant increase of ¥28.1 billion from the prior year. This growth is largely driven by the success of key products like ORGOVYX, MYFEMBREE, and GEMTESA, which collectively contribute substantial revenue, particularly in the North American market. ORGOVYX alone saw a 26% increase, underscoring the company's effective product portfolio. Effective cost management has also been pivotal, with SG&A and R&D expenses being tightly controlled, reducing from over ¥160 billion to approximately ¥108.5 billion in the first half of the fiscal year. This disciplined approach supports the company's strategic focus on oncology and regenerative medicine, positioning it well for future growth. Furthermore, the company is trading at 55.2% below its estimated fair value of ¥1,278.97, suggesting it is undervalued based on its SWS fair ratio, enhancing its attractiveness in the market.

Critical Issues Affecting the Performance of Sumitomo Pharma and Areas for Growth

Sumitomo Pharma faces significant challenges, particularly in financial health. The company remains unprofitable, with losses increasing at a rate of 71.7% over the past five years, and a concerning net debt to equity ratio of 254.1%. This financial strain is compounded by an operating loss of ¥8.2 billion, attributed to structural improvement expenses in Japan and the U.S. Additionally, MYFEMBREE's performance is underwhelming, struggling to achieve substantial volume growth. The company's negative return on equity of -244.58% further underscores the need for strategic financial management to stabilize and improve profitability.

Growth Avenues Awaiting Sumitomo Pharma

The future holds promising opportunities for Sumitomo Pharma, particularly with its forecasted revenue growth of 4% per year, outpacing the average market growth. The anticipated steady growth of key products in the latter half of the fiscal year is expected to bolster this trajectory. Strategic collaborations, such as the joint venture with Sumitomo Chemical, aim to advance drug discovery in regenerative medicine and cell therapy, providing a significant competitive edge. Additionally, the company's commitment to cost reduction and efficiency improvements, including asset streamlining, is poised to enhance operational efficiency and support a V-shaped recovery.

Regulatory Challenges Facing Sumitomo Pharma

Regulatory hurdles pose a notable threat, with ongoing discussions with the PMDA leading to the withdrawal of a target submission date for key approvals. This uncertainty is compounded by economic factors, such as volatile foreign exchange rates, which could impact financial income and costs. Competitive pressures also loom large, with the potential introduction of generic products altering the market dynamics. While these challenges are significant, Sumitomo Pharma's strategic initiatives and market positioning provide a foundation to navigate these threats effectively.

Conclusion

Sumitomo Pharma's recent revenue growth, driven by successful products like ORGOVYX, demonstrates its strong market presence, particularly in North America, and underscores its strategic focus on oncology and regenerative medicine. However, the company's financial health remains a concern, with increasing losses and a high net debt to equity ratio, highlighting the need for improved financial management. Future growth prospects are promising, supported by strategic collaborations and anticipated product growth, yet regulatory challenges and competitive pressures pose risks. Notably, the company is trading at 55.2% below its estimated fair value of ¥1,278.97, based on its Price-To-Sales Ratio, suggesting potential for market correction as it addresses financial and operational challenges.

Make It Happen

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4506

Sumitomo Pharma

Engages in the manufacture and sale of pharmaceuticals, food ingredients and additives, veterinary medicines, and others in Japan, North America, China, and internationally.

Undervalued with moderate growth potential.