Should Expanded VYLOY Reimbursement in Canada Prompt Action From Astellas Pharma (TSE:4503) Investors?

Reviewed by Sasha Jovanovic

- Astellas Pharma recently announced that VYLOY (zolbetuximab) has been added to public reimbursement programs in Ontario and Quebec for first-line treatment of certain gastric and gastroesophageal cancers, and will present significant new clinical data at multiple upcoming international conferences.

- The expanded funding for VYLOY in two major Canadian provinces marks a material step forward in patient access and commercial validation for this novel oncology therapy.

- To explore how expanding reimbursement for VYLOY could influence Astellas Pharma’s outlook, we’ll assess the company’s evolving investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Astellas Pharma Investment Narrative Recap

Astellas Pharma shareholders are betting on continued momentum from its "strategic brands," led by newly expanded public reimbursement for VYLOY in two key Canadian provinces. While greater VYLOY access is a positive sign for commercial execution, the most critical short-term catalyst, robust new clinical data and regulatory wins for the broader oncology pipeline, remains only modestly impacted, with the risk of revenue pressure from key patent expirations still a central concern.

The ten new abstracts Astellas will present at the upcoming ESMO Congress, particularly fresh data on PADCEV and XTANDI, align closely with this narrative. These updates reinforce Astellas' focus on oncology growth drivers while underscoring the importance of pipeline clinical progress in supporting future revenue streams.

Yet, in contrast to recent good news on drug access, investors should pay close attention to the looming expiry of exclusivity for key blockbusters like XTANDI and how...

Read the full narrative on Astellas Pharma (it's free!)

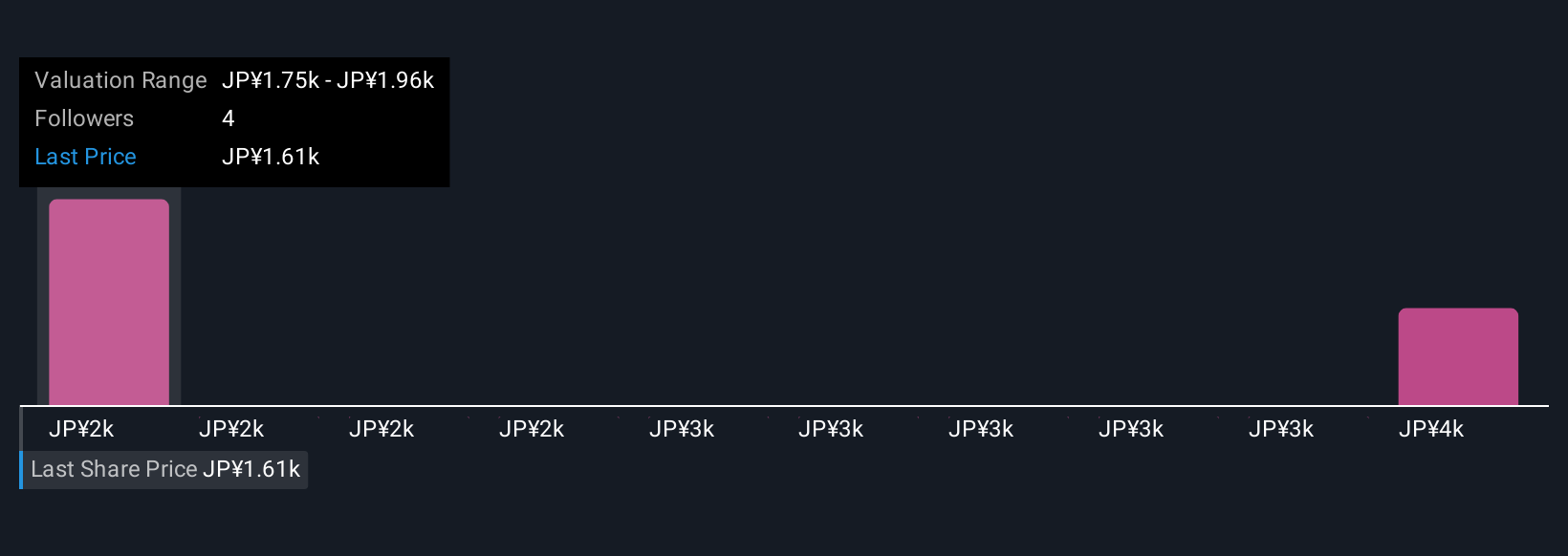

Astellas Pharma's outlook anticipates ¥1,868.3 billion in revenue and ¥184.0 billion in earnings by 2028. This scenario assumes a yearly revenue decline of 1.3% and an earnings increase of ¥102.4 billion from the current earnings of ¥81.6 billion.

Uncover how Astellas Pharma's forecasts yield a ¥1749 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Astellas’ fair value between ¥1,749 and ¥3,854 across two independent analyses. While opinions differ widely, looming loss of exclusivity for core products means holders face real uncertainty about future revenue streams.

Explore 2 other fair value estimates on Astellas Pharma - why the stock might be worth just ¥1749!

Build Your Own Astellas Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astellas Pharma research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Astellas Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astellas Pharma's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4503

Astellas Pharma

Manufactures, markets, and imports and exports pharmaceuticals in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives