How Takeda's Cell Therapy Exit and ¥58 Billion Impairment Will Impact Investors (TSE:4502)

Reviewed by Sasha Jovanovic

- Earlier this month, Takeda Pharmaceutical announced it will discontinue its cell therapy efforts as part of a portfolio reprioritization, seeking external partners for its platform technologies and taking an impairment charge of approximately ¥58.0 billion related to gamma delta T-cell therapy assets.

- This decision underscores Takeda's renewed focus on advancing preclinical programs in small molecules, biologics, and antibody-drug conjugates, reflecting a strategic shift toward therapies believed to deliver faster and broader patient impact.

- We'll explore how Takeda's exit from cell therapy and related impairment charges influence its investment narrative and pipeline priorities.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Takeda Pharmaceutical Investment Narrative Recap

To be a Takeda shareholder right now, you need confidence in its ability to offset ongoing revenue pressures from generic and biosimilar competition by delivering new innovations and pipeline execution. The decision to exit cell therapy, while resulting in a ¥58 billion impairment, does not materially change the company's most important short-term catalyst, progress on key late-stage assets like oveporexton for narcolepsy, nor does it shift the primary risk of insufficient pipeline performance to replace legacy product declines.

One of the most relevant recent announcements is the positive Phase 3 data for oveporexton in narcolepsy type 1, a program still progressing and well aligned with Takeda’s sharpened pipeline focus after its cell therapy exit. As Takeda pivots toward small molecules and biologics, the successful commercialization and clinical advancement of assets like oveporexton remain central to supporting future revenue and margin recovery.

But against these opportunities, investors should also consider that persistent pressure from generic erosion, especially for flagship brands, could mean...

Read the full narrative on Takeda Pharmaceutical (it's free!)

Takeda Pharmaceutical's outlook anticipates ¥4,696.5 billion in revenue and ¥339.5 billion in earnings by 2028. Achieving this will require 1.6% annual revenue growth and a ¥202.6 billion increase in earnings from the current ¥136.9 billion.

Uncover how Takeda Pharmaceutical's forecasts yield a ¥5003 fair value, a 18% upside to its current price.

Exploring Other Perspectives

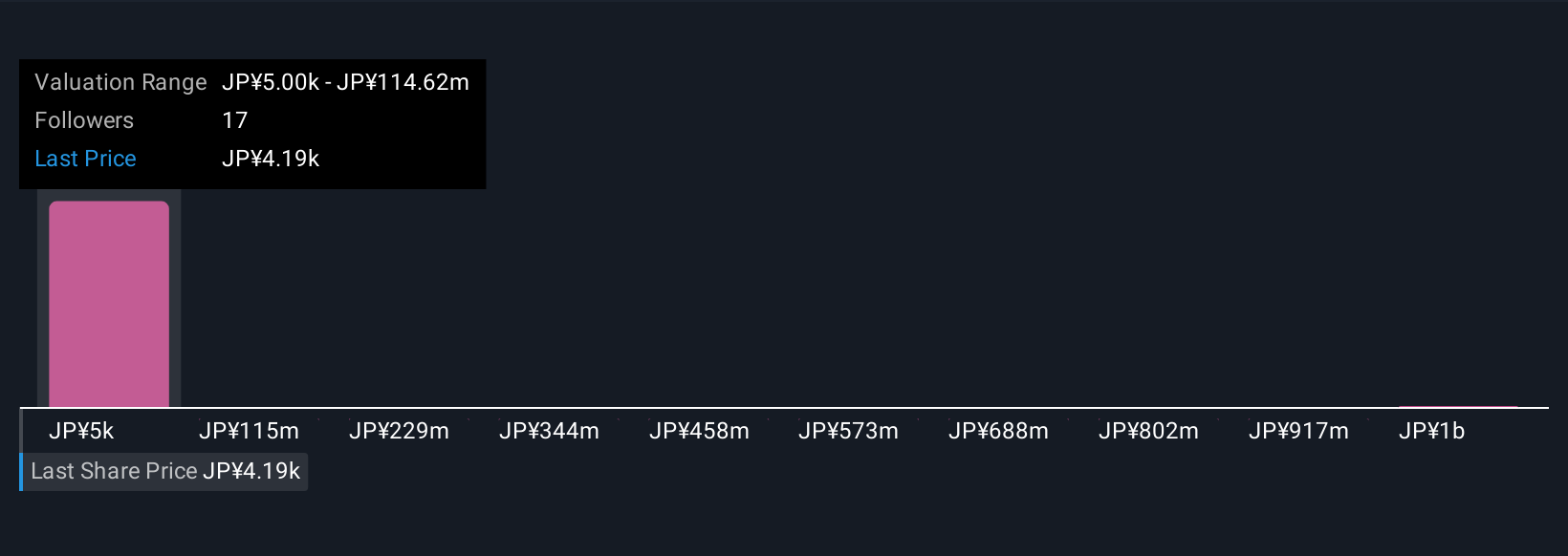

Three different community estimates for Takeda’s fair value range from ¥5,002.88 up to an eye-catching ¥1,146,201,984.08. The Simply Wall St Community’s widely differing views highlight how rising generic and biosimilar competition is fueling real debate over the company’s ability to sustain long-term earnings growth.

Explore 3 other fair value estimates on Takeda Pharmaceutical - why the stock might be a potential multi-bagger!

Build Your Own Takeda Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Takeda Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Takeda Pharmaceutical's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives