Here's Why We're Watching SymBio Pharmaceuticals' (TYO:4582) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for SymBio Pharmaceuticals (TYO:4582) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for SymBio Pharmaceuticals

Does SymBio Pharmaceuticals Have A Long Cash Runway?

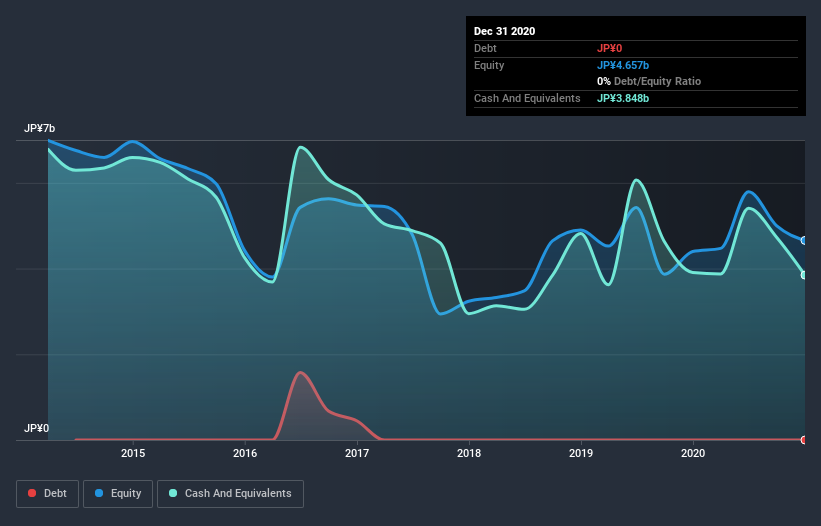

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In December 2020, SymBio Pharmaceuticals had JP¥3.8b in cash, and was debt-free. In the last year, its cash burn was JP¥4.3b. That means it had a cash runway of around 11 months as of December 2020. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. You can see how its cash balance has changed over time in the image below.

How Well Is SymBio Pharmaceuticals Growing?

SymBio Pharmaceuticals reduced its cash burn by 6.5% during the last year, which points to some degree of discipline. Revenue also improved during the period, increasing by 5.3%. Considering both these factors, we're not particularly excited by its growth profile. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how SymBio Pharmaceuticals is building its business over time.

Can SymBio Pharmaceuticals Raise More Cash Easily?

Given SymBio Pharmaceuticals' revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of JP¥42b, SymBio Pharmaceuticals' JP¥4.3b in cash burn equates to about 10% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

How Risky Is SymBio Pharmaceuticals' Cash Burn Situation?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought SymBio Pharmaceuticals' cash burn relative to its market cap was relatively promising. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Taking a deeper dive, we've spotted 4 warning signs for SymBio Pharmaceuticals you should be aware of, and 2 of them are a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading SymBio Pharmaceuticals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:4582

SymBio Pharmaceuticals

Engages in the research and development, manufacturing, and sales of pharmaceuticals and related operations to treat cancer, hematology, and viral infectious diseases in Japan and internationally.

Excellent balance sheet very low.

Market Insights

Community Narratives