- Japan

- /

- Entertainment

- /

- TSE:9697

Will Capcom’s Multi-Platform Resident Evil Requiem Release Redefine Its Growth Ambitions (TSE:9697)?

Reviewed by Simply Wall St

- Capcom recently announced that Resident Evil Requiem, along with Resident Evil 7 biohazard and Resident Evil Village, will launch simultaneously for Nintendo Switch 2, PlayStation 5, Xbox Series X|S, and PC on February 27, 2026, with Requiem having already received multiple awards at Gamescom 2025.

- This move reinforces Capcom's commitment to multi-platform releases and highlights the company's efforts to expand its audience by leveraging critical acclaim and established franchises.

- We'll explore how Capcom's expanded multi-platform strategy for Resident Evil Requiem could impact its future growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Capcom Investment Narrative Recap

Capcom's core appeal for shareholders lies in the company's global expansion strategy, built on both established franchises and growing digital sales. The recent announcement to simultaneously launch Resident Evil Requiem on all major platforms aligns with its multi-platform efforts, but the impact on near-term catalysts appears incremental rather than transformative, as growth still depends heavily on the ongoing appeal of flagship titles and the ability to efficiently manage development costs.

Among Capcom's latest updates, the upcoming release of Monster Hunter Wilds stands out as especially relevant. Like the Resident Evil multi-platform launch, it will test Capcom's ability to maintain momentum across its leading franchises, with results that could affect the earnings outlook and validate the long-term growth narrative if consumer interest holds strong.

By contrast, investors should be aware that even as Capcom expands its hit franchises, the risk of franchise fatigue remains a crucial factor that ...

Read the full narrative on Capcom (it's free!)

Capcom's narrative projects ¥223.7 billion revenue and ¥70.7 billion earnings by 2028. This requires 6.4% yearly revenue growth and a ¥15.0 billion earnings increase from ¥55.7 billion current earnings.

Uncover how Capcom's forecasts yield a ¥4624 fair value, a 12% upside to its current price.

Exploring Other Perspectives

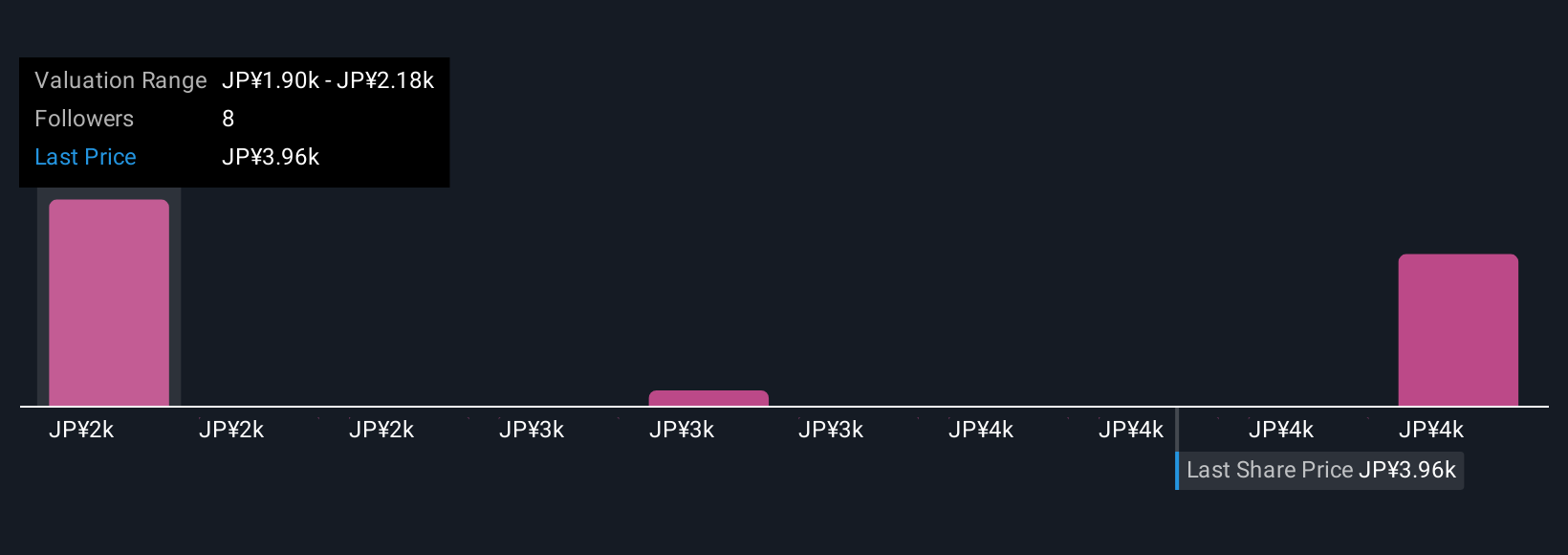

Three recent fair value estimates from the Simply Wall St Community span from ¥1,901,759 to ¥4,624,000, underscoring significant differences in views on Capcom’s future. While the company’s next major releases aim to broaden its user base and sustain earnings growth, these contrasting valuations invite you to explore a wide range of possible outcomes.

Explore 3 other fair value estimates on Capcom - why the stock might be worth as much as 12% more than the current price!

Build Your Own Capcom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capcom research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Capcom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capcom's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9697

Capcom

Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion