Last Update 06 Nov 25

Fair value Decreased 0.44%9697: Profit Margins Will Improve Amidst New Game Launches And Dividend Hike

Capcom's analyst price target was modestly reduced from ¥4,641.25 to ¥4,620.63 as analysts cite slightly slower projected revenue growth, with this being offset in part by improved profit margin expectations.

What's in the News

- Capcom announces dividend increase to JPY 20.00 per share for the fiscal second quarter ending March 31, 2026, scheduled for payment starting November 17, 2025 (Key Developments).

- Beard Papa's collaborates with Capcom for a Monster Hunter Wilds co-promotion from October 10 to 31, 2025, offering themed desserts, exclusive in-game rewards, and limited edition merchandise at select U.S. locations (Key Developments).

- Resident Evil Requiem, along with Resident Evil 7 biohazard and Resident Evil Village, will launch for Nintendo Switch 2 on February 27, 2026, as Capcom expands its multi-platform portfolio. Resident Evil Requiem has already won four Gamescom Awards 2025 (Key Developments).

- "Assassin's Creed Shadows" surpasses Capcom's Monster Hunter Wilds in 2025 European new game sales, as per TGB data (Periodicals).

Valuation Changes

- Consensus Analyst Price Target decreased modestly from ¥4,641.25 to ¥4,620.63.

- Discount Rate increased slightly from 7.01% to 7.09%.

- Revenue Growth projection fell from 6.58% to 5.21%.

- Net Profit Margin expectation improved from 31.75% to 32.14%.

- Future P/E ratio declined from 33.34x to 32.60x.

Key Takeaways

- Expanding globally, especially in emerging markets and digital platforms, is expected to grow Capcom's revenues and international presence.

- Diversified content strategies and investment in talent and technology aim to boost operational efficiency, broaden audiences, and stabilize recurring income.

- Heavy reliance on core franchises, rising talent and development costs, and industry consolidation threaten Capcom's margins, growth prospects, and overall earnings stability.

Catalysts

About Capcom- Plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally.

- Capcom's strategy to accelerate global expansion-particularly in emerging markets and through increased support for PC platforms-directly positions the company to capitalize on the ongoing growth in the worldwide gaming population, driving long-term revenue and potential international earnings growth.

- The continued shift toward digital content distribution, highlighted by robust catalog sales and increasing digital penetration globally, is expected to support both revenue growth and higher operating margins by lowering distribution costs and expanding the addressable market.

- Multi-pronged brand and IP strategies-including sequels, remakes, collaborations, transmedia content (e.g., Netflix anime, Amazon Prime animation), and eSports-are set to broaden Capcom's user base and diversify recurring revenue streams, boosting both topline growth and earnings stability.

- Investment in expanding in-house development capacity and updating proprietary technology (new development buildings, improved RE Engine) is poised to improve production efficiency and foster higher operating leverage, supporting margin improvement and sustainable earnings growth.

- Sustained focus on workforce expansion, talent development, and diversity is set to alleviate creative/talent bottlenecks and enhance operational resilience, underpinning Capcom's ability to deliver consistent pipeline expansion and future revenue growth.

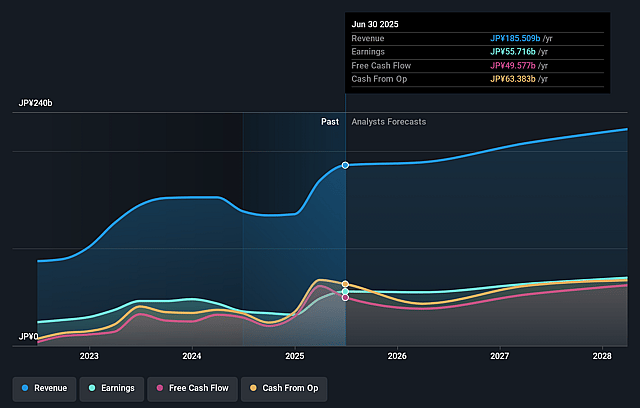

Capcom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Capcom's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 30.0% today to 31.6% in 3 years time.

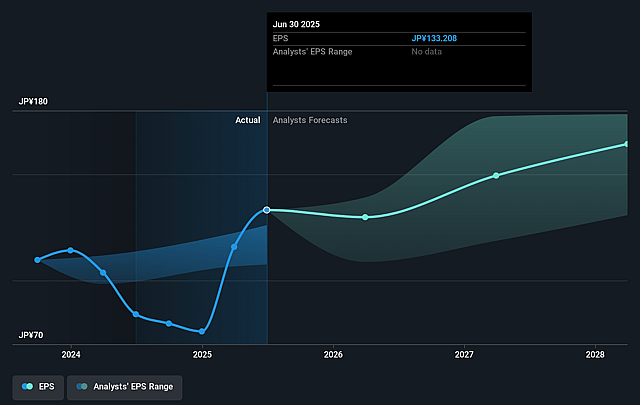

- Analysts expect earnings to reach ¥70.7 billion (and earnings per share of ¥167.02) by about September 2028, up from ¥55.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ¥62.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.6x on those 2028 earnings, up from 29.7x today. This future PE is greater than the current PE for the JP Entertainment industry at 22.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.16%, as per the Simply Wall St company report.

Capcom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overdependence on established franchises like Resident Evil, Monster Hunter, and Street Fighter increases the risk of franchise fatigue and could lead to stagnating or declining sales if new titles or remakes fail to meet consumer expectations, thereby impacting revenue growth and earnings stability.

- Significant investment in human capital, including rising average salaries and ongoing hiring, could materially increase labor costs; when combined with potential global talent shortages in technology and creative roles, these factors may pressure net margins and reduce operating leverage.

- With rapid expansion into new physical locations in the Arcade Operations segment and continued capital outlay for new development facilities, Capcom faces heightened exposure to cyclical downturns or operational inefficiencies, which may depress margins and erode profitability if either segment underperforms.

- Escalating development costs and longer production timelines for high-quality AAA titles heighten financial risk, as each major release carries a greater impact on annual results and may drive more volatile quarterly earnings if a single project underperforms or faces delays.

- Intensifying industry consolidation enables larger competitors to achieve greater scale, negotiating power, and exclusive access to technology and distribution networks, increasing the risk that Capcom could lose market share, face pressure on revenues from reduced visibility, or experience erosion of future earnings capacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥4624.0 for Capcom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5400.0, and the most bearish reporting a price target of just ¥3800.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥223.7 billion, earnings will come to ¥70.7 billion, and it would be trading on a PE ratio of 33.6x, assuming you use a discount rate of 7.2%.

- Given the current share price of ¥3957.0, the analyst price target of ¥4624.0 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Capcom?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.