- Japan

- /

- Entertainment

- /

- TSE:9602

Toho (TSE:9602) Margin Compression Raises Questions for Premium Valuation

Reviewed by Simply Wall St

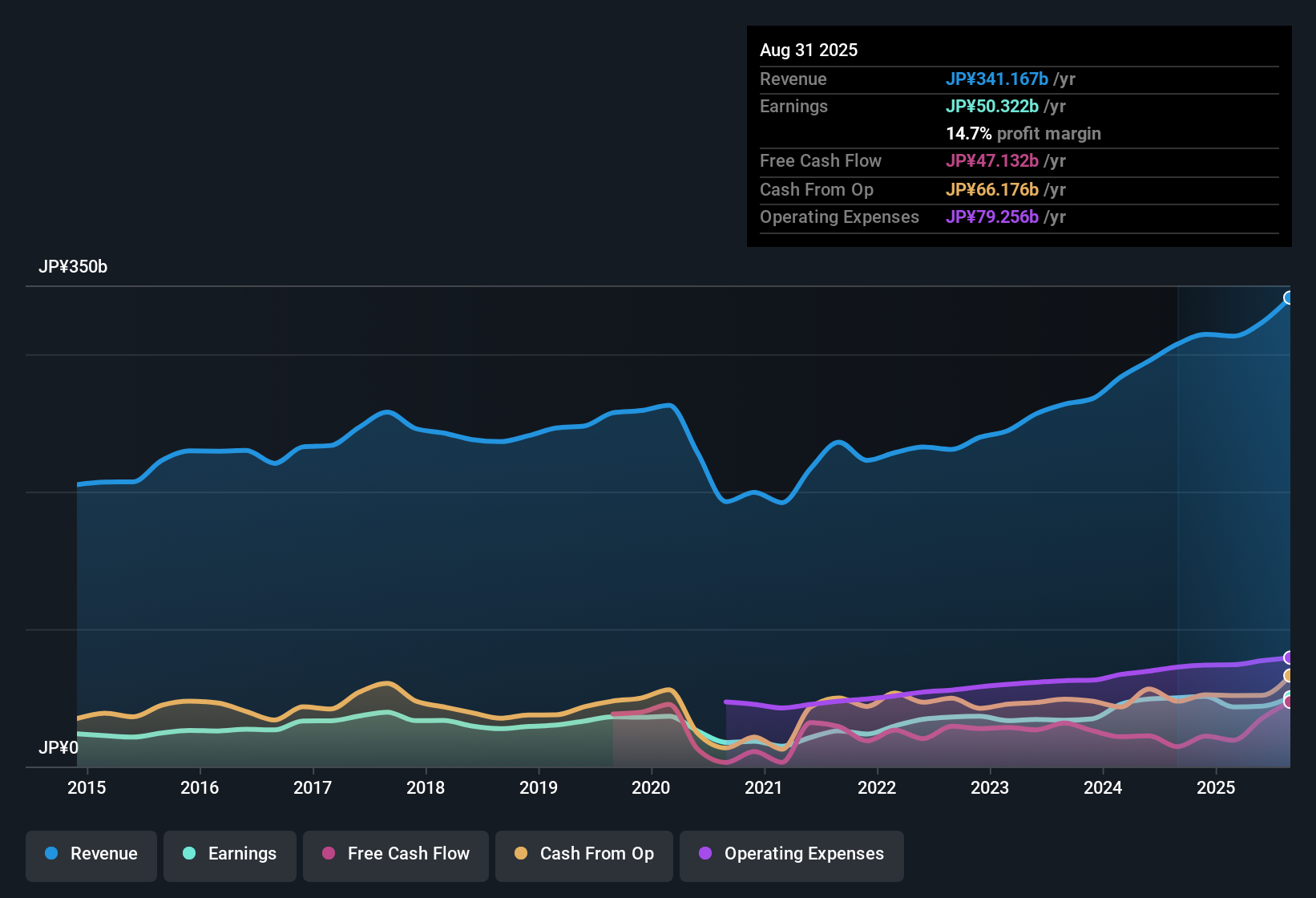

Toho (TSE:9602) posted revenue and earnings growth this year, with earnings forecast to climb 5.53% annually and revenue expected to grow 3.7% per year. Over the past five years, earnings rose by an average of 19.9% per year, but growth in the latest year was just 0.6%, paired with a net profit margin of 14.8% compared to 16.3% previously. This points to some margin compression. Investors may focus on the company’s steady historical performance and premium valuation as they weigh the outlook for future returns.

See our full analysis for Toho.The real test is how these numbers stack up against the prevailing market narratives. Some expectations will be validated, while others could be reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Compression Signals Cost Pressure

- Net profit margin dropped to 14.8% from 16.3% year-over-year, indicating that costs are rising faster than revenue in the latest period, even as overall sales continue to climb.

- Investor analysis draws attention to this margin squeeze, since what’s unexpected is that margins fell even as revenue moved upward.

- This trend could challenge arguments that Toho’s quality earnings are immune to operational headwinds. Despite steady profit growth historically, margin deterioration puts the spotlight on future cost management.

- The company's current margin trajectory stands in contrast to the high profit margin base it has maintained. This raises questions over the durability of high profitability moving forward.

Growth Forecast Trails Market Pace

- Earnings are projected to rise by 5.53% per year, and revenue by 3.7% per year. Both figures lag sector and peer benchmarks in Japan, which are growing faster on average.

- Analysis highlights that, according to market observers, Toho’s growth outlook is seen as more subdued than anticipated. Despite a five-year annual average earnings growth of 19.9%, the most recent annual gain was just 0.6%, sharply below long-term trends.

- While Toho’s past performance signals resilience, current forecasts suggest the company may struggle to keep pace with domestic entertainment peers, especially if sector competition intensifies.

- The market appears poised to reward companies with faster growth, so a continuation of this lower trend could weigh on sentiment if growth does not re-accelerate.

Premium Valuation Far Above Peers

- Toho shares trade at a Price-To-Earnings ratio of 31.7x, compared to a peer average of 20.4x and an industry average of 22.5x. The share price of 9,397 is also well above the DCF fair value of 4,109.33.

- Prevailing market view points to a hefty premium for Toho based on its track record and brand strength, but valuation multiples this high could expose investors to downside if future growth disappoints.

- There is tension between the company’s steady historic earnings and the fact that ongoing growth forecasts no longer justify such an elevated valuation relative to both peers and fundamentals.

- Investors may increasingly scrutinize whether brand leadership and franchise stability can sustain current price levels if earnings and margins continue to slip compared to lower-priced rivals.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Toho's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Toho’s elevated valuation stands at odds with its slowing earnings growth and recent margin compression. This dynamic may challenge the sustainability of its premium pricing.

If you want to target stocks where current prices better reflect future growth potential, check out these 877 undervalued stocks based on cash flows for options offering stronger value upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9602

Toho

Engages in the motion picture, theatrical production, and real estate businesses in Japan.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)