- Japan

- /

- Entertainment

- /

- TSE:9602

Is Toho's (TSE:9602) Interim Dividend Hike Reshaping Its Capital Return Narrative?

Reviewed by Sasha Jovanovic

- On September 16, 2025, Toho Co., Ltd. announced its Board of Directors resolved to pay an interim dividend of ¥42.5 per share, totaling ¥7.21 billion, with payment effective November 21, 2025 and a record date of August 31, 2025.

- This dividend increase highlights Toho's ongoing commitment to returning value to shareholders and signals management's confidence in the company's financial outlook.

- With the dividend increase as a key indicator, we'll examine how this development shapes Toho's investment narrative moving forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Toho's Investment Narrative?

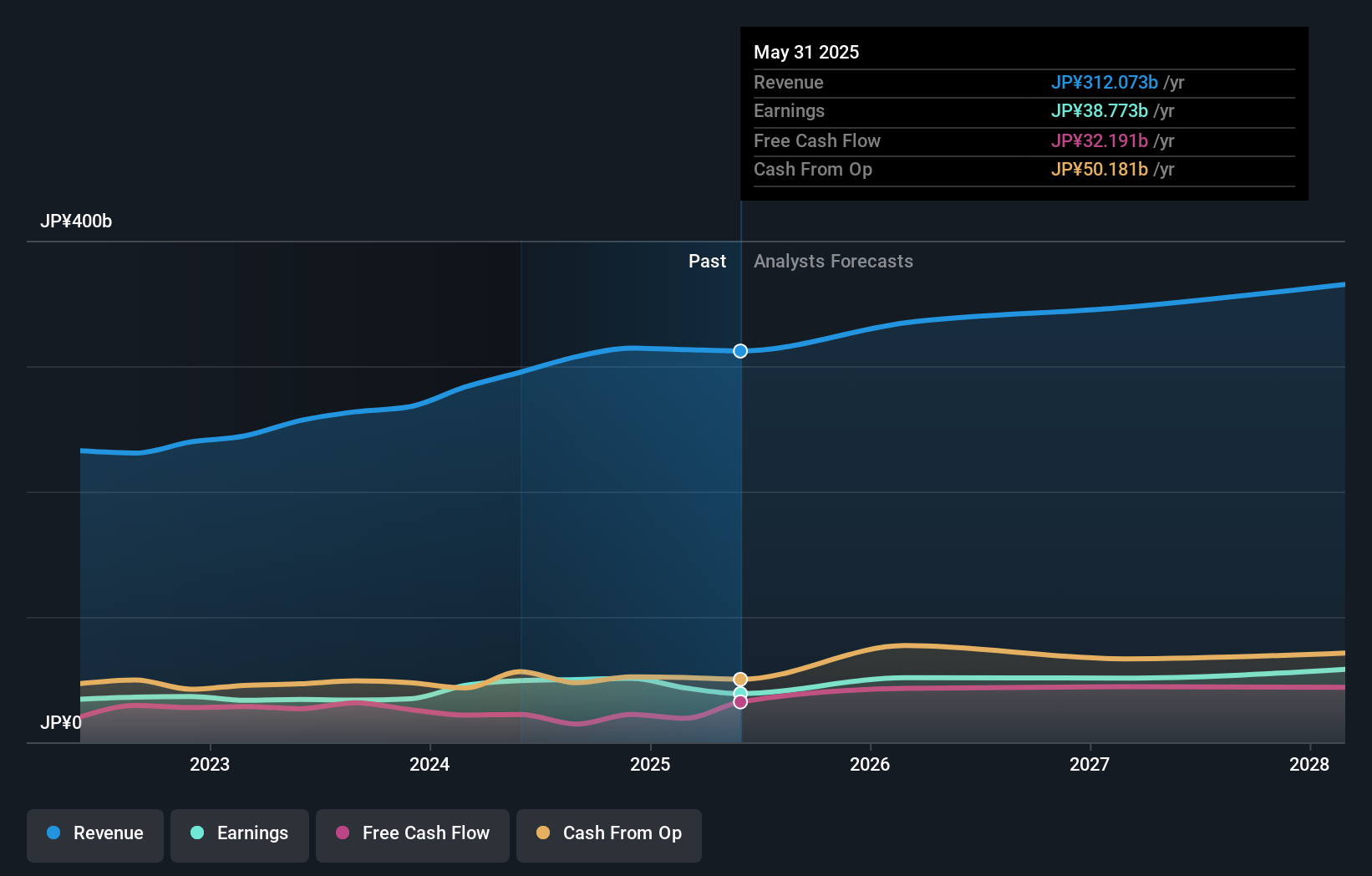

Toho's investment story centers on a belief in the enduring value of its intellectual property, disciplined capital return, and a steady pivot toward digital entertainment. The latest interim dividend hike, coming shortly after the launch of new content in KAIJU NO. 8 THE GAME, reinforces management’s message of stability and ongoing shareholder value creation. In the short term, the product-related announcement draws attention to Toho's efforts to diversify revenue streams beyond traditional film, but its impact on near-term financials is likely incremental given the scale of recent earnings revisions. The more material short-term catalysts remain robust earnings growth and additional content monetization, while key risks involve valuation concerns, Toho continues to trade at a significant premium to peers and fair value estimates. The recent news supports confidence but doesn’t fully offset ongoing questions around the current pricing and volatility. In contrast, valuation pressures remain information investors should be aware of.

Toho's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Toho - why the stock might be worth as much as ¥9089!

Build Your Own Toho Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toho research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Toho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toho's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9602

Toho

Engages in the motion picture, theatrical production, and real estate businesses in Japan.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives