- Japan

- /

- Entertainment

- /

- TSE:9601

Shochiku (TSE:9601) Turns Profitable, Challenging Narrative as Forward Earnings Forecasts Decline

Reviewed by Simply Wall St

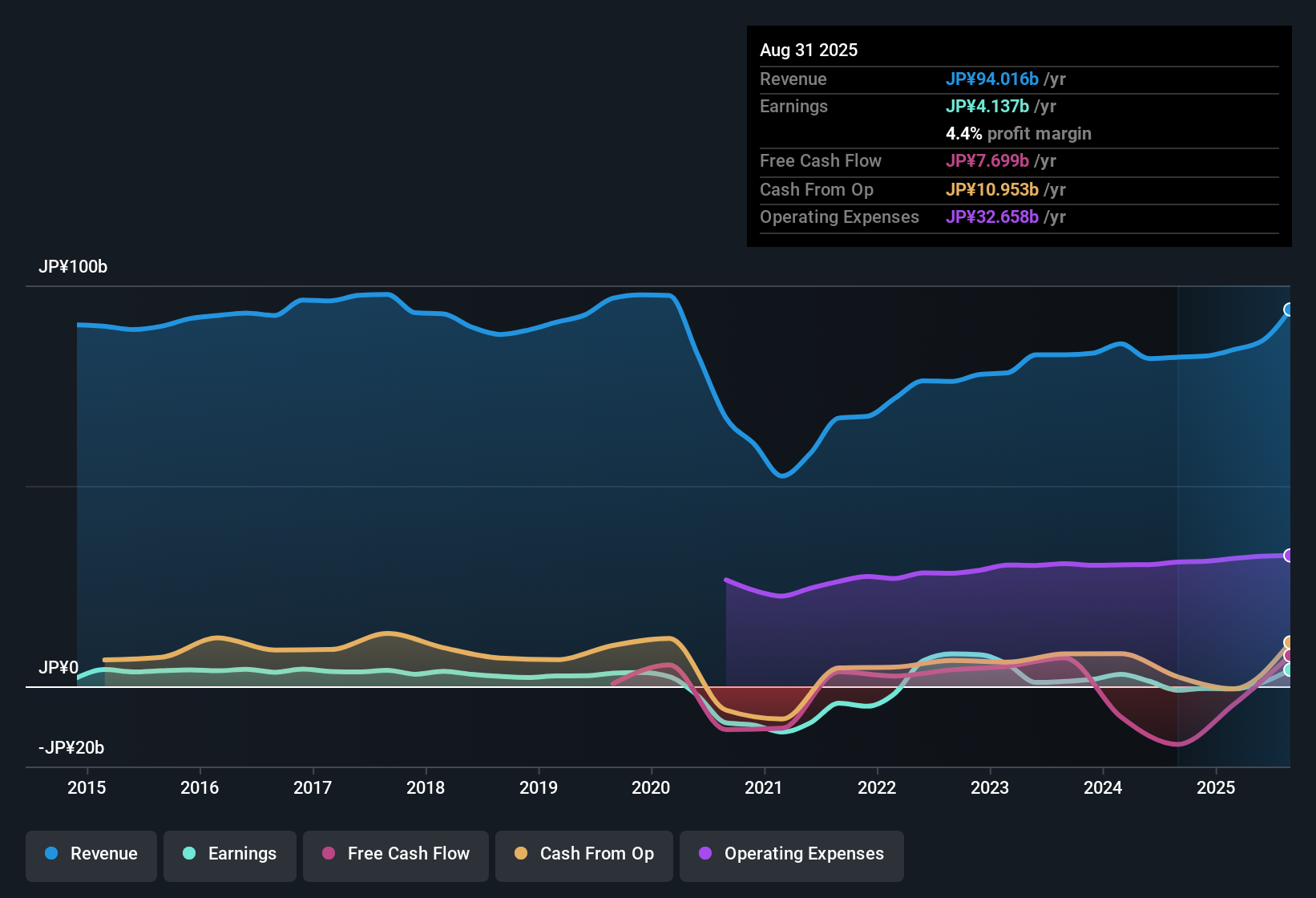

Shochiku (TSE:9601) turned profitable in the most recent year, with an impressive net profit margin shift and standout earnings growth, averaging 47.7% per year over the last five years. However, forecasts now point to annual earnings declining at 7.7% and revenue slipping slightly by 0.3% per year over the next three years. With its shares trading at a price-to-earnings ratio of 43.7x, well above peer and industry averages, investors face the task of weighing recent profitability against predictions of both declining growth and a premium valuation.

See our full analysis for Shochiku.Now, let's see how these headline figures measure up to the prevailing narratives and market expectations. The next section dives into the ways community insights and sentiment stack up against Shochiku's reported results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Transformation Surpasses Traditional Sector Peers

- Achieving profitability for the first time in the most recent year, Shochiku's net profit margin improvement marks a significant financial shift. This sets it apart from the generally stable but less dynamic trends seen across legacy Japanese entertainment companies.

- Shochiku’s move into positive margins, combined with its five-year average earnings growth of 47.7% per year, feeds the prevailing view that while the company’s operations remain solidly rooted in tradition, this earnings quality signals an enhanced defensive “moat” as outlined in market analysis.

- The stable, positive news flow with no negative developments reinforces Shochiku’s reputation as a dependable industry player and minimizes near-term downside risk, even as major digital innovation remains absent.

- Cultural relevance and strength in domestic branding continue to underpin Shochiku’s defensive positioning, even as flashier sector peers pursue aggressive digital expansion strategies.

Forecast Declines Temper Momentum Narrative

- Despite recent profitability, both revenue and earnings are projected to contract annually over the next three years, with earnings forecast to fall by 7.7% and revenue by 0.3% per year. This raises questions about the durability of recent financial gains.

- Prevailing market analysis points out that Shochiku’s lack of new strategic initiatives places it at risk of lagging behind more adaptive, growth-oriented peers.

- Bears highlight the absence of major growth catalysts or a pivot toward streaming as a vulnerability, suggesting the company’s valuation could face pressure as sector competition intensifies.

- Muted retail sentiment and little buzz in response to recent results support the case that Shochiku currently appeals to investors seeking low-volatility exposure but less to those seeking dynamic upside.

Valuation Stands at a Steep Premium to DCF and Industry

- At a share price of ¥13,140, Shochiku trades at a price-to-earnings multiple of 43.7x, far above both its peer average of 19.5x and the Japanese entertainment industry average of 22.5x, with the share price sitting well above its DCF fair value of ¥5,713.94.

- This premium price, coupled with lackluster forward guidance, gives weight to the market’s view that current valuation bakes in a “steady value” premium rather than expectations of breakthrough growth.

- Market discussions emphasize that unless Shochiku announces a meaningful new partnership, catalyst, or pivot, the price may remain anchored, with sector dynamics favoring innovative competitors.

- Investors face a clear trade-off: pay up for stability and brand legacy or demand better alignment with financial fundamentals and sector innovation, given the premium to DCF fair value and sector norms.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shochiku's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Shochiku’s forecasted declines in earnings and revenue, combined with its high valuation premium, leave investors exposed to downside risk if growth momentum stalls.

If you want greater alignment between price and future opportunity, use these 874 undervalued stocks based on cash flows to discover stocks trading closer to their underlying value and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9601

Shochiku

Engages in audio and video, theatre, real estate, and other businesses in Japan and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives