As global markets navigate a landscape marked by steady inflation and evolving monetary policies, Asian tech stocks are gaining attention for their potential in a region where liquidity remains robust and innovation is thriving. In this context, identifying high-growth tech stocks involves focusing on companies that demonstrate resilience amid economic shifts and capitalize on technological advancements to drive growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Fositek | 33.77% | 43.92% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Zhongji Innolight | 26.22% | 26.73% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Foxconn Industrial Internet | 27.61% | 27.23% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| ALTEOGEN | 55.36% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Anhui XDLK Microsystem (SHSE:688582)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui XDLK Microsystem Corporation Limited focuses on the research and development, production, and sale of sensors in China, with a market cap of CN¥30.51 billion.

Operations: The company generates revenue primarily from its electronic test and measurement instruments segment, amounting to CN¥520.32 million.

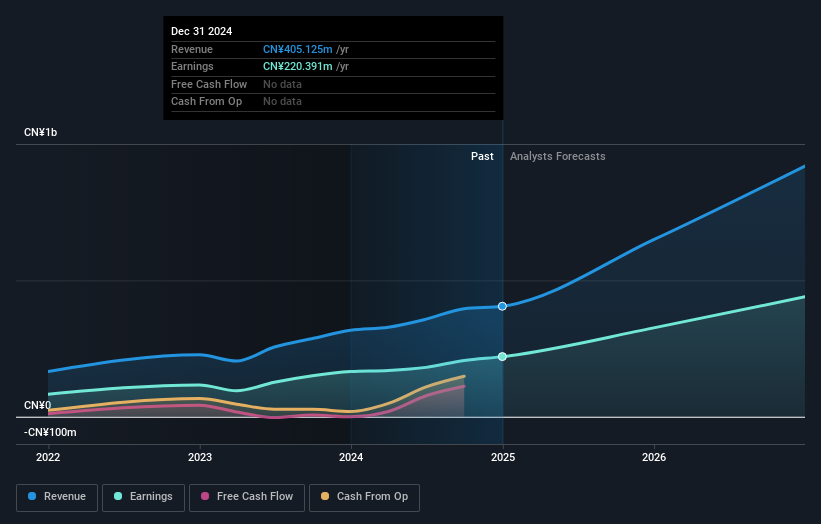

Anhui XDLK Microsystem has demonstrated robust financial performance with a significant surge in revenue and net income, reporting a jump from CNY 137.32 million to CNY 253.13 million in revenue and from CNY 56.45 million to CNY 154.32 million in net income for the first half of 2025. This growth trajectory is supported by an annualized earnings growth forecast of 31% and revenue growth at an impressive rate of 37.6% per year, outpacing the broader Chinese market's average. The company's investment in innovation is evident from its R&D focus, crucial for maintaining technological leadership in a competitive sector where rapid advancements are common. Moreover, Anhui XDLK’s recent earnings quality has been high, indicating that its profit gains are sustainable and not merely accounting enhancements. With earnings expected to grow significantly over the next three years, the company is well-positioned within Asia’s high-growth tech landscape despite a volatile share price recently noted over the past three months. These factors collectively underscore Anhui XDLK Microsystem’s potential as it continues to expand its market presence and refine technological offerings.

- Click here and access our complete health analysis report to understand the dynamics of Anhui XDLK Microsystem.

Learn about Anhui XDLK Microsystem's historical performance.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers a range of network security products and services globally, with a market capitalization of CN¥19.19 billion.

Operations: The company delivers network security products, trusted security management platforms, and specialized security services globally. It operates with a market capitalization of CN¥19.19 billion.

Venustech Group, navigating through a challenging landscape, reported a significant reduction in losses from CNY 182.25 million to CNY 93.35 million for the first half of 2025, showcasing resilience amid market fluctuations. Despite a decrease in revenue from CNY 1,573.7 million to CNY 1,132.58 million year-over-year, the company's strategic adjustments are evident as it aims for profitability with an anticipated earnings growth of 48% annually. This shift is underpinned by their commitment to R&D which remains crucial as they pivot towards emerging tech trends within Asia’s competitive environment. Venustech's focus on innovation could set a robust foundation for future growth as it continues to refine its technological offerings and enhance shareholder value through strategic initiatives.

- Delve into the full analysis health report here for a deeper understanding of Venustech Group.

Gain insights into Venustech Group's past trends and performance with our Past report.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

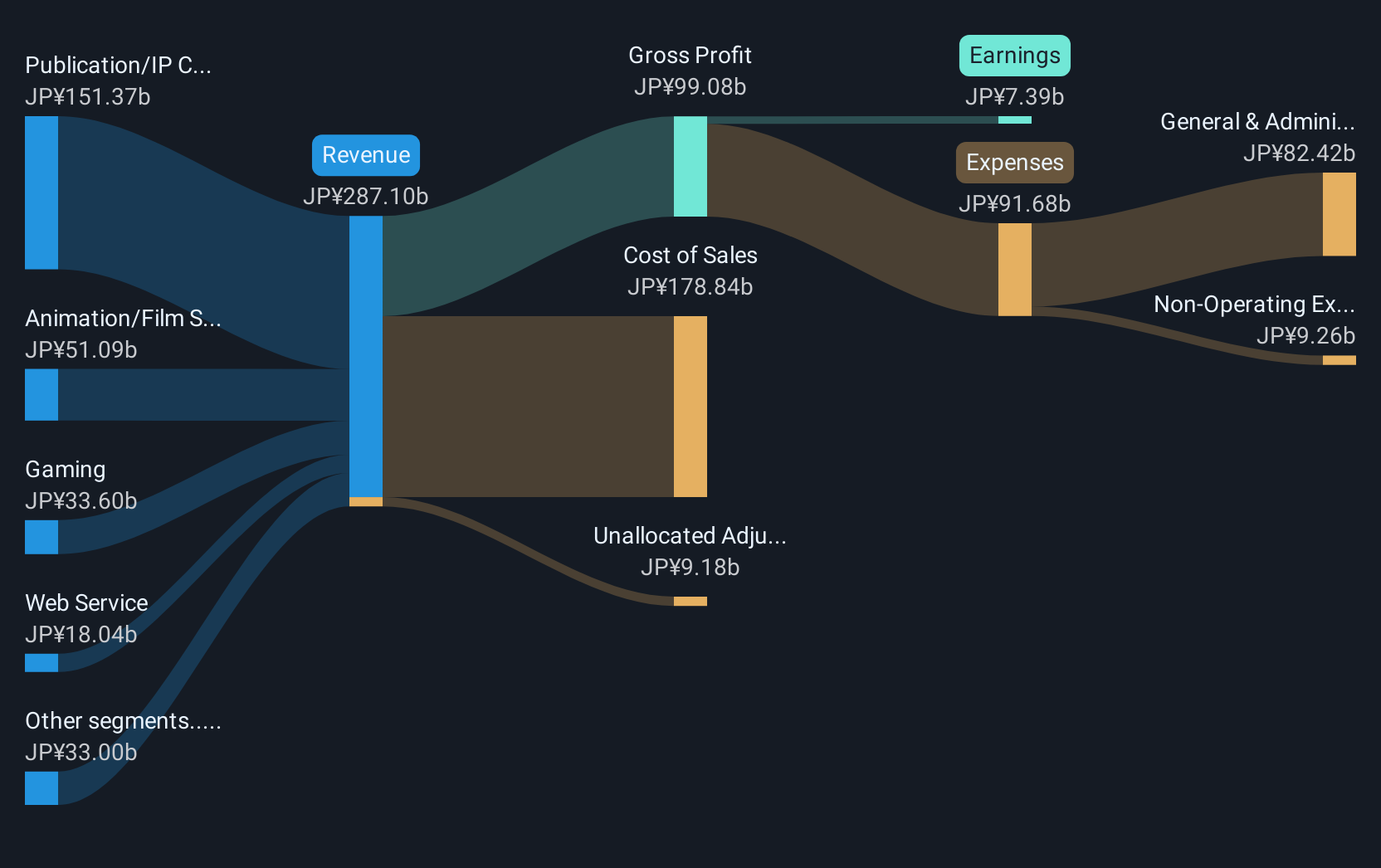

Overview: Kadokawa Corporation is a Japanese entertainment company with a market cap of ¥480.09 billion.

Operations: Kadokawa generates revenue through its diverse entertainment portfolio, including publishing, film, and digital media. The company focuses on content production and distribution across various platforms to reach a broad audience.

Kadokawa Corporation, amidst a dynamic tech landscape in Asia, is set to report its Q1 2026 results soon, reflecting its strategic positioning. With an expected annual earnings growth of 25% and revenue growth at 6.3%, Kadokawa is outpacing the Japanese market's averages of 8.2% and 4.3%, respectively. Despite a challenging past year with earnings contraction by 38.2%, their commitment to innovation through R&D is evident as they aim to leverage their media prowess into profitable ventures, aligning with broader industry shifts towards digital and multimedia experiences.

- Get an in-depth perspective on Kadokawa's performance by reading our health report here.

Assess Kadokawa's past performance with our detailed historical performance reports.

Taking Advantage

- Navigate through the entire inventory of 179 Asian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives