- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6645

High Growth Tech Stocks in Japan to Watch October 2024

Reviewed by Simply Wall St

Japan's stock markets have shown significant gains recently, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%, buoyed by optimism surrounding China's stimulus measures and a dovish stance from the Bank of Japan. In this context, investors are increasingly focused on high-growth tech stocks that can capitalize on favorable economic conditions and innovations in technology, making them important to watch as potential drivers of market performance.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market capitalization of ¥125.07 billion.

Operations: Medley, Inc. generates revenue primarily from its Human Resource Platform Business, contributing ¥17.87 billion, and its Medical Platform Business, contributing ¥6.09 billion. The company also explores growth through New Services with a revenue of ¥573 million.

Medley's strategic acquisition of Offshore Inc. aims to bolster its market presence, reflecting a proactive approach in expanding its operational scope. This move, coupled with Jobley's aggressive U.S. expansion after a successful initial focus on the dental sector, underscores Medley's commitment to broadening its service offerings and geographical footprint. With R&D expenses soaring by 25%, Medley is not just investing in growth but also innovating aggressively to stay ahead in the competitive healthcare tech landscape. The firm’s earnings have surged by 39.2% over the past year, outpacing the industry average of 11.9%, and are projected to climb by 30.4% annually, indicating robust future prospects amidst challenging market conditions.

- Click to explore a detailed breakdown of our findings in Medley's health report.

Gain insights into Medley's historical performance by reviewing our past performance report.

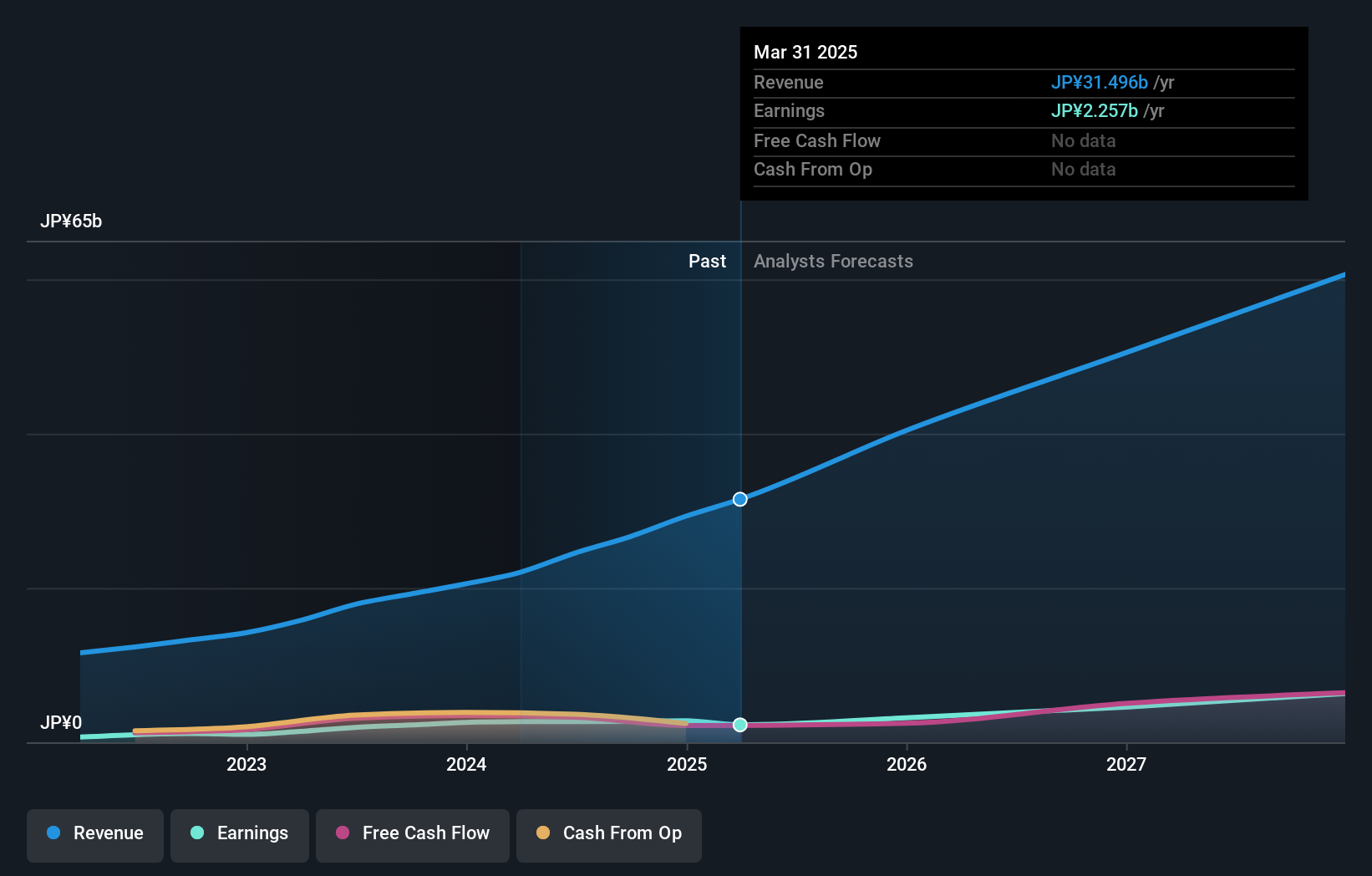

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors, with a market capitalization of ¥1.28 trillion.

Operations: OMRON Corporation's revenue is primarily driven by its Industrial Automation Business, generating ¥373.70 billion, followed by the Social Systems, Solutions and Service Business at ¥156.85 billion. The Healthcare Business contributes ¥150.40 billion, while the Devices & Module Solutions Business adds ¥143.69 billion to the overall revenue structure.

Amid a challenging landscape, OMRON is setting a brisk pace with its projected annual earnings growth of 46.2%, signaling robust potential in automation technology. This growth trajectory is supported by an R&D commitment that saw expenses rise to meet evolving market demands, reflecting a strategic push to foster innovation and maintain competitive edge. With recent activities including an insightful Analyst/Investor Day and a consistent dividend payout, the firm is actively engaging with stakeholders while strengthening its financial base. Despite slower revenue growth forecasts at 5.6% annually compared to some global peers, OMRON's focus on high-quality manufacturing solutions positions it well within Japan's tech sector for potential future profitability.

- Dive into the specifics of OMRON here with our thorough health report.

Understand OMRON's track record by examining our Past report.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation is a Japanese entertainment company with a market cap of ¥433.51 billion, engaging in diverse operations including gaming, publishing, web services, animation/film production, and education/edtech.

Operations: Kadokawa generates revenue primarily from its publishing segment, which accounts for ¥143.28 billion, followed by animation/film production at ¥46.36 billion and gaming at ¥28.63 billion. The company also engages in web services and education/edtech sectors, contributing to its diverse business model.

Kadokawa stands out in Japan's tech landscape with its robust earnings growth forecast at 21.5% annually, significantly outpacing the broader Japanese market's 8.7%. This growth is underpinned by a strategic emphasis on R&D, where expenses have been meticulously aligned with future revenue projections, showcasing a commitment to innovation and market adaptation. Despite facing intense competition within the media industry, Kadokawa has managed to exceed industry earnings growth by 23.8%, compared to the industry average of 3.8%. Additionally, its revenue is expected to grow at 6.7% per year, surpassing the Japanese market forecast of 4.2%, which could position Kadokawa favorably among tech peers for sustained financial health and sector influence.

- Delve into the full analysis health report here for a deeper understanding of Kadokawa.

Gain insights into Kadokawa's past trends and performance with our Past report.

Where To Now?

- Explore the 121 names from our Japanese High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6645

OMRON

Engages in industrial automation, device and module solutions, social systems, and healthcare businesses worldwide.

Excellent balance sheet with reasonable growth potential.