- China

- /

- Electronic Equipment and Components

- /

- SZSE:300657

High Growth Tech Stocks In Asia With Promising Potential

Reviewed by Simply Wall St

Amid hopes for trade de-escalation between the U.S. and China, Asian markets have shown resilience, with small- and mid-cap indexes experiencing gains alongside a mixed performance in major global indices. In this context of cautious optimism, high-growth tech stocks in Asia stand out as potential opportunities due to their innovative capabilities and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.52% | 29.12% | ★★★★★★ |

| Fositek | 26.80% | 33.99% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.34% | 29.48% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| ALTEOGEN | 54.92% | 71.24% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| HFR | 33.91% | 111.76% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company that develops and sells smartphones in Mainland China and internationally, with a market capitalization of HK$1.31 trillion.

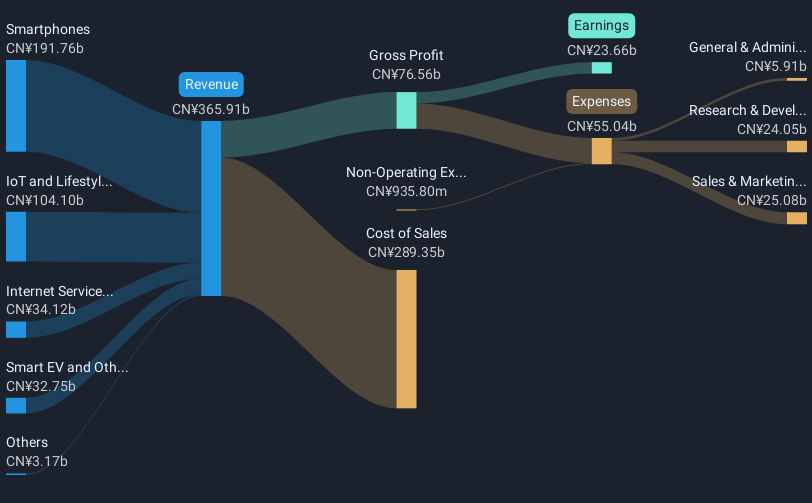

Operations: The company generates revenue primarily from the sale of smartphones (CN¥191.76 billion) and IoT and lifestyle products (CN¥104.10 billion), complemented by internet services (CN¥34.12 billion) and smart EV initiatives (CN¥32.75 billion).

Xiaomi's strategic maneuvers, including a recent HKD 42.6 billion follow-on equity offering and robust full-year earnings with sales up to CNY 365.91 billion from CNY 270.97 billion, underscore its aggressive expansion in high-growth sectors like smart mobility. The partnership with NaaS Technology enhances Xiaomi Auto's ecosystem, tapping into China’s burgeoning NEV market which saw over 50% of new car sales in late 2023. These initiatives complement Xiaomi's impressive annual revenue growth rate of 16.9% and earnings surge by 21.8%, positioning it well amidst Asia’s tech evolution despite a competitive landscape marked by rapid technological advancements and shifting consumer preferences.

- Click here to discover the nuances of Xiaomi with our detailed analytical health report.

Review our historical performance report to gain insights into Xiaomi's's past performance.

Xiamen Hongxin Electronics Technology Group (SZSE:300657)

Simply Wall St Growth Rating: ★★★★★★

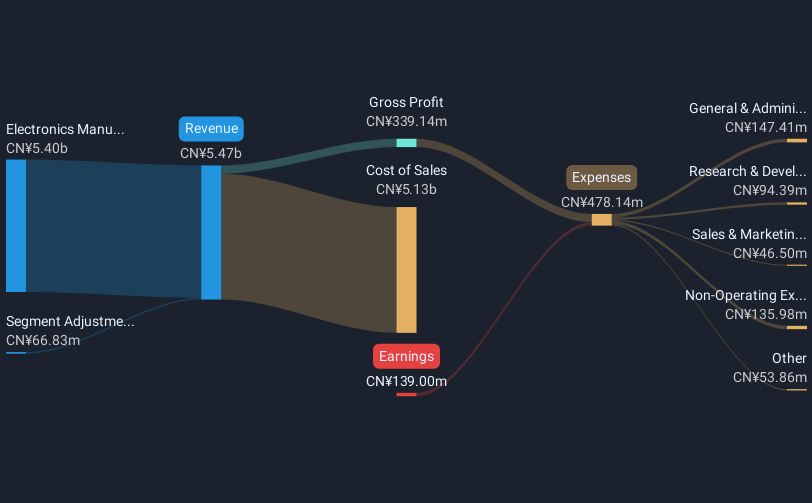

Overview: Xiamen Hongxin Electronics Technology Group Inc. operates in the electronics sector, focusing on the development and manufacturing of electronic components, with a market cap of CN¥14.43 billion.

Operations: The company specializes in producing electronic components, with its revenue primarily generated from this segment. It operates within the electronics sector and has a market capitalization of CN¥14.43 billion.

Xiamen Hongxin Electronics Technology Group has demonstrated a robust turnaround, with its recent annual report showing a revenue leap from CNY 3.41 billion to CNY 5.79 billion and transitioning from a net loss of CNY 435.52 million to a net income of CNY 56.82 million. This significant recovery is underscored by an aggressive R&D investment strategy, which aligns with its ambitious growth targets in the competitive electronics sector in Asia. The firm's strategic amendments to its bylaws and expansion into new business areas suggest proactive governance that could steer future growth amidst evolving market demands, especially noted during their recent AGM where they revised the company's scope and capital structure.

- Get an in-depth perspective on Xiamen Hongxin Electronics Technology Group's performance by reading our health report here.

Understand Xiamen Hongxin Electronics Technology Group's track record by examining our Past report.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

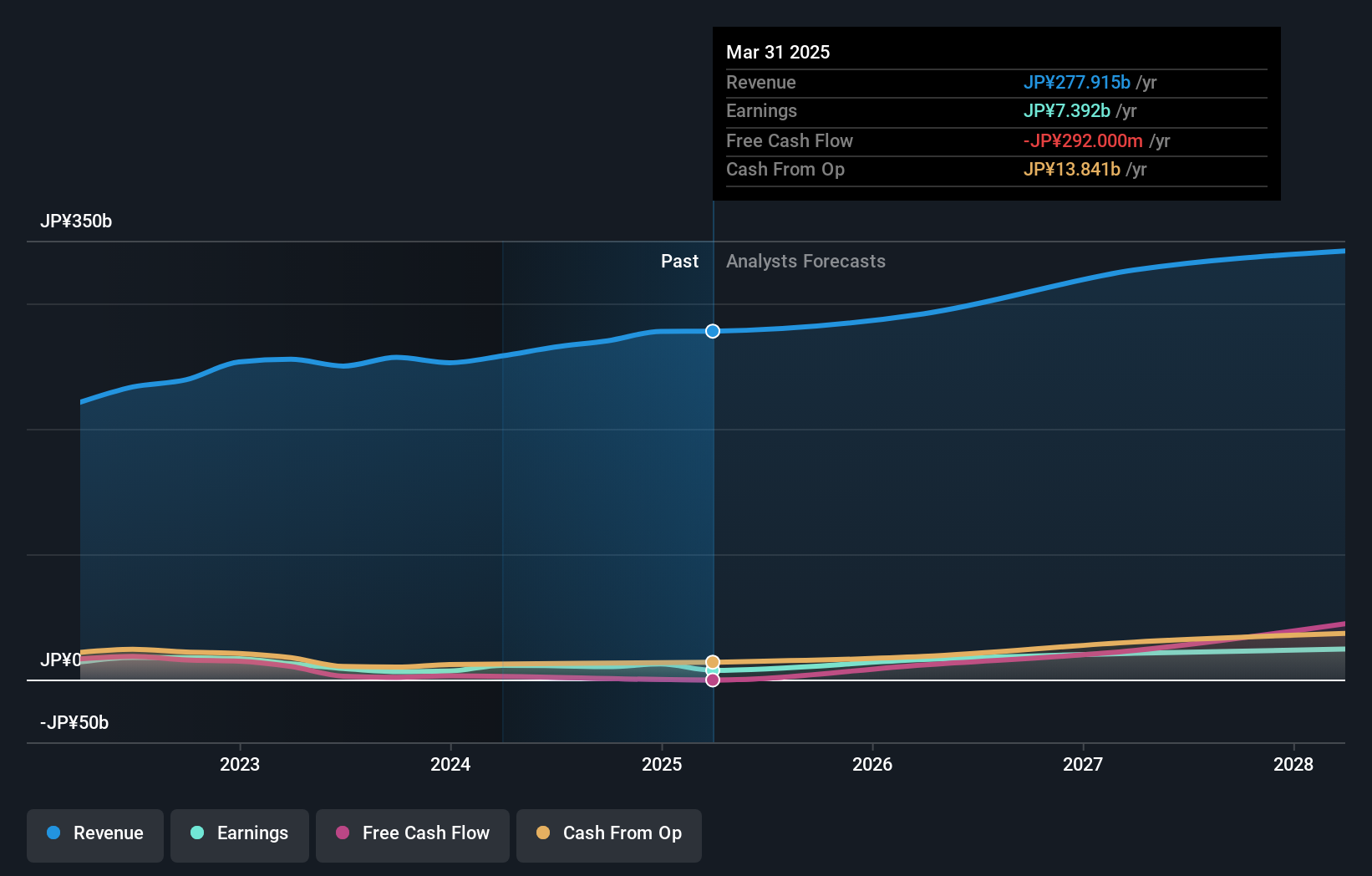

Overview: Kadokawa Corporation is an entertainment company in Japan with a market cap of ¥550.58 billion.

Operations: The company engages in various entertainment sectors, including publishing, film production, and digital content. Its diverse revenue streams encompass books, magazines, movies, and gaming. The business model leverages multimedia synergies to enhance brand value across different platforms.

Kadokawa Corporation's strategic initiatives and recent financial performance underscore its potential in the Asian tech landscape. With a forecasted annual revenue growth of 7.9% and earnings growth of 29.6%, Kadokawa is outpacing the Japanese market averages of 4.1% and 7.5%, respectively. The company's commitment to innovation is evident from its collaboration with NHN Corporation to develop a game based on the popular anime 'OSHI NO KO', indicating a savvy blend of cultural content and digital expansion. Despite lower profit margins this year at 2.7%, down from last year's 4.4%, their proactive approach in media integration, coupled with consistent dividend payments, positions them well for leveraging emerging entertainment technologies.

- Delve into the full analysis health report here for a deeper understanding of Kadokawa.

Gain insights into Kadokawa's past trends and performance with our Past report.

Key Takeaways

- Investigate our full lineup of 477 Asian High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300657

Xiamen Hongxin Electronics Technology Group

Xiamen Hongxin Electronics Technology Group Inc.

Exceptional growth potential low.

Similar Companies

Market Insights

Community Narratives