Nippon BS Broadcasting (TSE:9414) Profit Margins Slip, Reinforcing Bearish Growth Narratives

Reviewed by Simply Wall St

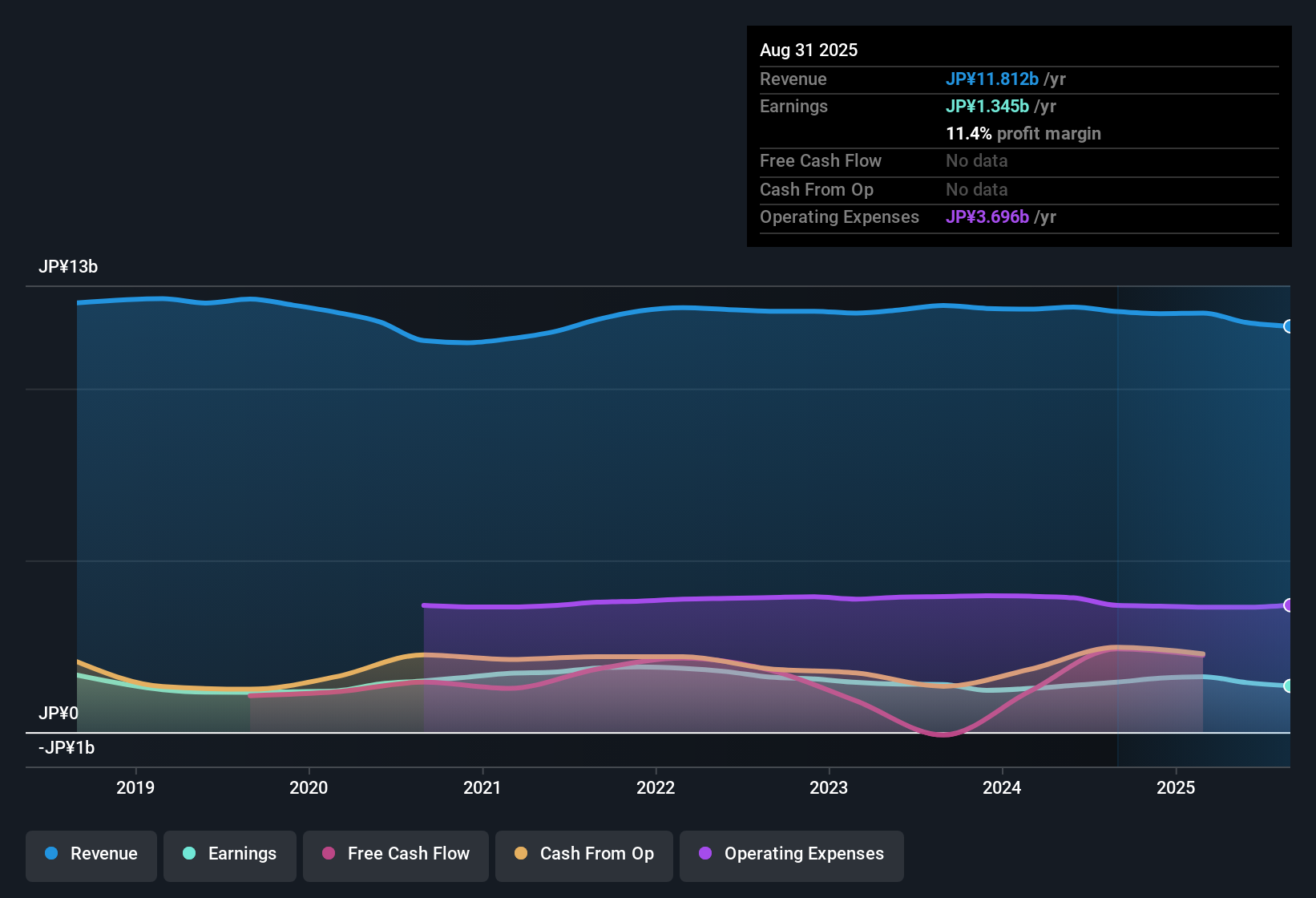

Nippon BS Broadcasting (TSE:9414) reported a net profit margin of 11.4%, just below last year’s 11.9%, while earnings have been on a downward trend, falling 4.9% per year over the past five years and showing another decline in the most recent period. Despite these headwinds, the stock’s Price-To-Earnings ratio is 13x, which stands lower than peers (15.7x) and the broader Japanese media sector (17.7x), with shares trading at ¥981, well under the fair value estimate of ¥2,616.13. The results show margin pressure and persistent earnings declines, but valuation multiples could draw investor attention given the discounted share price.

See our full analysis for Nippon BS Broadcasting.The next section weighs these results against the main market narratives, highlighting where the numbers confirm expectations and where there may be surprises for investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slips to 11.4%

- The company's net profit margin dropped to 11.4%, slightly lower than last year's 11.9%. This continues a gradual compression trend in profitability.

- Softer margins reinforce the prevailing narrative that legacy broadcasters like Nippon BS are feeling the effects of shifting advertising markets and increased competition from digital platforms.

- While the company's established TV base once shielded profits, ongoing declines in traditional ad revenue and operating leverage now make further margin pressure a key risk.

- Investors watching for a turnaround in core profitability may be disappointed unless digital or cost initiatives drive a reversal.

Five-Year Earnings Slide Deepens

- Earnings have fallen at an annualized rate of 4.9% over the past five years, with another year of negative earnings growth just reported.

- The trend adds weight to concerns about structural headwinds in the Japanese broadcasting sector. The lack of visible top-line growth or turnaround stories leaves the company exposed to further declines.

- Bears argue that without meaningful new revenue streams, ongoing earnings slippage is likely to remain an overhang on both investor sentiment and the stock’s fundamental outlook.

- The earnings drag also reduces headroom for possible future dividend increases or reinvestment in content and platforms.

Valuation Discount vs. Sector Peers

- The stock trades on a 13x Price-To-Earnings ratio, undercutting both peer group (15.7x) and sector (17.7x) multiples, while sitting well below the DCF fair value of ¥2,616.13.

- This sizable discount is consistent with investors demanding a margin of safety for declining growth. It could also appeal to value-focused buyers seeking defensive sector exposure at a bargain price.

- Despite the negative profit trends, the valuation gap versus fair value, coupled with the company’s legacy market position, may limit downside for patient investors if sector headwinds begin to ease.

- However, further earnings deterioration would likely require the discount to widen or persist, as reflected in the caution shown by current market multiples.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nippon BS Broadcasting's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nippon BS Broadcasting continues to struggle with declining earnings and margin pressure, which raises doubts about its long-term stability and growth prospects.

If you want to avoid companies facing persistent earnings slumps, use stable growth stocks screener to focus on businesses consistently expanding their revenues and profits across changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nippon BS Broadcasting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9414

Nippon BS Broadcasting

Engages in the BS digital broadcasting business in Japan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)