- Japan

- /

- Entertainment

- /

- TSE:7974

How Investors May Respond To Nintendo (TSE:7974) Leadership Changes Amid Switch 2 Sales Momentum

Reviewed by Sasha Jovanovic

- Nintendo recently announced that Doug Bowser, President and COO of Nintendo of America, will retire at the end of 2025, with Devon Pritchard stepping in as his successor and Satoru Shibata joining as CEO, all while the Switch 2 achieved 2 million units sold in Japan.

- This leadership transition at Nintendo of America signals an important shift in senior management that could influence the company’s direction in its key regional market.

- We will explore how this planned change at the top of Nintendo of America could reshape Nintendo’s investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Nintendo's Investment Narrative?

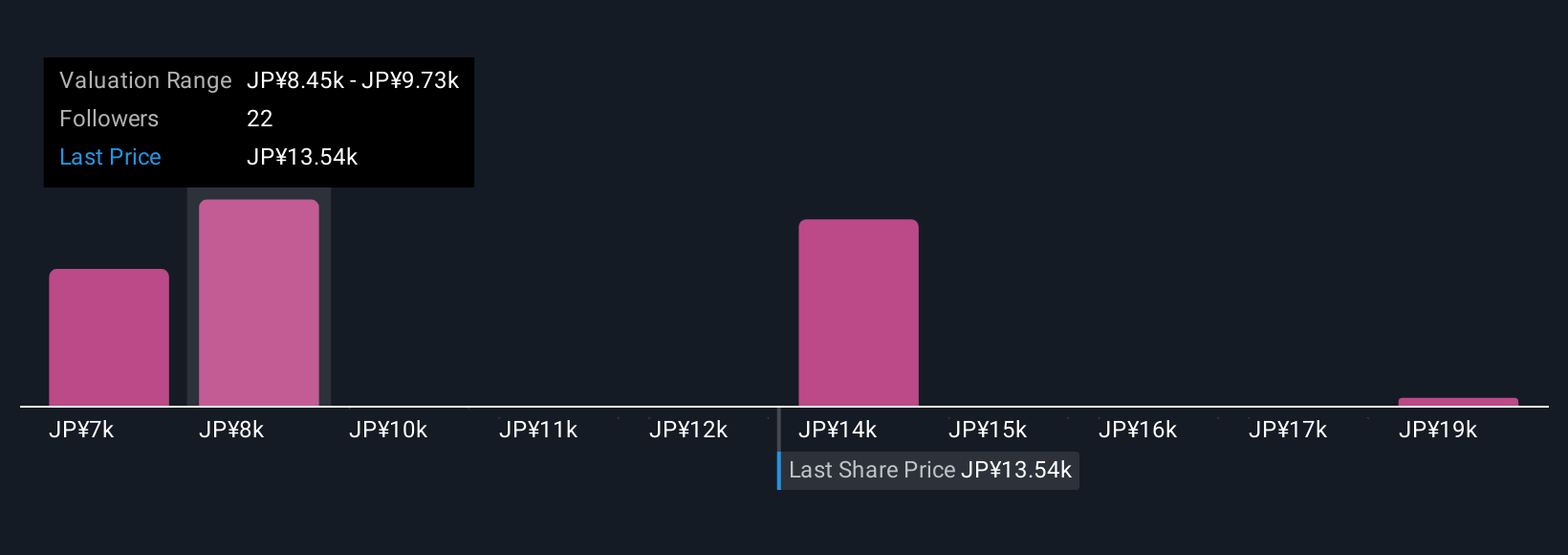

Being a Nintendo shareholder right now is largely anchored in believing in the company’s creative strengths and hardware momentum, balanced with an understanding of its premium share pricing. The Switch 2’s strong debut with 2 million units sold in Japan solidifies near-term confidence in the product cycle, but recent leadership announcements in Nintendo of America, including Doug Bowser's retirement and new executive appointments, bring new attention to what is already a critical U.S. market for Nintendo. While these leadership changes reflect a thoughtful succession plan, they are unlikely to immediately affect core catalysts such as new game launches or the sustained rollout of Switch 2, given Nintendo's deep bench of industry experience and clear announcements on upcoming releases and guidance. However, as always, the most important risks to watch remain profit margin pressures and the market’s current valuation premium, especially as share price is already trading above consensus fair value.

On the other hand, Nintendo’s current market valuation remains a point investors should be aware of.

Exploring Other Perspectives

Explore 8 other fair value estimates on Nintendo - why the stock might be worth as much as 54% more than the current price!

Build Your Own Nintendo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nintendo research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Nintendo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nintendo's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives