Amidst the recent volatility in Japan's markets, driven by political changes and a shifting economic landscape, investors are increasingly looking toward small-cap stocks for potential opportunities. In this environment, identifying stocks with strong fundamentals and growth potential can be crucial for navigating the complexities of the current market.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Morita Holdings (TSE:6455)

Simply Wall St Value Rating: ★★★★★★

Overview: Morita Holdings Corporation, with a market cap of ¥94.21 billion, develops, manufactures, and sells ladder trucks, fire trucks, and specialty vehicles both in Japan and internationally through its subsidiaries.

Operations: Morita Holdings generates revenue primarily from the development, manufacture, and sale of ladder trucks, fire trucks, and specialty vehicles. The company's net profit margin has shown notable fluctuations over recent periods.

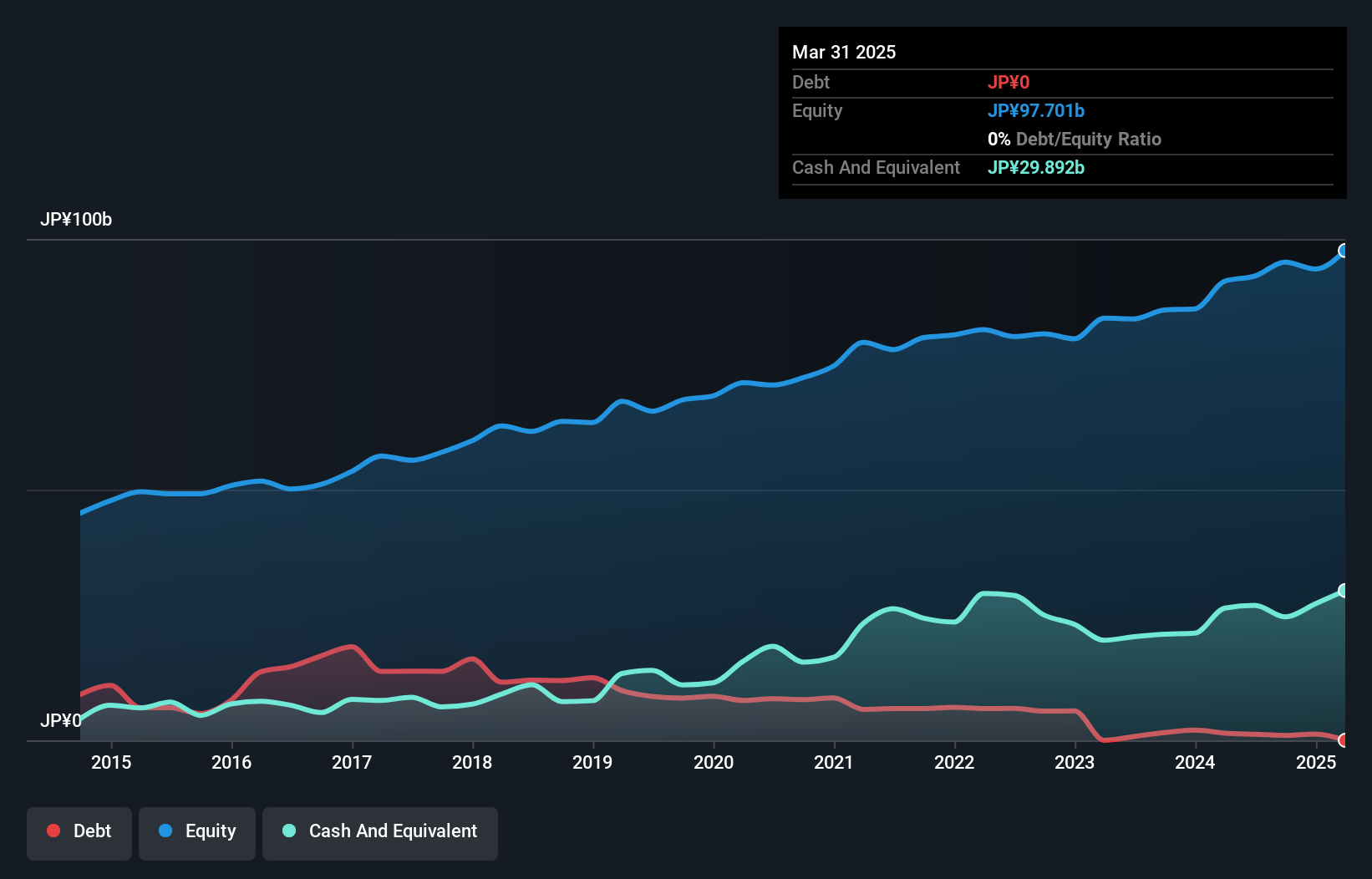

Morita Holdings, a relatively small player in the machinery sector, stands out with its earnings growth of 72.9% last year, far surpassing the industry average of 12.3%. The company has successfully reduced its debt to equity ratio from 13.4% to an impressive 1.3% over five years and boasts high-quality past earnings. Trading at nearly 56% below estimated fair value suggests potential for upside, while a ¥25 dividend per share adds appeal for income-focused investors.

- Unlock comprehensive insights into our analysis of Morita Holdings stock in this health report.

Evaluate Morita Holdings' historical performance by accessing our past performance report.

Daiichikosho (TSE:7458)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiichikosho Co., Ltd. specializes in the sale and rental of commercial karaoke systems in Japan, with a market capitalization of ¥193.39 billion.

Operations: The company generates revenue primarily from its Commercial Karaoke and Karaoke and Restaurant Business segments, with ¥61.10 billion and ¥65.50 billion respectively. The Music Soft segment contributes an additional ¥6.50 billion to the overall revenue stream.

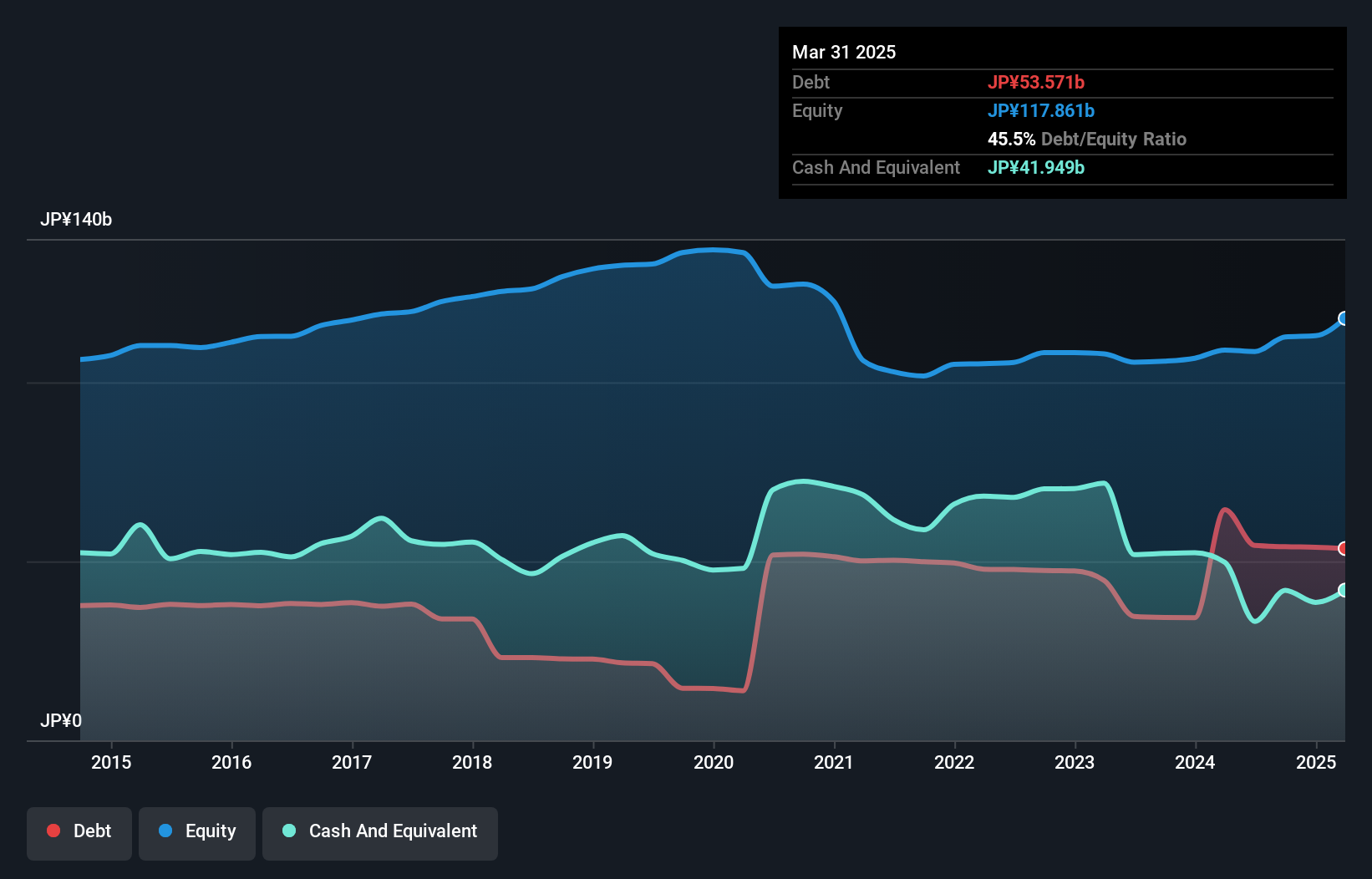

Daiichikosho, a notable name in Japan's entertainment sector, has shown impressive earnings growth of 49.7% over the past year, outpacing the industry average of -14.1%. Its price-to-earnings ratio stands at 15.4x, which is attractive compared to the sector's 24x average. Despite an increase in its debt to equity ratio from 16.1% to 50.1% over five years, interest payments are well covered by EBIT at a robust 402 times coverage. The company recently repurchased shares worth ¥2 billion and adjusted its buyback plan to include more shares and funds until October end.

- Take a closer look at Daiichikosho's potential here in our health report.

Understand Daiichikosho's track record by examining our Past report.

77 Bank (TSE:8341)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd. offers a range of banking products and services to both corporate and individual customers in Japan, with a market capitalization of ¥290.26 billion.

Operations: 77 Bank generates revenue primarily through its banking products and services offered to corporate and individual customers in Japan. The company has a market capitalization of ¥290.26 billion.

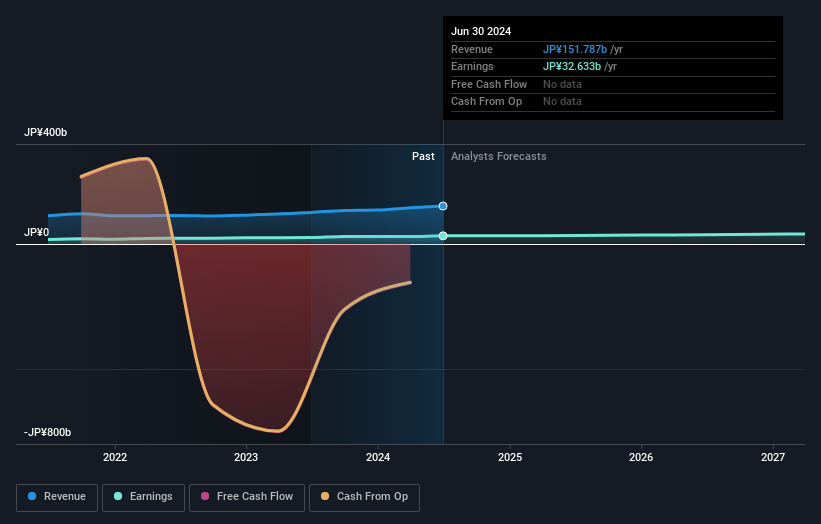

With total assets of ¥10,577.6 billion and equity at ¥595.7 billion, 77 Bank stands out with its robust financial structure. Deposits amount to ¥8,999.8 billion while loans are at ¥5,866.4 billion; however, the allowance for bad loans is notably low at 0%, despite a high ratio of non-performing loans at 1010%. Earnings have surged by 27% over the past year, outpacing industry growth of 19%. The company is trading significantly below its estimated fair value by about 47%, presenting a potential opportunity for investors seeking undervalued stocks in Japan's banking sector.

- Get an in-depth perspective on 77 Bank's performance by reading our health report here.

Gain insights into 77 Bank's past trends and performance with our Past report.

Taking Advantage

- Unlock more gems! Our Japanese Undiscovered Gems With Strong Fundamentals screener has unearthed 732 more companies for you to explore.Click here to unveil our expertly curated list of 735 Japanese Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6455

Morita Holdings

Through its subsidiaries, engages in the development, manufacture, and sale of ladder trucks, fire trucks, and specialty vehicles in Japan and internationally.

Flawless balance sheet established dividend payer.