- Japan

- /

- Interactive Media and Services

- /

- TSE:7069

Positive Sentiment Still Eludes CyberBuzz, Inc. (TSE:7069) Following 40% Share Price Slump

The CyberBuzz, Inc. (TSE:7069) share price has fared very poorly over the last month, falling by a substantial 40%. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

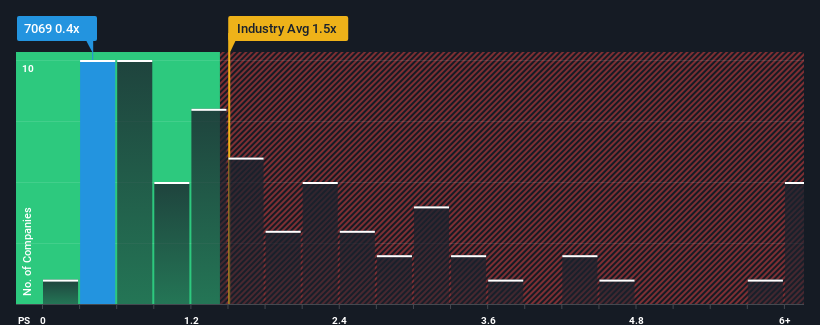

Since its price has dipped substantially, it would be understandable if you think CyberBuzz is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Japan's Interactive Media and Services industry have P/S ratios above 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for CyberBuzz

How CyberBuzz Has Been Performing

Recent times have been advantageous for CyberBuzz as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CyberBuzz will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, CyberBuzz would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. The latest three year period has also seen an excellent 143% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 18% each year over the next three years. That's shaping up to be materially higher than the 7.3% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that CyberBuzz's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

CyberBuzz's recently weak share price has pulled its P/S back below other Interactive Media and Services companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems CyberBuzz currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with CyberBuzz (at least 1 which can't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on CyberBuzz, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7069

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.