Despite posting strong earnings, Hope, Inc.'s (TSE:6195) stock didn't move much over the last week. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

See our latest analysis for Hope

Zooming In On Hope's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

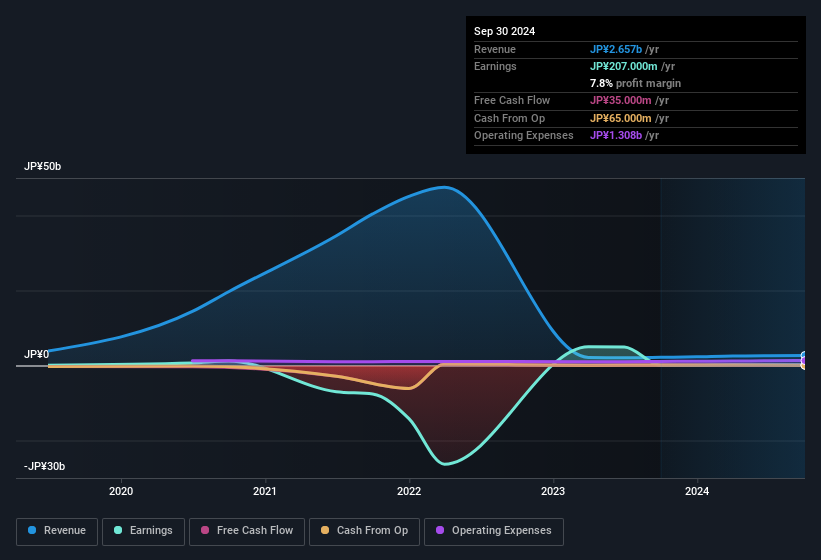

Over the twelve months to September 2024, Hope recorded an accrual ratio of 1.17. Ergo, its free cash flow is significantly weaker than its profit. As a general rule, that bodes poorly for future profitability. Indeed, in the last twelve months it reported free cash flow of JP¥35m, which is significantly less than its profit of JP¥207.0m. Hope's free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits. However, as we will discuss below, we can see that the company's accrual ratio has been impacted by its tax situation. This would partially explain why the accrual ratio was so poor.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hope.

An Unusual Tax Situation

Moving on from the accrual ratio, we note that Hope profited from a tax benefit which contributed JP¥55m to profit. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Hope's Profit Performance

This year, Hope couldn't match its profit with cashflow. On top of that, the unsustainable nature of tax benefits mean that there's a chance profit may be lower next year, certainly in the absence of strong growth. Considering all this we'd argue Hope's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing Hope at this point in time. Every company has risks, and we've spotted 3 warning signs for Hope (of which 1 is a bit unpleasant!) you should know about.

Our examination of Hope has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6195

Hope

Provides advertising services to local governments and private companies.

Excellent balance sheet and good value.

Market Insights

Community Narratives