Vector (TSE:6058) Margin Dip Reinforces Concerns Over Profit Resilience Despite Low Valuation

Reviewed by Simply Wall St

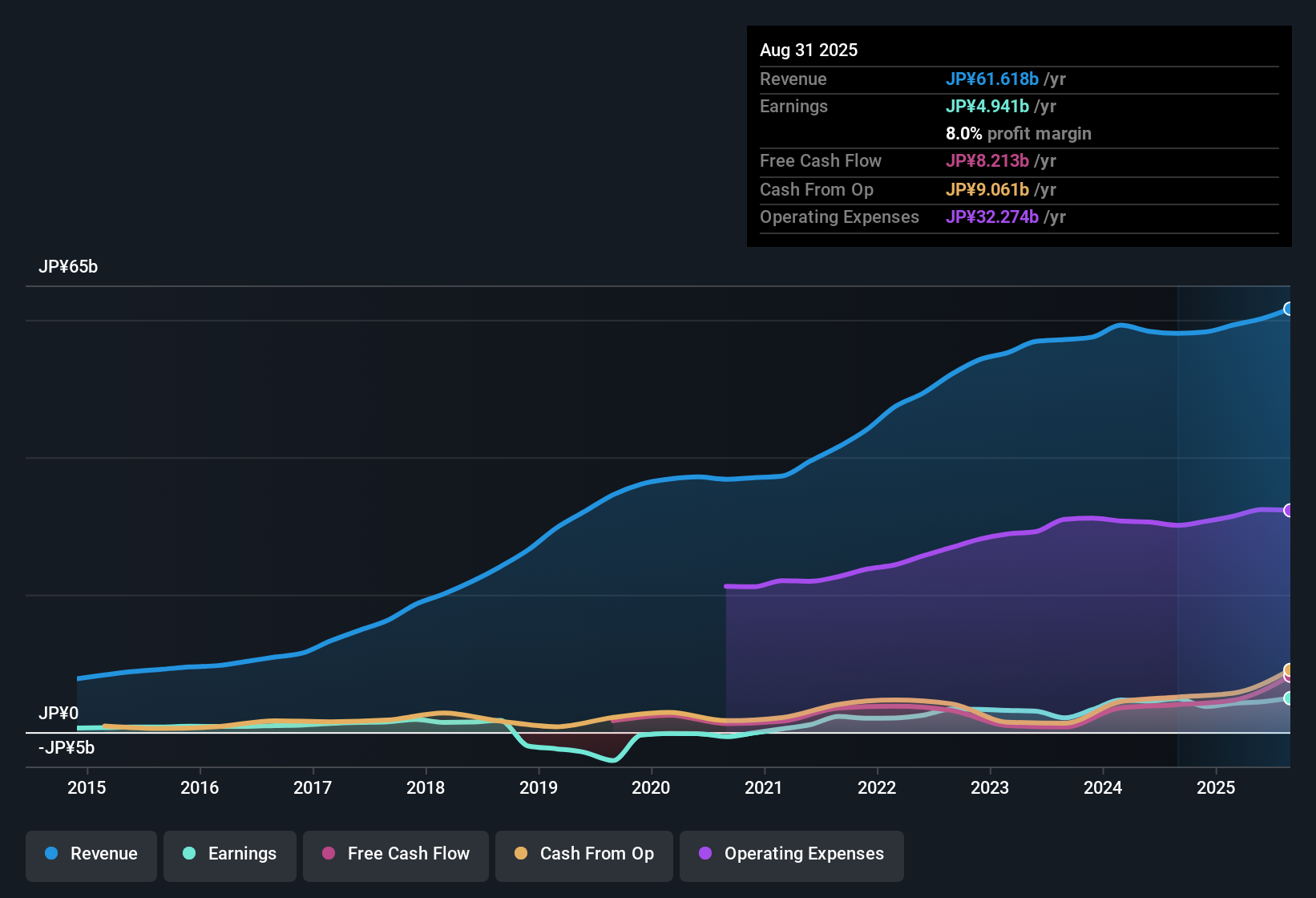

Vector (TSE:6058) reported earnings growth of just 1.3% over the past year, a notable slowdown from its impressive 5-year average of 32.8% per year. Looking ahead, analysts expect annual earnings and revenue growth to come in at 3.7% and 3.2% respectively, both of which fall short of the broader Japanese market averages. For investors, the high earnings quality, history of profit expansion, and price-to-earnings ratio of 11.4x, which is well below industry peers, stand out even as profit margins dip slightly and questions around dividend sustainability remain in focus this earnings season.

See our full analysis for Vector.The next section dives into how these fresh earnings results stack up against the most widely followed narratives and expectations from the Simply Wall St community, highlighting where the numbers fit and where they challenge the story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Take a Step Back

- Net profit margin came in at 8%, lower than the prior year’s 8.4%. This subtle drop tends to raise investor eyebrows over cost management and profitability strength, especially after a run of strong multi-year earnings growth.

- The prevailing market view suggests a constructive stance on Vector’s high-quality earnings and history of profit expansion. However, this margin dip highlights a tension between the company’s earnings durability and its ability to defend profitability as sales increase.

- While multi-year profit growth has been impressive at a 32.8% average annually, even a modest margin decline can test confidence in ongoing cost discipline, particularly as sector growth cools or competition intensifies.

- Investors watching for both top-line expansion and stable margins may question if last year’s slip is a blip or a reminder to temper expectations going forward.

Growth Slowing Compared to Market

- Forward guidance points to annual earnings growth of 3.7% and revenue growth of 3.2%, both of which trail Japanese market averages of 8.1% and 4.4% respectively. This signals that Vector’s upward trajectory is now more muted than the broader sector.

- Prevailing market commentary leans on the company’s ability to sustain long-term growth and capitalize on sector tailwinds, but these below-average forecasts highlight how Vector’s momentum is lagging the industry benchmark.

- Despite prior standout years, Vector’s forecasted growth now underperforms its national peers, making it harder for bullish investors to justify a return to premium valuation multiples.

- As competitors are expected to deliver higher earnings and revenue gains, Vector’s lower projections may reset shareholder expectations for outsized performance in the near term.

Valuation Gap Versus Peers Wide

- Vector is currently trading at a price-to-earnings ratio of 11.4x, far below the peer average of 27.4x and the broader Japanese media sector’s 17.3x. This highlights a significant discount even as its DCF fair value is estimated at 2497.40 and the current share price stands at 1206.00.

- Prevailing market analysis heavily supports the narrative that this valuation gap offers upside for value-focused investors, as long as the company can maintain its high earnings quality and avoid further slippage in profitability.

- The discount to both sector multiples and intrinsic value means patient investors could benefit if market sentiment shifts or growth rebounds, provided dividends are sustainable and margins do not fall further.

- However, the risk is that if growth rates and profitability do not turn up, the lower multiple simply reflects justified caution from the market rather than an unfounded opportunity.

If Vector manages to close the gap on growth or margins, watch for renewed interest from value investors seeking stocks with a big discount to both peers and DCF fair value. See our latest analysis for Vector.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Vector's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Vector’s slowing growth, recent margin slip, and weaker forecasts mean it is not matching the consistency or momentum of its top-performing peers.

If you want steadier, more predictable returns, check out stable growth stocks screener (2096 results) where companies show reliable earnings and revenue growth no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6058

Vector

Engages in the public relations (PR) and advertising, press release distribution, video release distribution, direct marketing, media, investment, and human resources businesses in Japan, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives