- Turkey

- /

- Telecom Services and Carriers

- /

- IBSE:TTKOM

Türk Telekomünikasyon Anonim Sirketi And 2 Other Stocks That Might Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a complex environment marked by tariff uncertainties and mixed economic signals, with major indices experiencing slight declines amid these challenges. Despite this volatility, some stocks may present opportunities for value-oriented investors who are seeking assets potentially priced below their estimated worth. Identifying such undervalued stocks requires careful analysis of financial fundamentals and market conditions to uncover potential discrepancies between a company's intrinsic value and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.71 | US$37.36 | 49.9% |

| KG Mobilians (KOSDAQ:A046440) | ₩4445.00 | ₩8850.75 | 49.8% |

| Alarum Technologies (TASE:ALAR) | ₪3.356 | ₪6.68 | 49.7% |

| Celsius Holdings (NasdaqCM:CELH) | US$21.28 | US$42.43 | 49.8% |

| Aoshikang Technology (SZSE:002913) | CN¥29.12 | CN¥57.92 | 49.7% |

| S&U (LSE:SUS) | £16.25 | £32.33 | 49.7% |

| Similarweb (NYSE:SMWB) | US$11.87 | US$23.62 | 49.7% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Medy-Tox (KOSDAQ:A086900) | ₩119200.00 | ₩235487.26 | 49.4% |

| Kyndryl Holdings (NYSE:KD) | US$41.15 | US$81.37 | 49.4% |

Underneath we present a selection of stocks filtered out by our screen.

Türk Telekomünikasyon Anonim Sirketi (IBSE:TTKOM)

Overview: Türk Telekomünikasyon Anonim Sirketi, along with its subsidiaries, functions as an integrated telecommunication company in Turkey with a market cap of TRY174.79 billion.

Operations: The company's revenue is primarily derived from its Fixed-Line segment at TRY67.30 billion and Mobile segment at TRY45.38 billion.

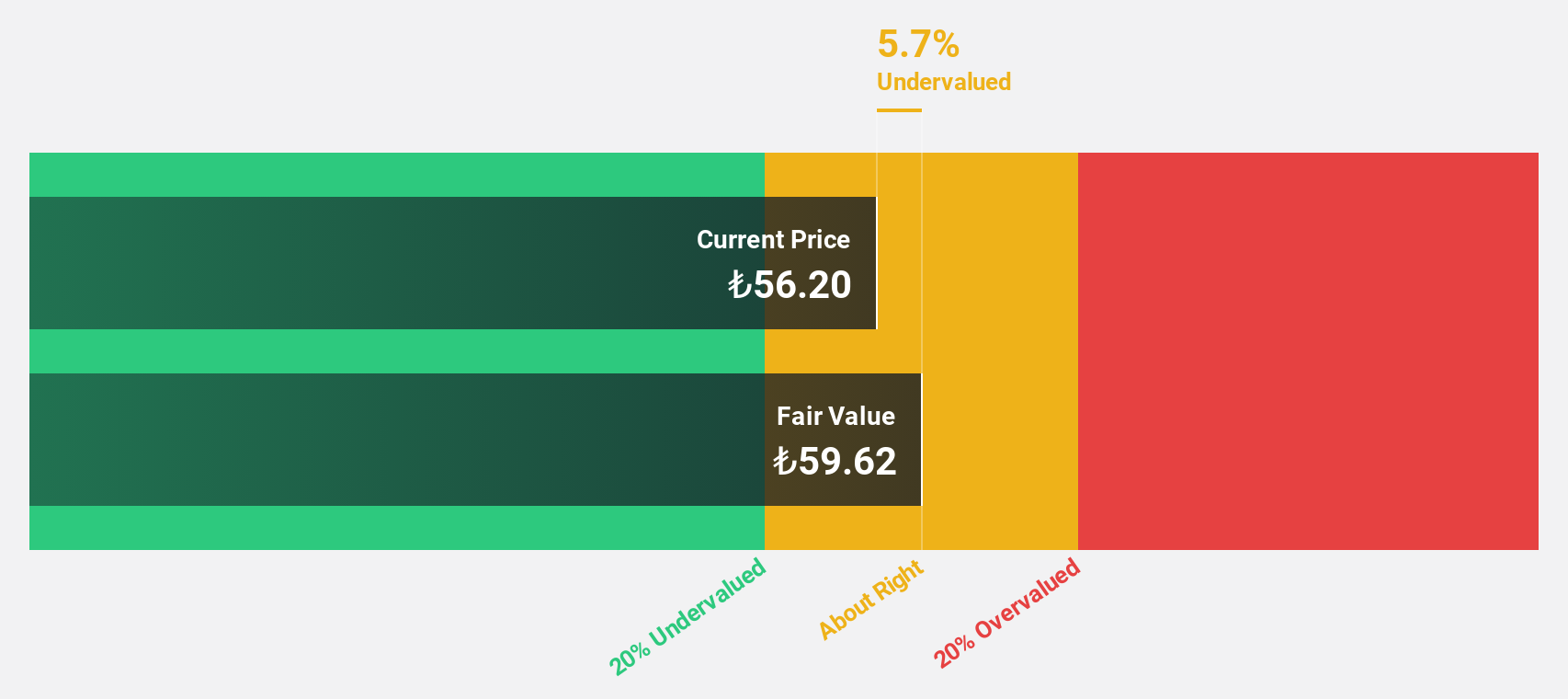

Estimated Discount To Fair Value: 14.5%

Türk Telekomünikasyon Anonim Sirketi is trading at TRY49.94, below its estimated fair value of TRY58.38, representing a 14.5% discount. Despite being only moderately undervalued based on discounted cash flow analysis, the company shows robust growth potential with earnings expected to grow significantly at 32% annually over the next three years and revenue projected to rise by 27.3% per year, outpacing market growth rates in Turkey.

- Our expertly prepared growth report on Türk Telekomünikasyon Anonim Sirketi implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Türk Telekomünikasyon Anonim Sirketi stock in this financial health report.

GemPharmatech (SHSE:688046)

Overview: GemPharmatech Co., Ltd. is a contract research organization offering genetically engineered mouse models and preclinical research services globally, with a market cap of CN¥6.42 billion.

Operations: GemPharmatech Co., Ltd. generates revenue through its provision of genetically engineered mouse models and preclinical research services to the global scientific community.

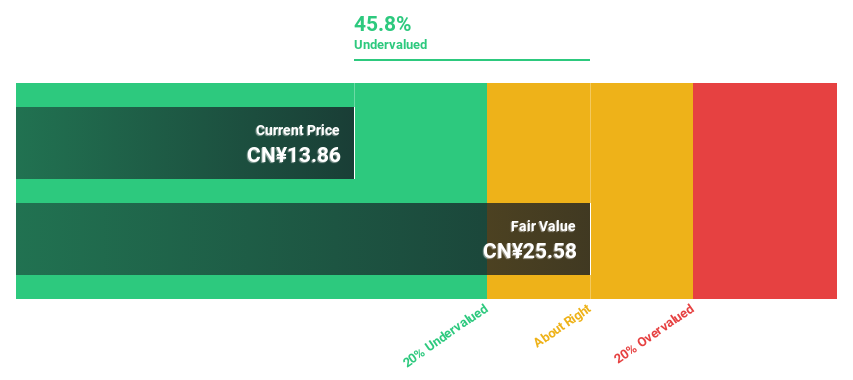

Estimated Discount To Fair Value: 35.6%

GemPharmatech, trading at CN¥15.71, is significantly undervalued with a fair value estimate of CN¥24.41. The company's revenue is projected to grow at 20.4% annually, surpassing the Chinese market's growth rate of 13.5%. Despite high non-cash earnings and an expected annual profit growth of 24.2%, its return on equity remains low at a forecasted 8.8%. Recent buybacks totaling CN¥8.8 million could enhance shareholder value amidst this undervaluation scenario.

- Our growth report here indicates GemPharmatech may be poised for an improving outlook.

- Click here to discover the nuances of GemPharmatech with our detailed financial health report.

note (TSE:5243)

Overview: Note Inc. operates in the media platform business in Japan and has a market cap of ¥47.66 billion.

Operations: The company generates revenue through its media platform business in Japan.

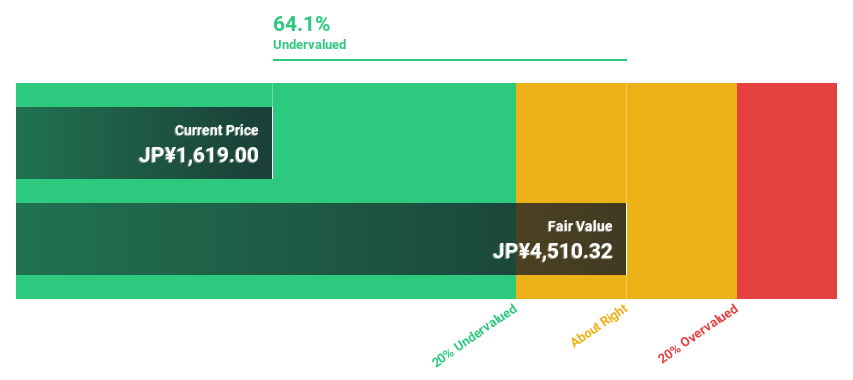

Estimated Discount To Fair Value: 35.4%

Note Inc., currently trading at ¥2909, is undervalued with a fair value estimate of ¥4504.09. The company has recently become profitable and forecasts significant earnings growth of 42.91% annually, outpacing the Japanese market's average. Despite a volatile share price, revenue is expected to grow by 17.5% per year, faster than the market rate of 4.3%. A recent private placement raised approximately ¥490 million, enhancing financial flexibility with participation from Google International LLC.

- Our earnings growth report unveils the potential for significant increases in note's future results.

- Click to explore a detailed breakdown of our findings in note's balance sheet health report.

Summing It All Up

- Click here to access our complete index of 916 Undervalued Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Türk Telekomünikasyon Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TTKOM

Türk Telekomünikasyon Anonim Sirketi

Operates as an integrated telecommunication company in Turkey.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives