Dentsu's India Sports and Entertainment Launch Might Change The Case For Investing In Dentsu Group (TSE:4324)

Reviewed by Sasha Jovanovic

- Dentsu Group has launched its Sports & Entertainment network in India, appointing Yosuke Murai to lead this first dedicated practice as part of the company’s global expansion efforts.

- This initiative marks a move to help brands tap into India's fast-evolving sports, culture, and entertainment sectors, specifically aiming to engage younger, digitally native audiences through immersive experiences.

- We'll explore how Dentsu's entry into India's sports and entertainment market could influence its expansion into higher-growth, content-driven services.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dentsu Group Investment Narrative Recap

To be a Dentsu Group shareholder today, you would need to believe in the company's ability to shift from traditional advertising toward high-growth, content-driven business areas, like sports and entertainment, while addressing ongoing challenges in its international operations. The recent launch of Dentsu’s Sports & Entertainment network in India is a logical fit for expanding its higher-growth portfolio, but it does not materially resolve the biggest short-term risk: continued weakness and uncertainty in its overseas business, particularly in the Americas and EMEA.

Among recent announcements, ongoing talks regarding potential partnerships or “strategic alternatives” for Dentsu’s international business remain the most relevant. While the India expansion showcases efforts to tap into new revenue streams, the company’s active exploration of structural changes abroad ties directly into investor focus on revenue diversification and stabilization of margins.

By contrast, investors should also be aware of the risk if international businesses continue to underperform and whether proposed overseas partnerships will actually...

Read the full narrative on Dentsu Group (it's free!)

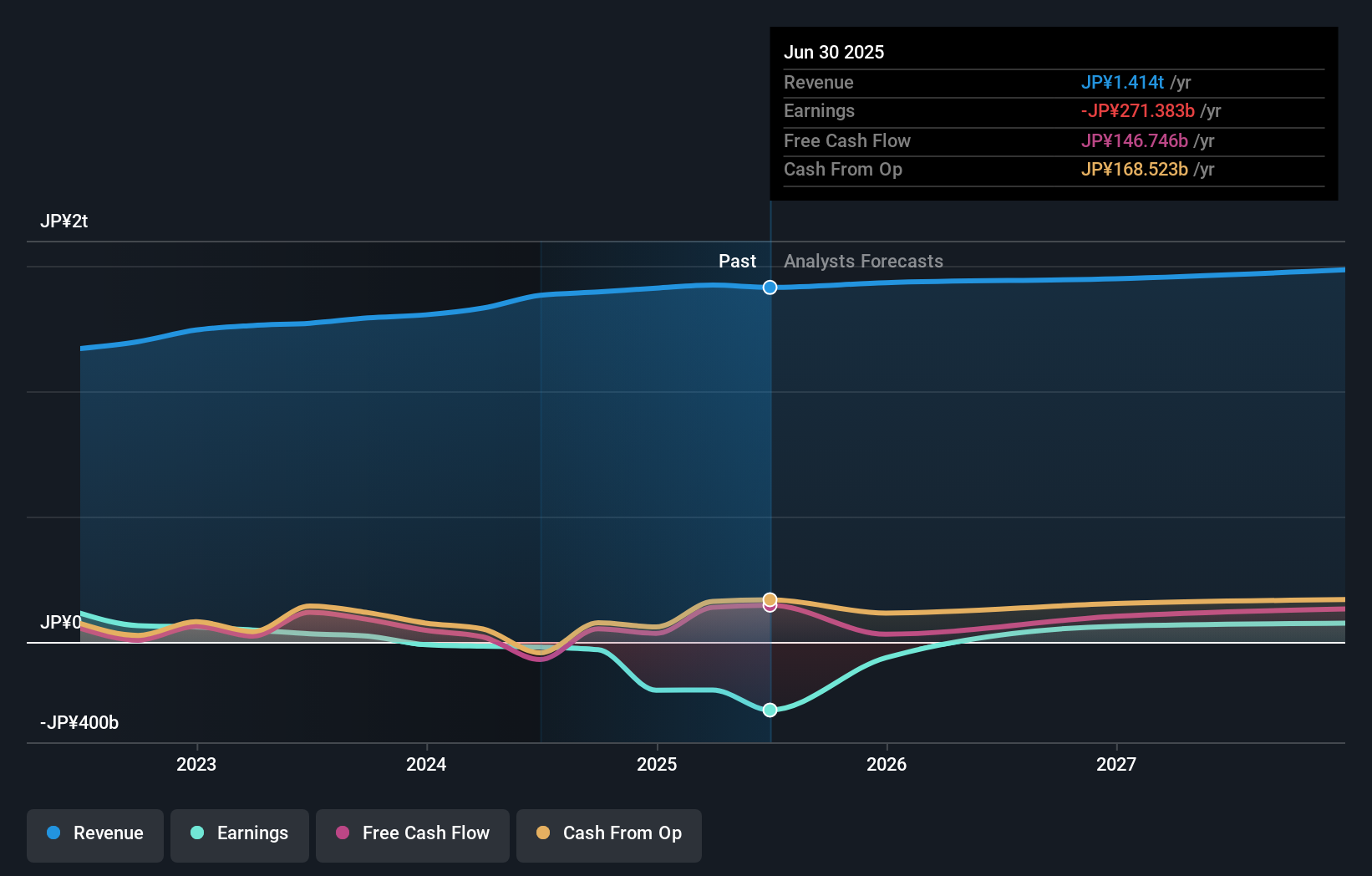

Dentsu Group's outlook anticipates ¥1,495.9 billion in revenue and ¥83.7 billion in earnings by 2028. This reflects a 1.9% annual revenue growth rate and an earnings increase of ¥355.1 billion from the current loss of ¥-271.4 billion.

Uncover how Dentsu Group's forecasts yield a ¥3070 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members see Dentsu's fair value ranging from ¥3,070 to ¥7,279, across 2 distinct valuations. As you weigh these different views, consider how the company’s attempts to unlock value from its international segment could shape future earnings and risk profiles.

Explore 2 other fair value estimates on Dentsu Group - why the stock might be worth over 2x more than the current price!

Build Your Own Dentsu Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dentsu Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dentsu Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dentsu Group's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4324

Dentsu Group

Operates in the advertising business in Japan, the Americas, Europe, the Middle East and Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives