- Japan

- /

- Interactive Media and Services

- /

- TSE:4176

Investors Still Aren't Entirely Convinced By coconala Inc.'s (TSE:4176) Revenues Despite 27% Price Jump

coconala Inc. (TSE:4176) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.2% in the last twelve months.

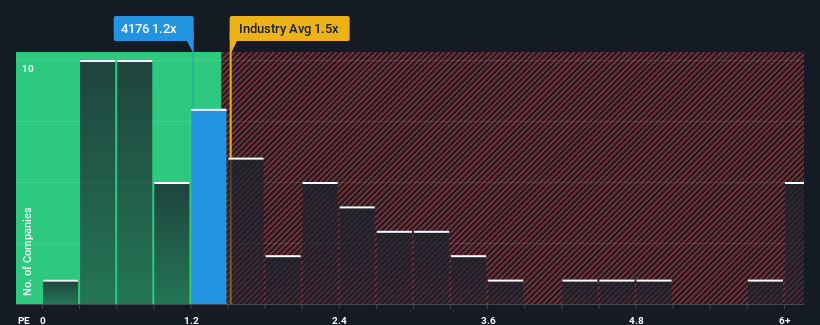

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about coconala's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Interactive Media and Services industry in Japan is also close to 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for coconala

What Does coconala's Recent Performance Look Like?

Recent times have been advantageous for coconala as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think coconala's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For coconala?

The only time you'd be comfortable seeing a P/S like coconala's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 41%. The strong recent performance means it was also able to grow revenue by 140% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 21% per annum during the coming three years according to the sole analyst following the company. With the industry only predicted to deliver 7.2% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that coconala's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

coconala's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that coconala currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware coconala is showing 3 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if coconala might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4176

coconala

Operates a platform to buy and sell knowledge, skills, and experience in production, business support, and consultation categories in Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives