- Japan

- /

- Real Estate

- /

- TSE:3498

December 2024's Top Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, with the Nasdaq reaching new heights amidst broader index declines and central banks adjusting rates, investors are increasingly focusing on growth stocks that demonstrate resilience and potential. In this context, companies with significant insider ownership often stand out as they typically signal strong internal confidence in their business prospects, making them appealing candidates for those looking to align with management's vested interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Kasumigaseki CapitalLtd (TSE:3498)

Simply Wall St Growth Rating: ★★★★★★

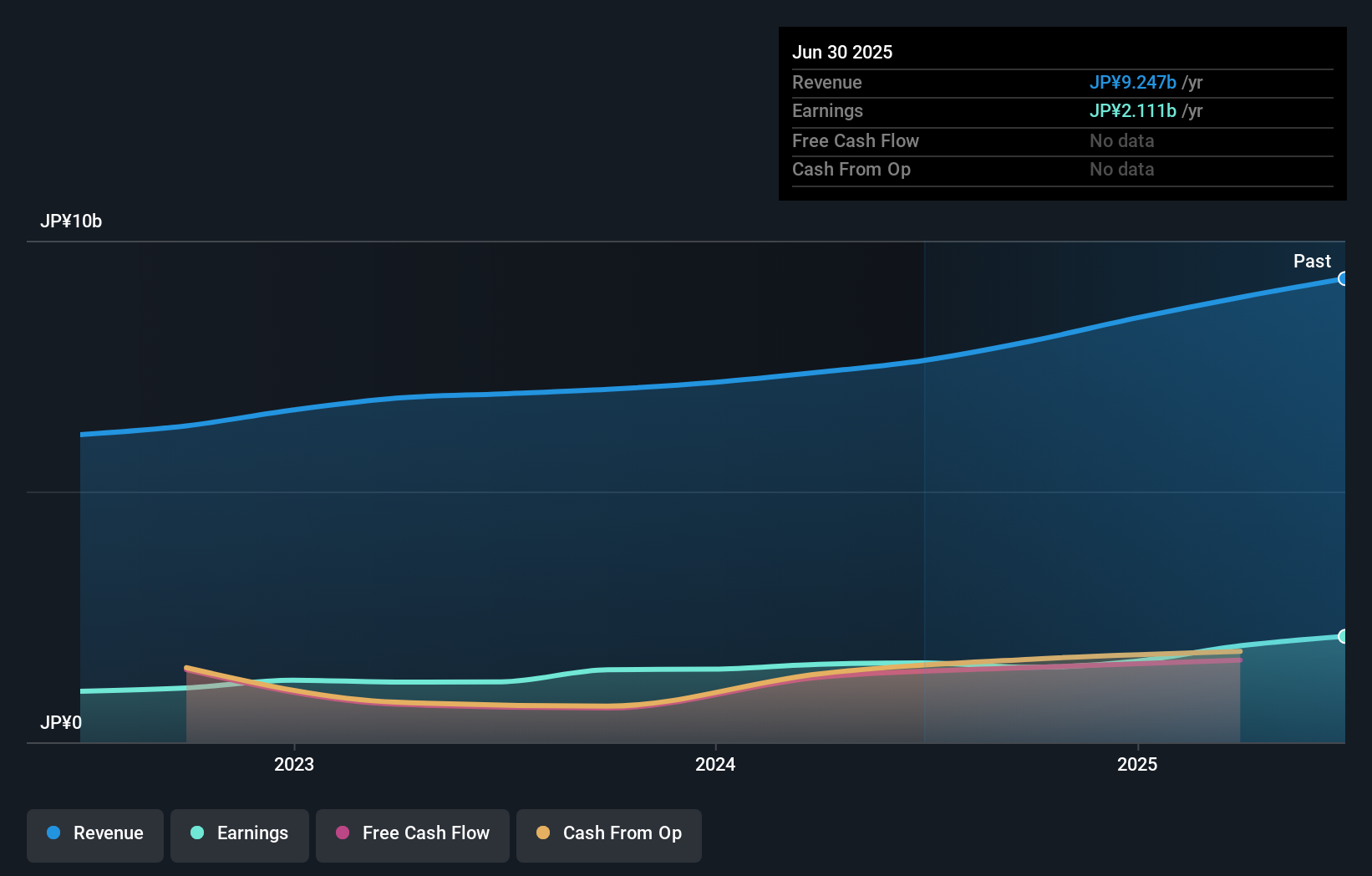

Overview: Kasumigaseki Capital Co., Ltd. operates in the real estate consulting sector in Japan and has a market capitalization of ¥115.79 billion.

Operations: The company generates revenue from its real estate consulting business, amounting to ¥65.69 billion.

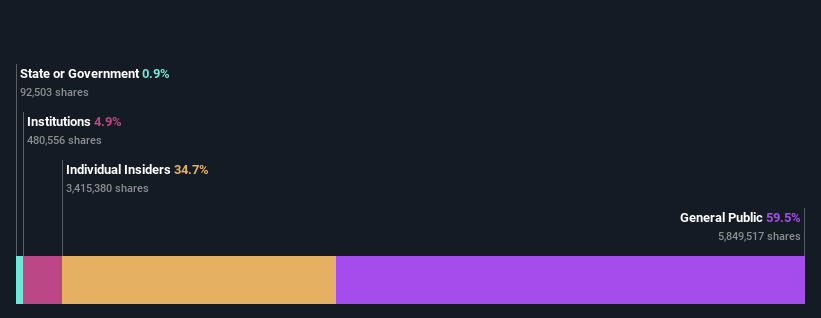

Insider Ownership: 34.4%

Kasumigaseki Capital Ltd. demonstrates strong growth potential, with earnings projected to rise 34.1% annually, significantly outpacing the Japanese market's average. Revenue is also expected to grow at a robust 29.2% per year. Despite high-quality earnings and trading below estimated fair value, the company faces challenges such as volatile share prices and dividends not well-covered by free cash flow. Additionally, debt coverage by operating cash flow remains inadequate, posing financial risks amidst promising growth forecasts.

- Click here and access our complete growth analysis report to understand the dynamics of Kasumigaseki CapitalLtd.

- In light of our recent valuation report, it seems possible that Kasumigaseki CapitalLtd is trading beyond its estimated value.

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fixstars Corporation is a software company operating in Japan and internationally, with a market capitalization of ¥58.70 billion.

Operations: The company's revenue is derived from two main segments: the SaaS business, which generates ¥487.52 million, and the Solution Business, contributing ¥7.70 billion.

Insider Ownership: 25.3%

Fixstars is experiencing significant earnings growth, forecasted at 20.5% annually, outpacing the Japanese market's average of 7.9%. Revenue is also set to grow faster than the market at 14.7% per year, although it remains below the high-growth threshold of 20%. Despite no recent insider trading activity and a highly volatile share price over three months, Fixstars maintains strong growth prospects with its substantial insider ownership providing potential alignment with shareholder interests.

- Take a closer look at Fixstars' potential here in our earnings growth report.

- Our expertly prepared valuation report Fixstars implies its share price may be too high.

Akatsuki (TSE:3932)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Akatsuki Inc. operates in the gaming, comic, and other related industries mainly in Japan, with a market cap of ¥38.93 billion.

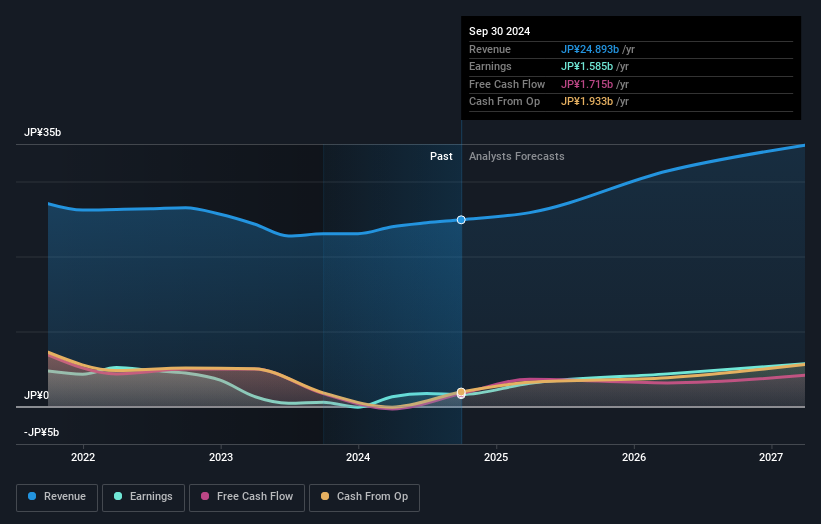

Operations: The company generates revenue from its Game segment at ¥23.07 billion and Comics segment at ¥1.03 billion, primarily in Japan.

Insider Ownership: 29.4%

Akatsuki's earnings are expected to grow significantly at 42.4% annually, surpassing the Japanese market's average of 7.9%. Revenue growth is also projected at 14.4% per year, outpacing the market but not reaching high-growth levels. Despite recent shareholder dilution and no substantial insider trading activity in the past three months, Akatsuki trades at a substantial discount to its estimated fair value, suggesting potential upside if growth forecasts materialize.

- Click to explore a detailed breakdown of our findings in Akatsuki's earnings growth report.

- Our expertly prepared valuation report Akatsuki implies its share price may be lower than expected.

Taking Advantage

- Embark on your investment journey to our 1501 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kasumigaseki CapitalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3498

Kasumigaseki CapitalLtd

Engages in real estate consulting businesses in Japan.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives