- China

- /

- Tech Hardware

- /

- SHSE:688489

High Growth Tech Stocks In Asia To Watch October 2025

Reviewed by Simply Wall St

As the Asian markets navigate a landscape of renewed U.S.-China trade tensions and mixed economic signals, investors are closely watching high-growth tech stocks that could offer resilience amid global uncertainties. In this environment, a good stock is often characterized by its ability to leverage technological advancements, maintain robust growth potential, and adapt to shifting geopolitical dynamics.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 23.97% | 28.52% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market cap of CN¥5.75 billion.

Operations: Sansec Technology specializes in cryptographic products and solutions aimed at enhancing internet information security within China. The company generates revenue primarily through the development and sale of these security-focused technologies.

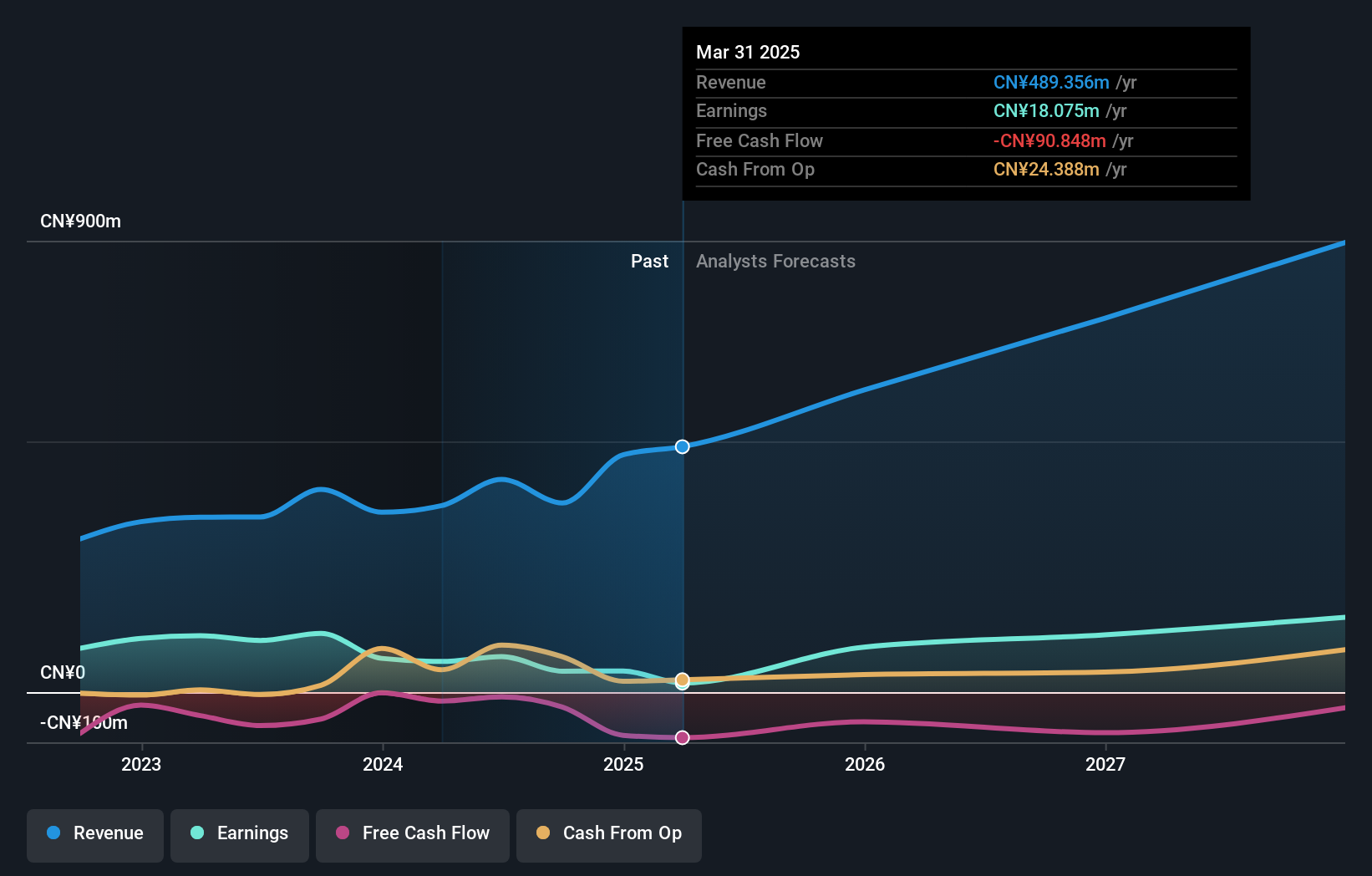

Sansec Technology, amid a challenging financial landscape marked by a net loss of CNY 29.39 million for the first half of 2025, contrasts sharply with its prior year's net income of CNY 13.71 million. Despite these hurdles, the company is poised for robust future growth with expected revenue increases at an annual rate of 22.3%, outpacing the Chinese market forecast of 13.9%. This growth trajectory is underpinned by significant R&D investments aimed at driving innovation and securing competitive advantages in high-growth tech sectors across Asia. The firm's strategic focus on expanding its technological capabilities suggests potential for recovery and profitability, aligning with forecasts that predict profitability within three years and an earnings growth rate projected at 61.64% annually.

PR TIMES (TSE:3922)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PR TIMES Corporation operates the PR TIMES platform, facilitating connections between companies, media, and consumers through news distribution in Japan, with a market cap of ¥39.40 billion.

Operations: The company generates revenue primarily from its Press Release Distribution Business, contributing ¥7.63 billion. The focus is on connecting companies with media and consumers through news distribution in Japan.

PR TIMES, a key player in Asia's tech landscape, has demonstrated resilience and adaptability with a 12.7% annual revenue growth rate, outpacing the Japanese market's average of 4.5%. This robust performance is supported by an aggressive R&D strategy that not only fuels innovation but also aligns with industry shifts towards digital media solutions. With earnings forecast to expand by 17.1% annually, PR TIMES is strategically positioned to capitalize on evolving market demands while maintaining a competitive edge through continuous technological advancements and client-focused offerings.

- Dive into the specifics of PR TIMES here with our thorough health report.

Explore historical data to track PR TIMES' performance over time in our Past section.

Takara Bio (TSE:4974)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Takara Bio Inc. operates globally in the fields of reagents, equipment, contract services, and genetic medicine with a market capitalization of ¥114.39 billion.

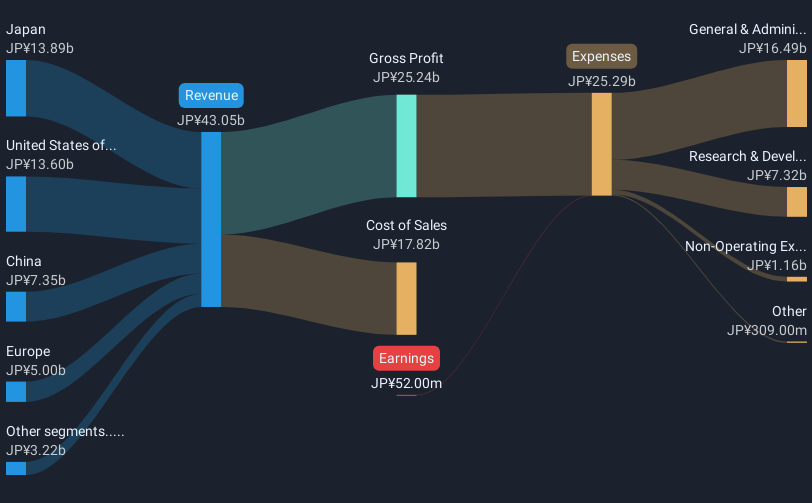

Operations: The company generates revenue primarily through its drug discovery segment, contributing ¥45.81 billion. It operates across various regions including Japan, China, and the United States.

Takara Bio stands out in Asia's high-growth tech sector, not just for its impressive earnings growth of 29.7% annually but also due to its strategic R&D investments which are crucial for sustaining innovation and market competitiveness. Despite a challenging environment, the company has managed a revenue increase of 4.9% per year, surpassing Japan's average market growth. This performance is underpinned by significant advancements in biotechnology that cater to evolving healthcare demands, positioning Takara Bio well for future technological trends and client needs.

- Click here to discover the nuances of Takara Bio with our detailed analytical health report.

Evaluate Takara Bio's historical performance by accessing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 187 Asian High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688489

Sansec Technology

Engages in the research, development, and production of commercial cryptographic products and solutions for internet information security in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives